The Montana property tax system supports local public services, including schools, roads, and other infrastructure. Residential property owners pay almost half of all property taxes. Every two years, the state undergoes a reappraisal process to update property values for purposes of property taxes.

Property Taxes Educate Children and Protect Families

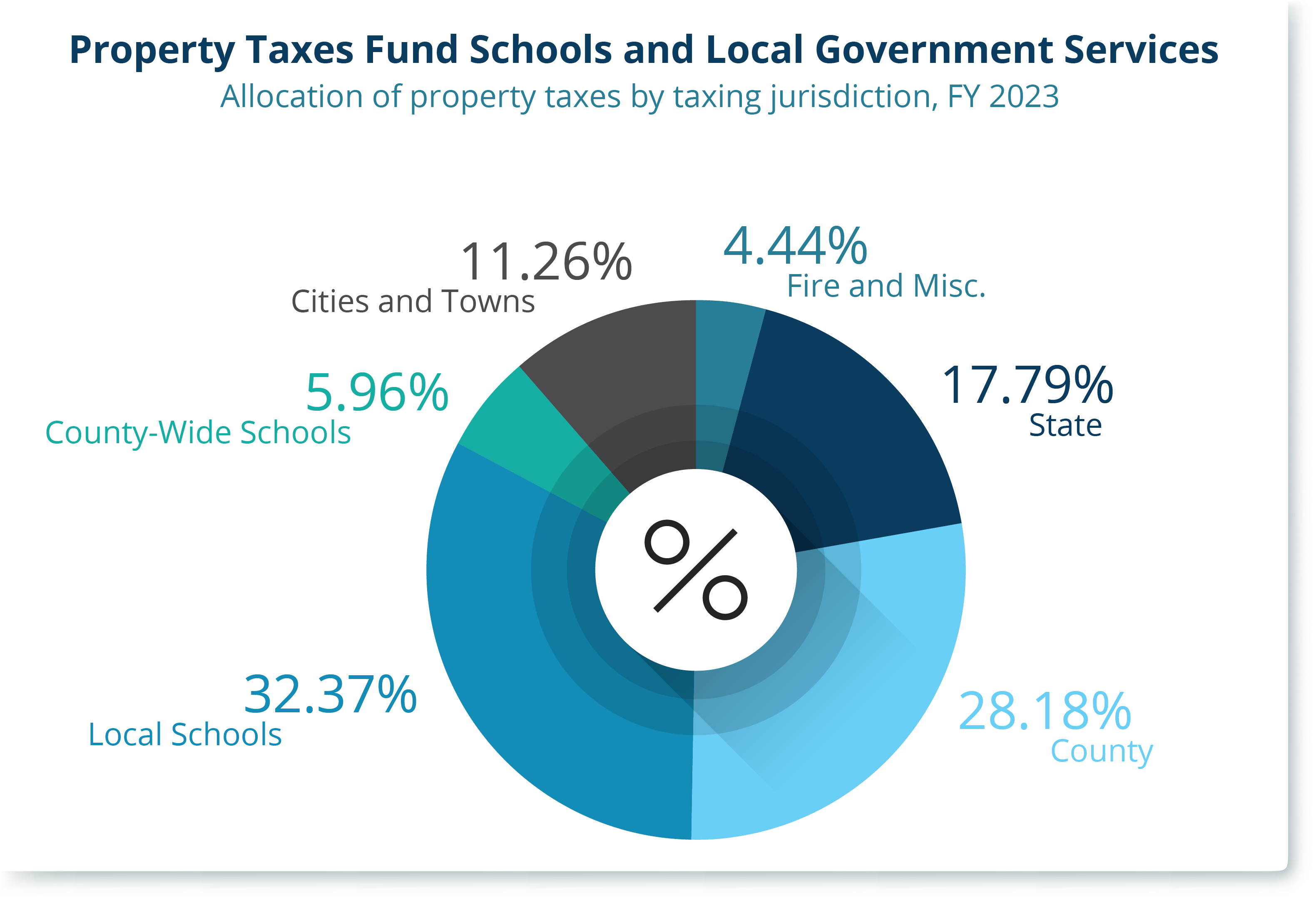

State and local property taxes collected in Montana make up approximately 40 percent of our total state and local tax revenue, for a total of $2.1 billion in fiscal year 2023.[1] Most of these funds are directed toward local governments and schools to invest in public services we all rely on. Eighty-two percent of property tax revenue is invested in local governments, including supporting local schools, services like fire protection, and infrastructure, such as roads and bridges.[2] The state of Montana receives about 18 percent of property taxes through statewide mills – to ensure equitable support of local schools, universities, and technical colleges.[3]

Families Living on Low Incomes Pay Greatest Share of Income in Property Taxes

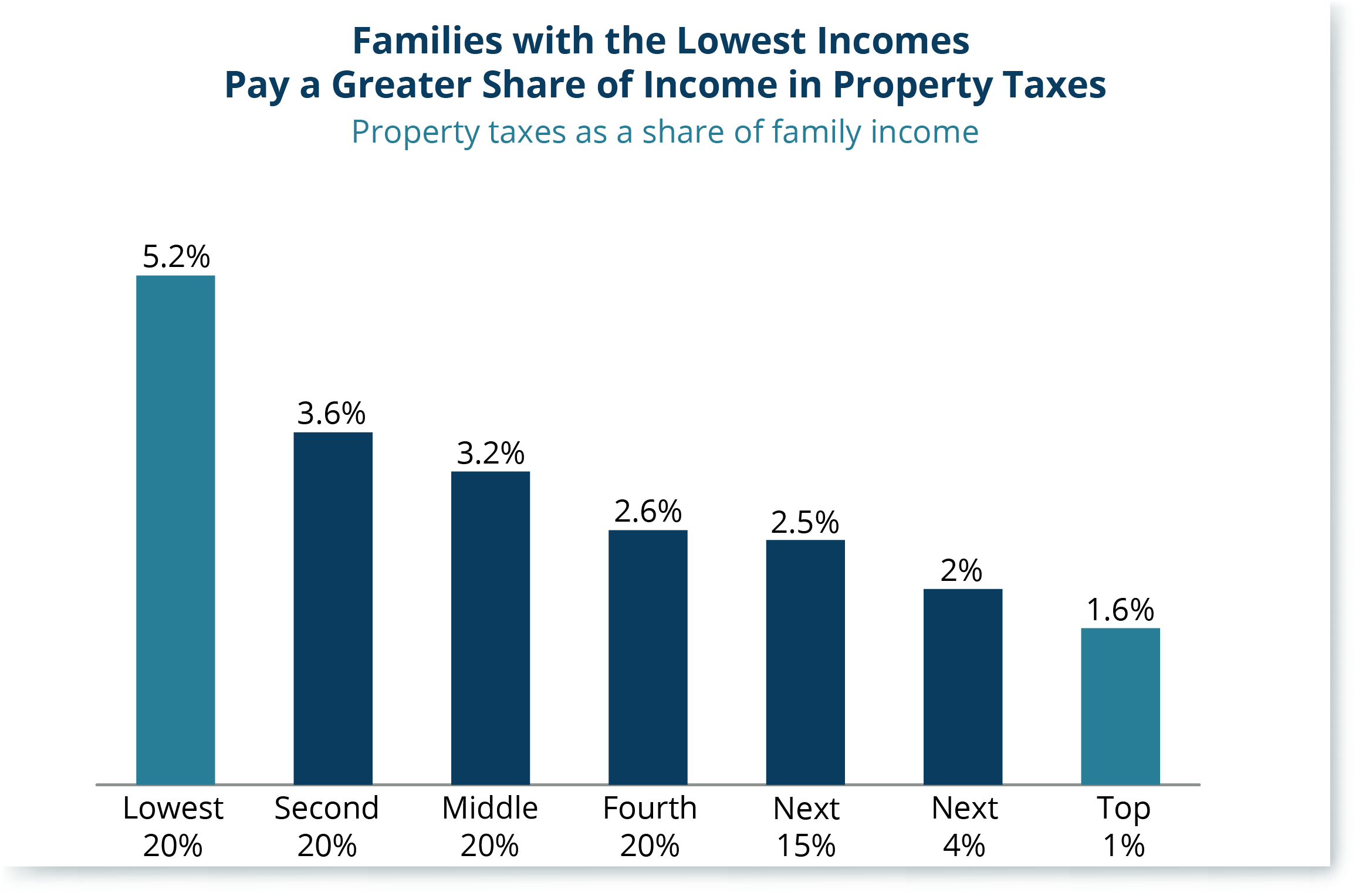

Montana homeowners pay over half of total property taxes, the share of which has increased over time.[4] While property taxes are greater for homes of higher value, the property tax system is still considered regressive, meaning that, on average, households with higher incomes pay a smaller share of their income in property taxes than households living on lower and moderate incomes. In Montana, property taxes paid by the wealthiest 1 percent of taxpayers represents 1.6 percent of their overall income, compared to 5.2 percent of income for the Montanans living on the lowest incomes.[5]

Property taxes tend to be regressive because they do not take into account a homeowner’s income or ability to pay and because housing costs tend to be larger in proportion to the income of households living on lesser means than households with more wealth.[6] For example, a family making $50,000 a year may own a home costing $150,000, or three times their wages, while a family making $1 million per year may own a home costing $500,000, or half their pay. Therefore, the property taxes paid by a household with low income will represent a greater proportion of their family income than those paid by a household with high income.

It is important to remember that property taxes are not limited to property owners. Renters pay a portion of the property taxes paid on rental properties because the taxes are “passed through” by the landlords when setting the rent amount.[7]

Both State and Local Governments Play a Role in Assessing Property Taxes

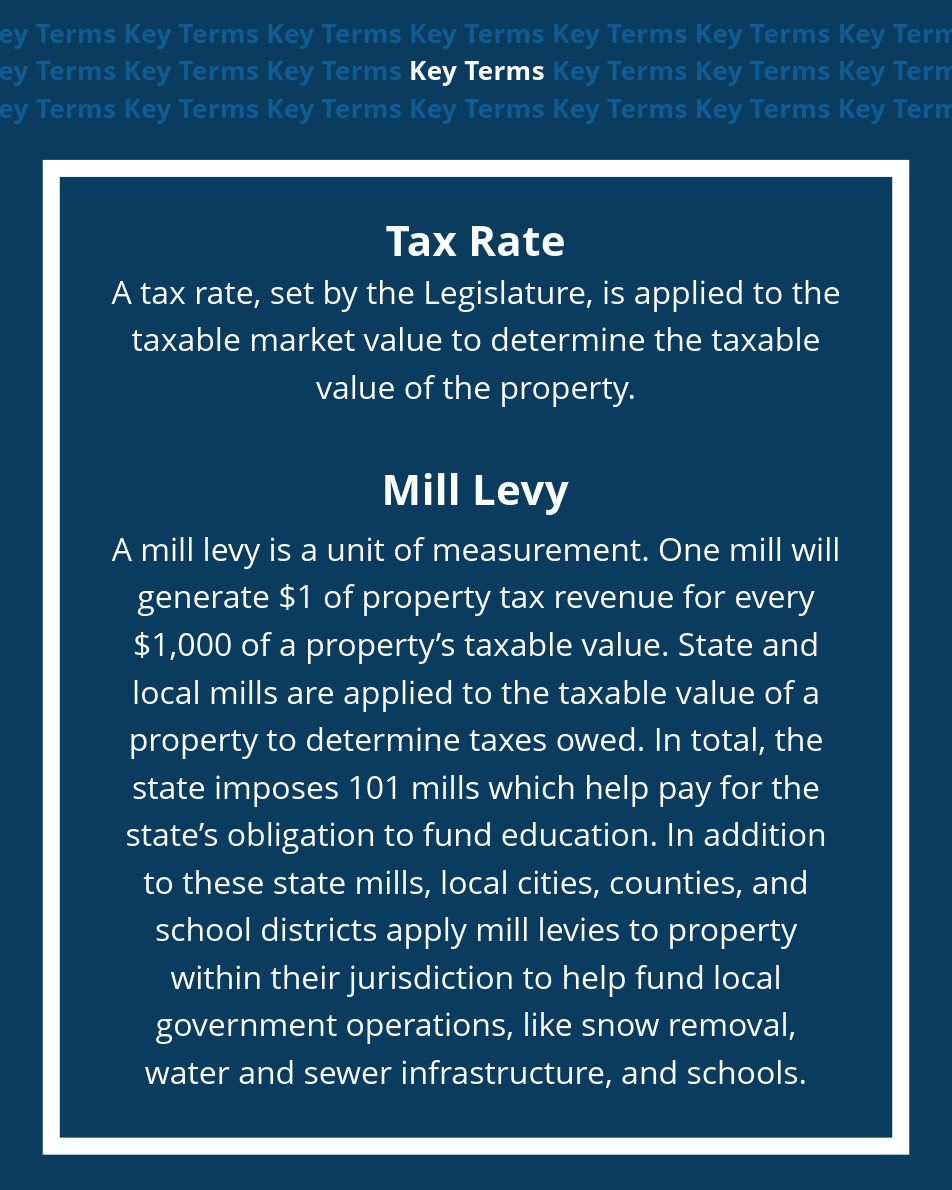

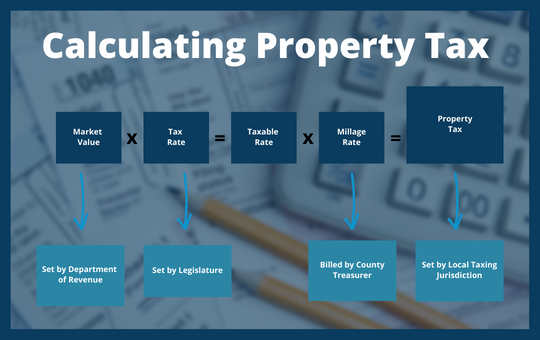

Determining what the property taxes will be on a piece of property is complicated and requires a series of steps. The Department of Revenue is responsible for appraising – or valuing – property in the state to determine the market value.[8] Each taxing jurisdiction – county, city, or school district – uses these values to calculate property taxes.

The Legislature created 16 different classes of property, including residential and commercial property, agricultural land, business equipment, and centrally assessed property.[9] Centrally assessed property is property owned by a company operating as a single entity and connected across county or state borders. This includes things like railroads, telecommunication lines, power lines, natural gas or oil transmission lines, and airlines. Each property within a class is valued in the same manner. For residential property, the market value is the value for which the property would sell between a willing buyer and willing seller.[10] The Department of Revenue uses the sales price of similar properties in the area to determine the value of properties that have not been sold.[11]

The Legislature then assigns a tax rate to each class of property and multiplies that tax rate by the property’s market value to determine the taxable value. The tax rate in 2022 was 1.35 percent for residential property and 1.89 percent for commercial property.[12]  Local taxing jurisdictions – cities and counties – apply the mill levies to the property’s taxable value to determine taxes owed. County governments are responsible for collecting property taxes and distributing the appropriate portion of those taxes to the state, cities, school districts, and other taxing jurisdictions.[13]

Local taxing jurisdictions – cities and counties – apply the mill levies to the property’s taxable value to determine taxes owed. County governments are responsible for collecting property taxes and distributing the appropriate portion of those taxes to the state, cities, school districts, and other taxing jurisdictions.[13]

Reappraisal Process Critical to Accurately Valuing Property

The Montana Constitution and state law require the Department of Revenue to reappraise all property periodically and similarly value comparable property across the state.[14] The reappraisal process is important in ensuring local governments, schools, and the state accurately reflect property values for property tax purposes. Taxing jurisdictions in the state set their budgets and mills based on these updated values. Tax year 2015 began the first year of a two-year appraisal cycle for residential, commercial, industrial, and agricultural property.[15] Forest land remains on a six-year appraisal cycle.

The Legislature maintained the tax rates for all classes in the most recent legislative sessions. The impact on individual homeowners depends on market values in their region or county and varies from home to home.

Homeowners Pay the Greatest Share of Total Property Taxes

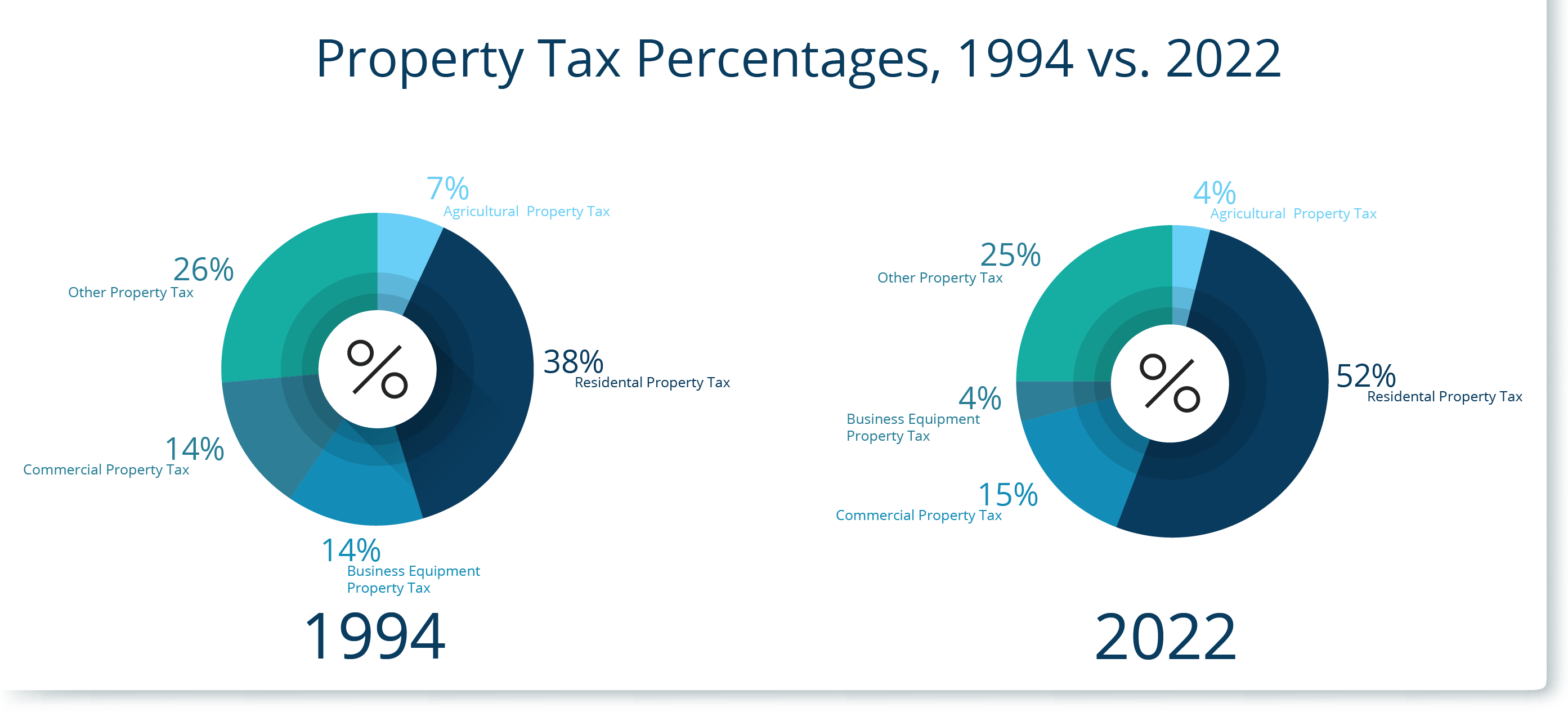

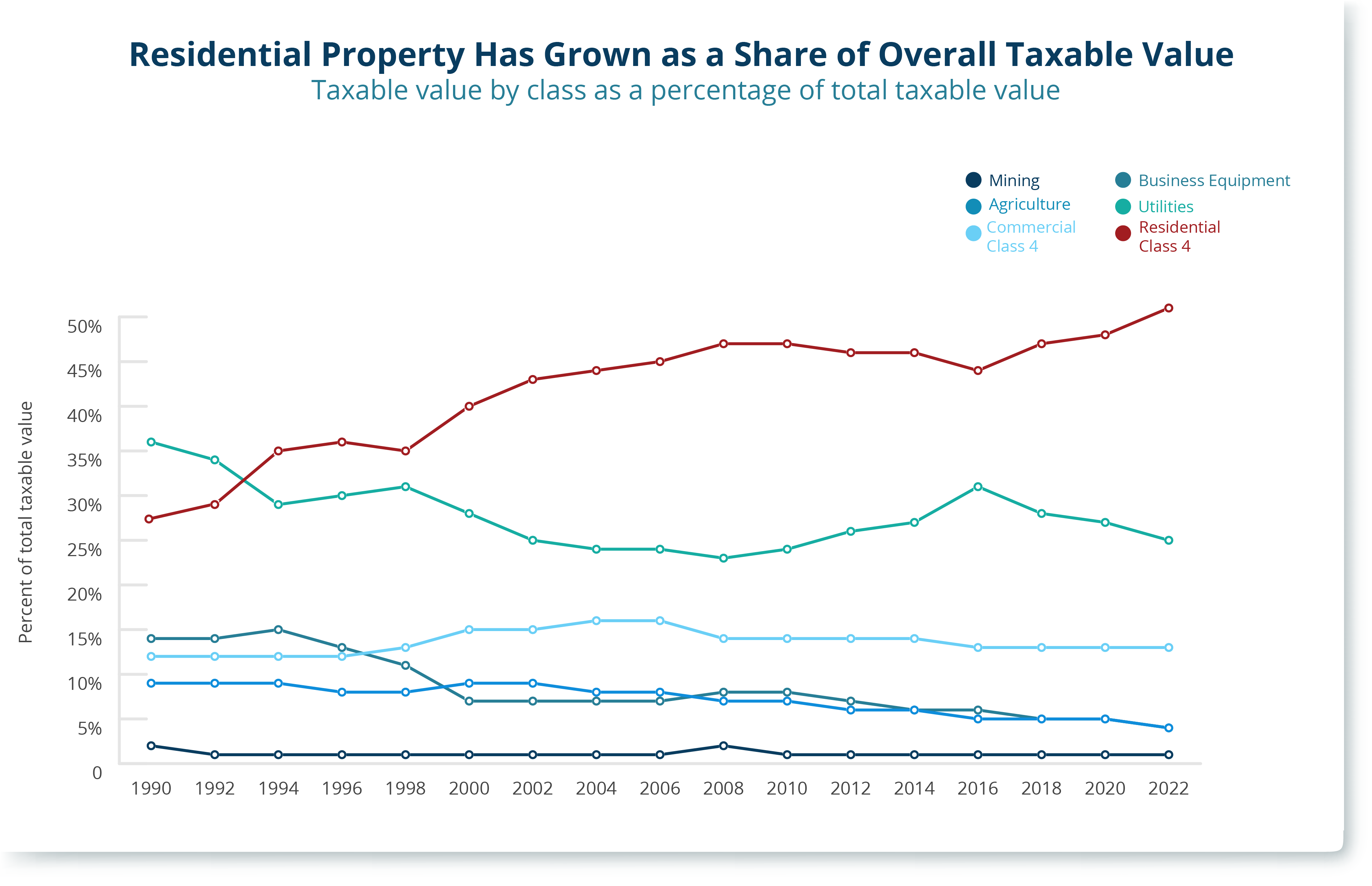

Property taxes paid by residential homeowners comprise over half of all property taxes.[16] In the last few decades, Montana homeowners have seen an increase in the share of property taxes they pay compared to other property classes.[17]

Residential property owners pay a greater share of property taxes, partly because the Legislature has cut the tax rates on other property classes. For example, over the past several decades, the share of property taxes paid by business equipment owners has fallen from 14 percent to less than 5 percent.[18] This often results in a shift of tax liability to other property taxpayers over time.[19] The Legislature caps the amount local governments can raise from property taxes.[20] When the Legislature cuts the tax rates for some property classes, the total taxable value in the entire local jurisdiction decreases. When the taxable value goes down, so does the amount of revenue for that jurisdiction. The local jurisdiction would have to raise its mill levies on all property owners to maintain revenue levels.[21] The increased mill levies are then applied to the remaining property in the jurisdiction, most significantly to residential property. As a result, local revenue remains constant, but the obligation to support local government functions shifts to homeowners and other property owners.

While Montana’s local governments and schools rely heavily on property tax for needed revenue, Montana’s effective tax rate for property tax is lower than the national average. Montana generates a large portion of its total taxes from property tax (40 percent), compared to the national average of 32 percent.[22] This difference is partly because Montana does not have a sales tax like most other states. Nationwide, Montana ranks 33rd for its effective residential property tax rate of 0.73 percent. The national median is 1.05 percent.[23]

Property Taxes in Indian Country

All reservations consist of lands that tribal nations either reserved from their land cessions to the U.S., or lands set aside for their exclusive use via statutes and executive orders. Land owned collectively by the tribal nation, as well as land allotted to individual tribal citizens per the General Allotment Act of 1887, is called trust land and is held in trust for tribal nations by the federal government. Like all other federal property, such as national parks and forestlands, trust land cannot be taxed and is therefore not subject to state or local property taxes.[24] While the lack of state property taxation of trust land has been misconstrued as a “loss” of state tax revenue, the tax base was never lost, as it never existed in the first place.

As a result of the forced allotment of many reservations, there are now parcels of fee land that are privately owned and subject to state and local property taxation. This includes fee land owned by tribal citizens, even when their property is located on their reservation.[25] To help offset the loss of property taxes that support local public schools, districts located on reservations and other federal lands can apply for federal Impact Aid, also known as Title VII funds.[26] Through Impact Aid, 64 school districts in Montana received nearly $68 million in federal aid in 2020. Fifty-seven of these school districts included reservation land.[27]

For more information on property taxation in Indian Country, please see our policy basics reports on Taxation Authority in Indian Country and Land Status of Indian Country.

The State Provides Assistance for Property Taxpayers Living on Low Incomes

The Legislature has established four distinct programs to reduce property tax liability for some homeowners. The largest of these programs, the Elderly Homeowners/Renter Credit, provides taxpayers age 62 or older with household incomes less than $45,000 an income tax credit to help offset property taxes. The refundable credit is capped at $1,000 and phases out at incomes between $35,000 and $45,000.[28] In 2017, 13,567 Montana seniors with income tax liability received the Elderly Homeowner/Renter Credit.[29]

The state also provides two property tax programs that directly reduce property taxes for certain households. The first, the Property Tax Assistance Program (PTAP), reduces residential property taxes for households with low incomes. The taxpayer must live in their home for at least seven months out of the year and have income below $27,621 for one eligible owner (or below $37,019 for a property with more than one eligible owner).[30] In 2022, more than 21,000 property taxpayers received assistance through PTAP, nearly a threefold increase since 2006.[31]

The state also provides the Disabled American Veterans (DAV) program, which provides property tax assistance for disabled veterans. The property must be the taxpayer’s primary residence, and a taxpayer qualifies if they are a veteran honorably discharged and paid at the 100 percent disabled rate for a service-connected disability.[32] A spouse of a veteran who was killed while on active duty or who died from a service-connected disability may also be eligible for the DAV program. In 2022, more than 3,000 veterans or family members received assistance through the Disabled American Veterans program.[33]

In 2017, the Legislature created a new property tax assistance program starting in 2018 for long-time property owners where the value of their land is disproportionately higher than the value of their home.[34] The program caps the land value of their primary residence parcel to 150 percent of the improvement value, subject to a minimum per acre value consistent with the statewide average value.[35] To qualify, the owner must live in the property for at least seven months of the year and have owned (or family owned) the property for at least 30 years.

State Budget Cuts Put Strain on Property Assessment Process

The 2017 legislative session resulted in deep cuts to nearly all state agencies, including the Department of Revenue. As a result of lower revenue levels, the governor and Legislature cut approximately $6 million in general fund appropriations from the Department.[36] Within the Department, the Property Assessment Division (PAD) faced the most severe cuts, with the closure of half of all county property assessment offices and a loss in the number of staff positions.[37] Fewer office locations result in people living in rural communities with less access to those who determine property values and set property taxes, which are a significant portion of a household’s state and local taxes.

We Can Fund Schools and Services with a Fair Tax System

Montana’s property tax system provides important funding for education through our local schools, infrastructure, like our roads and bridges, and other local services, like fire protection. Elected officials, such as our state legislators, have a very important role in deciding how our property tax system works. The Department of Revenue’s role to reappraise property in the state ensures a fair system of valuing property for purposes of taxation.

Unfortunately, Montanans living on lower incomes pay a larger share of property tax than Montanans with high incomes. There are further options for improving the fairness of our state property tax system, in addition to those already in existence, such expanding property tax assistance programs and repealing property tax exemptions for large corporations. Further connecting income to property taxes by expanding the elderly homeowner and renter credit to all ages would ensure that Montanans with lower incomes are not priced out of their homes due to increases to property taxes. Also, continuing to broaden the property tax base rather than passing further exemptions can reduce the increasing share of property taxes paid by residential homeowners.

[1] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[2] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[3] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[4] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[5] Institute on Taxation and Economic Policy, “Who Pays? 2020 MT Results,” Mar. 2021, on file with author.

[6] Institute on Taxation and Economic Policy, “Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability,” May 11, 2023.

[7] Institute on Taxation and Economic Policy, “Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability,” May 11, 2023.

[8] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[9] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[10] Mont. Code Ann., 15-8-111.

[11] Mont. Code Ann., 15-8-111.

[12] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[13] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[14] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[15] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[16] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[17] Dale, E, Montana Department of Revenue, “RE: updated property taxes by class,” email to Rose Bender, MBPC, Nov. 9, 2020, on file with author. Montana Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[18] Dale, E, Montana Department of Revenue, “RE: updated property taxes by class,” email to Rose Bender, MBPC, Nov. 9, 2020, on file with author. Montana Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[19] In some, but not all, instances of cuts to Class 8 property tax rates, the legislature has backfilled the loss of revenue to local taxing jurisdictions through additional general fund appropriations, which has the effect of costing the state twice.

[20] Mont. Code Ann., 15-10-420.

[21] Mont. Code Ann., 15-10-420.

[22] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[23] Young, D, “Rising Property Taxes – What You Should Know,” MSU-Bozeman, May 2020.

[24] National Congress of American Indians, “Taxation.”

[25] Bureau of Indian Affairs, “Frequently Asked Questions.” See also County of Yakima v. Confederated Tribes and Bands of the Yakima Indian Nation (1992).

[26] U.S. Department of Education Office of Elementary and Secondary Education, “Impact Aid Program.”

[27] National Association of Federally Impacted Schools, “Impact Aid Payments Overview, FY 2020,” 2020.

[28] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[29] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[30] Income limits were increased in 2023, effective 2024. Montana 68th Legislature, “An Act Revising the Property Tax Assistance Program,” HB 189, enacted on May 18, 2023.

[31] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[32] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[33] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[34] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[35] Department of Revenue, “Biennial Report: July 1, 2020 – June 30, 2022,” Dec. 2021.

[36] Budget cuts include $3.3 million reduction during the regular session and $2.9 million cut under the governor’s 17-7-140 cuts. Legislative Fiscal Division, “Legislative Fiscal Report 2019 Biennium,” June 2017. See also Legislative Fiscal Division, “2017 Nov. Special Session Fiscal Report,” Dec. 11, 2017.

[37] Department of Revenue, “Property Assessment Division Office Closures,” Presented to Revenue and Transportation Interim Committee, Mar. 13, 2018.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.