This report focuses on taxation authority and is the final of a five-part series that introduces readers to basic concepts in Indian Country. Taxation authority, or the power to tax, intersects with the topics of sovereignty, citizenship, land, and jurisdiction, all topics covered earlier in this series.

This report is not intended to fully capture the breadth and complexity of taxation authority in Indian Country. Rather, its purpose is to provide an overview of taxation authority today and what that means for tribal government revenues. For more on taxes in Indian Country, see the Montana Budget & Policy Center’s reports that focus on taxes as they relate to tribal citizens and tribal governments.

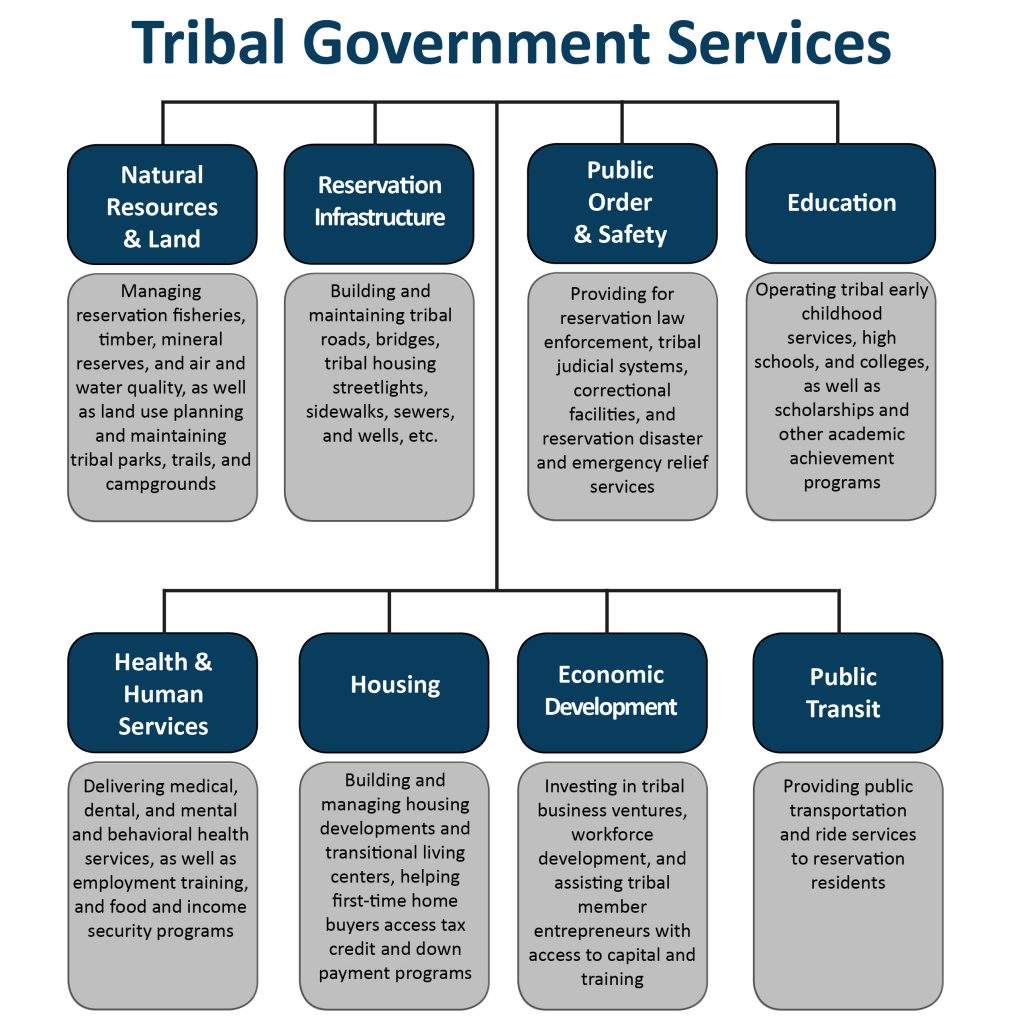

Exercising the power to tax is an important government function. Like all governments, tribal governments need revenue. Taxes fund public services like bridges and roads, schools, water and sewer systems, and so much more. However, non-tribal taxing jurisdictions have hamstrung the ability of tribal governments to raise needed tax revenue by challenging tribal governments’ once-exclusive taxation authority. This has clear consequences for tribal revenues.

It is important to begin with the fact that the power of tribal nations to tax is inherent to tribal sovereignty, or the inherent right of tribal nations to self-govern and to self-determine their futures. As discussed in the first policy basics of this series, the United States did not give tribal nations this right. Tribal nations have been sovereign since time immemorial. The same sovereignty that allowed tribal nations to enter into treaties with the United States is also what enables them to tax within the boundaries of their reservations.[1]

Taxation is important to tribal sovereignty for at least two reasons. First, it is an important tool of control. This could apply to the regulation of economic activity, for example. Second, taxes help to pay for te government programs, services, and functions on which we all rely.[2] Like any government, tribal governments need revenue to fund essential services and programs that, among other things, keep communities healthy, educate children, protect natural resources and land, and develop workforces. Taxes help to provide that revenue.

Tribal governments once held exclusive taxation authority in Indian Country. While the inherent right of tribal nations to tax is well-established, non-tribal governments have challenged tribal taxing power. In fact, taxation authority in Indian Country has been one of the most litigated issues between tribal nations and state and local governments. This is largely because federal tax policy in Indian Country leaves room for legal challenges between governments with overlapping jurisdictions and competing interests in terms of revenue needs.[3]

Over time, state and local governments have successfully challenged in court the exclusive right of tribal governments to tax within their own reservation boundaries to the point that tribal taxation authority is diminished today. This denies tribal governments much-needed revenue and means that tribal governments must provide many of the same services as other governments without the usual tax revenue on which those governments rely.[4]

It also means that many tribal nations must rely on natural resources, leases, and tribally owned enterprises as their only source of revenue outside of federal dollars. Even here, states have fought for the ability to co-tax certain economic activities involving non-Indians in Indian Country, extracting wealth from tribal communities and creating a system that can hamstring economic growth.[5]

To be clear, despite state and local government challenges to tribal taxation authority, tribal governments retain their sovereign power to tax. Yet, states generally assert their taxation authority when jurisdictions overlap. This undermines tribal taxation authority and worsens fiscal problems for tribal nations.[6]

Below is a basic overview of both tribal and state taxation authority in Indian Country. This section helps to illustrate how the actions of non-tribal governments have complicated taxation authority in Indian Country and how that limits revenue sources for tribal governments.

Because of their sovereign status, tribal governments can impose taxes on their citizens living on their reservations. Though, few tribal governments do this. One reason includes economic challenges, which are part of the legacy of settler colonialism. Among the few taxes that tribal governments in Montana assess are excise taxes on the on-reservation sale of alcohol, tobacco, and fuel and severance taxes on natural resource development. However, the state shares in this revenue. Tribal governments can impose taxes on certain activities of non-Indians on reservation trust land and on reservation fee land, but only when the tax passes certain tests.[7]

In general, the state cannot tax tribal nations or tribal citizens on their reservation. As subdivisions of the state, local governments are subject to the same limitations.[8] Property taxes are an exception to this, as states and counties can assess property taxes on on-reservation fee land that tribal nations or citizens own. In the case of state income taxes, it depends on where tribal citizens both live and work.[9] Like tribal governments, the state can impose taxes on activities of non-Indians in Indian Country when the tax meets certain conditions.[10]

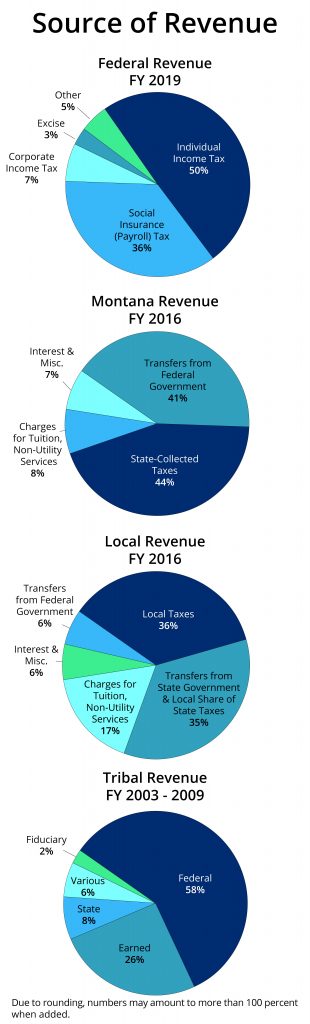

Given this history, it is no coincidence that tribal governments are generally on uneven footing with federal, state, and local governments in exercising their power to tax.[11] This section outlines the striking differences in revenue sources for federal, state, local, and tribal governments.

The federal government gets most of its money by collecting taxes and borrowing.[12] In 2019, tax revenue paid for nearly $3.5 trillion of the federal government’s $4.4 trillion budget.[13],[14] Of that, individual income taxes made up nearly 50 percent, payroll taxes made up about 36 percent, and corporate income taxes made up roughly 7 percent. Excise and other taxes made up the rest.[15]

According to the latest Montana Department of Revenue biennial report, taxes represent the largest source of state revenue (44 percent). Of tax revenue, individual income taxes make up the largest share (roughly 45 percent), followed by sales and excise taxes (14.3 percent), severance and other taxes (13 percent), and property taxes (10.6 percent). Other taxes make up the remaining share.[16]

Money from the federal government is the second largest source of state revenue (41 percent). This money includes federal pay

ments to the state for Medicaid and other state programs, as well as education funding for local school districts. The remaining revenue comes from other sources.[17]

As with the federal government and the state, tax revenue is the largest revenue source for local governments (36 percent). Local government and school district tax collections come almost entirely from property taxes (96.5 percent). Like the state, local governments also receive money from other governments. Transfers from the state make up 35 percent of local government revenue, while federal transfers make up 6 percent of revenue. Other sources make up the remaining share.[18]

Unlike other governments, tax revenue is an insignificant source of revenue for tribal governments. Nearly half (47 percent) of state and local revenue in Montana comes from taxes.[19] As mentioned above, the federal government used tax revenue to pay for almost 80 percent of its $4.4 trillion budget in 2019.

According to the Montana Department of Commerce, federal funding represents the largest share of revenue for tribal governments (roughly 58 percent). To be clear, most of this federal funding to tribal nations stems from the federal government’s trust responsibility to fund services, as articulated in treaties.[20] However, the federal government chronically fails to uphold this legally binding trust responsibility. For example, the Indian Health Service budget meets just more than half of American Indian health-care needs.[21]

Without a strong tax base, tribal governments rely on business revenues as their core source of revenue outside of federal dollars. The second largest revenue source for tribal governments is earned (nearly 26 percent), which comes from leasing activity, investments, and tribally owned enterprises, for example. The remaining revenue is a combination of state and other sources.[22]

Tribal governments retain their sovereign power to tax. Non-tribal taxing jurisdictions currently limit the ability of tribal governments to exercise that power and to provide essential services that benefit Montana. Honoring tribal taxation authority presents an opportunity to protect and enhance tribal government functions and services.[23] What is good for Indian Country is good for Montana.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.