Throughout U.S. history, the federal government has permitted and instigated inequality. The United States did not end the enslavement of Black people until just over 150 years ago. It also repeatedly went to war with and stole land from Indigenous people.[1] These actions helped enshrine racial inequality from our country’s founding and have continued throughout its political landscape.

The funding and budget decisions that have created long-standing structural barriers that perpetuate inequity in our country are an often overlooked element in this inequity. These decisions, which favor the white and the wealthy, have been in effect since the country’s beginnings and continue to be reinforced in how the federal government generates resources and funds programs and services. Policymakers have prioritized the interests of the white and wealthy in the federal budget, while simultaneously refusing to fund equitable opportunities for Black, Indigenous, and other people of color (BIPOC), including education, employment, and access to health care. These policy decisions have resulted in a large racial wealth divide.[2]

To address the racial wealth gap, policymakers at the federal level have an obligation to craft a budget that invests in communities. Policymakers need to fund public services to communities of color at an equitable level today and at levels sufficient to address the harm of past underinvestment. Additionally, the federal government must provide people of color with financial reparations to account for government-sanctioned policies that contributed to the racial wealth gap.

This report covers three examples of inequitable federal policies: failure to meet trust and treaty obligations, insufficient safety net spending, and unequal revenue generation.

Historical policies that removed American Indians from their land onto reservations, combined with chronic underfunding of federal programs, have created economic barriers in Indian Country. The federal government needs to fund programs at a level that meets the current need and is also sufficient to undo the damages of past underinvestment.

Tribal nations are sovereign nations and are recognized in the U.S. Constitution. In exchange for the forced relinquishment of a vast amount of tribal nations’ land, the U.S. government promised certain services and support.[3] The United States would not exist without the 375 treaties it signed with tribal nations. These treaties permanently bind the federal government to provide health care, housing, and economic development, in addition to the provision of land boundaries and recognition of rights.3

The United States also has established a trust responsibility to tribal nations to protect tribal lands and self-government and provide federal assistance in perpetuity.3 This trust relationship has been established through treaties, laws, Supreme Court decisions, and Executive Orders. The United States’ trust responsibility also recognizes the unique relationship between the government of the United States and the governments of tribal nations.3

The United States, however, has never provided the funds necessary to honor its trust and treaty responsibilities fully. In its failure, the federal government has perpetuated economic underdevelopment and poverty in Indian Country.3 The U.S. Commission on Civil Rights found that between 2003 and 2018, federal government funding for agencies and subagencies that served Indian Country failed to keep up with inflation and remains grossly inadequate at meeting the need. In FY 2019, the federal government set aside $20 billion for federal agencies and subagencies to provide services to American Indians, however, the amount is insufficient to address the needs of Indian Country.

Rather than provide appropriate financial assistance to tribal governments to educate children, the federal government funded boarding schools and highly-segregated public schools. These schools, such as the Fort Shaw Boarding School in Montana, were not designed to meet the educational obligation of the federal government or to meet the educational needs of children. Instead, these schools set out to forcibly segregate families and eradicate culture.3 The federal effort to assimilate Indigenous people created lasting trauma.

In 1975, Congress passed the Indian Self-Determination and Education Assistance Act to allow tribal nations to operate schools and education programs previously run by the federal government.3 The Bureau of Indian Education (BIE) operates schools for 7 percent of American Indian youth, but BIE remains under-resourced and therefore less effective at graduating students than public schools.

In addition to the lack of funding to address the historical trauma of boarding schools, educational inequity persists in Indian Country. For example, Montana has seven of the nation’s 37 tribal colleges and universities.[4] While the federal government has authorized $8,000 per student who is an enrolled citizen of a federally recognized tribal nation, in 2015, only $6,355 was allocated. The federal government provides no funding for students who are not tribal citizens. Non-Indian students make up between 3.2 percent to 25.7 percent of the student body for tribal colleges in Montana, and the schools must make up the difference from their budgets.

The federal government has a legal obligation to provide health care to citizens of tribal nations. American Indians face high health care needs, due to facing both institutionalized and individual racism. The historical trauma of culture loss through boarding schools, land loss, and genocide has created lasting impacts on the health of American Indians.[5] American Indians have difficulty accessing health care due to factors such as a lack of health care coverage and the underfunding of the Indian Health Service (IHS) and can also face discrimination in health care settings.[6],[7

Despite medical inflation and a growing American Indian population, the IHS budget has been static in recent decades and remains well below the need. The federal government spent just $4,078 on average per IHS recipient in FY 2019, compared to $8,436 and $10,536 on Medicaid and Medicare beneficiaries, respectively. [8],[9],[10] The IHS Tribal Budget Work Group, which consists of tribal representatives from each IHS area, estimates that IHS would require $32 billion to fully meet health care needs.3 In 2021, the IHS budget was just $6.3 billion.[11]

In 2016, Montana used federal funds to expand Medicaid to Montanans with incomes up to 138 percent of the federal poverty level.[12] Over 17,000 American Indians receive health care coverage through Medicaid expansion in Montana, comprising 16 percent of Medicaid recipients in the state.[13] Medicaid expansion has helped free up support for IHS and tribally operated facilities. In 2019, at no cost to the state, $138 million in federal Medicaid funding went to IHS and tribally operated facilities, 40 percent of which was payments for expansion enrollees.[14]

Medicaid expansion, while a significant step forward in addressing the government’s trust responsibility, cannot fully compensate for the historical lack of funds for health care in Indian Country.

The federal government has a trust obligation to ensure housing is accessible for tribal citizens, but for decades, federal policy has undermined the ability of tribal nations to provide affordable and culturally appropriate housing. In 1887, the General Allotment Act allowed the sale of tribal lands to non-Indians, resulting in a complex patchwork of ownership status on reservations.[15] This resulted in a significant drop of land under tribal control. Land that was not sold off to non-Native people or businesses was held in trust by the U.S. government. In Montana today, two-thirds of land on reservations is trust land.[16] The federal government mismanaged trust land and refused tens of thousands of tribal citizens access to their own funds. Allotment helped institutionalize generational poverty on reservations and resulted in the 2009 court case Cobell vs. Salazar and a $3.4 billion settlement.[17],[18]

Today, the allotment of tribal land continues to create barriers to housing security. The trust status of land is an obstacle to obtaining a mortgage and higher cost loans when they are available.[19] Despite the government’s legal obligation to tribal nations, policymakers have not allocated funds to address these hurdles. The Housing Act was established in 1937, but it was not until 1961 that tribal governments were eligible to receive funding for public housing programs.[20]

The Native American Housing Block Grant is the largest source of federal funding for housing in Indian Country and allows tribal nations to build, acquire, and rehabilitate houses. Funding for the program, however, has failed to keep up with inflation. In 1998, Congress appropriated $599 million to the program, close to $1 billion in today’s dollars.[21],3 For FY 2021, however, Congress had raised the appropriation by only $48 million.[22]

While the government created barriers to accessing health care, housing, and education in Indian Country, it also enacted hurdles for other racial groups. For example, in the 1930s, redlining made it more difficult for people to buy homes in neighborhoods with large Black populations. Redlining prevented Black people from receiving federal assistance for housing and made it more difficult for people to gain financial stability.[23] While practices such as redlining primarily occurred in states with larger Black populations, racist policies across the nation affect Montanans.

On average, racially diverse states invest less than other states in their social safety nets. [24] At first glance, Montana, a state where white people comprise 89 percent of the population, may not appear to fit that description.[25] The history of the state is more complicated. At one point, Montana was home to thriving Chinese and Black communities. Racist attitudes against people of color, economic changes, as well as legalized discrimination through state anti-miscegenation laws, discriminatory taxes, and anti-immigration laws led to the erosion of many communities of color in Montana as they had previously existed.[26], [27] Thus, legalized discrimination at federal and local levels played a heavy hand in Montana’s demographic makeup.

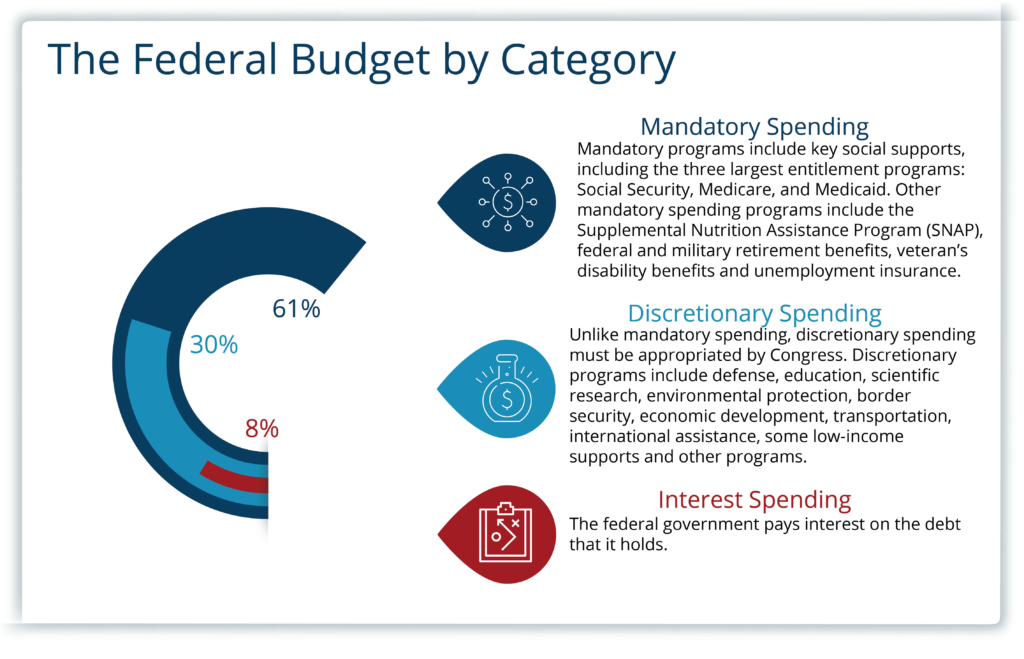

Racial animosity has also led to chronic underinvestment in the safety net, nationally disadvantaging all people who rely on it and further compounding racial inequality.24 Funds for safety net programs are commonly federally funded but state administered, opening the door for variations in the quality of the social supports available to people who live in any given state. Montana, like other states, suffers from the lack of investment in the social safety net caused by racial animosity at a federal level.[28] The social safety net has been undermined by racist narratives and fails to meet the needs of Montanans living on low incomes, especially Montanans of color.

The list of racist policy choices at the federal level is long. For example, Aid to Dependent Children, now known as Temporary Assistance to Needy Families (TANF) initially excluded many Black workers when it began in the early 1900s.[29] Changes to the program in the latter half of the 20th century were primarily based on negative racial stereotypes. Politicians promoted the idea of a “culture of poverty” among communities of color. They pushed “personal responsibility” as the antidote, without recognizing the government policies and funding choices that led to the high poverty rates. When policymakers shifted TANF from a cash assistance program into a state block grant program, fewer families ultimately received cash assistance.[30] In Montana today, just one in four families (2,823 families) living in poverty receive assistance through TANF.

Montanans of color are harmed by inadequate federal investment in other areas. A disproportionate number of Montanans who experience homelessness are people of color.[31] In 2021, housing choice vouchers supported 10,631 Montana people.[32] Because the federal government fails to fund the program adequately, only a quarter of eligible households receive housing voucher assistance.[33]

The Supplemental Nutrition Assistance Program (SNAP) provides significant federal funds to fight food insecurity. One in 10 Montanans rely on SNAP, but American Indians are more likely to face food insecurity.[34] This high rate of food insecurity is due to settler colonialism dismantling traditional food sources and being more likely to live in areas far from grocery stores and food outlets due to a lack of government investment in infrastructure on reservations.[35] SNAP, while a significant resource for families, nevertheless falls short of meeting the needs of households.[36]

SNAP households, as well as participants in other social safety net programs, face burdensome work requirements. These work requirements trace their roots to the same arguments used to justify slavery – that Black people must be forced to work.[37] Montana currently has waived work requirements for Able-Bodied Adults Without Dependents (ABAWD) for all counties except Missoula, Yellowstone, and Lewis and Clark, and all reservations in the state.[38] Unemployment for American Indians is still higher than the general population, regardless of whether they live in reservation or urban communities.[39]

Work requirements harm workers of color who have difficulty finding work due to discrimination in the job market. Data shows that Montanans of color are unemployed at greater rates than white Montanans regardless of educational attainment.[40] An insufficiently funded federal program hurts all Montanans who rely on it, but it disproportionately harms Montanans of color.

While the federal tax code overall is progressive, meaning those with higher incomes pay more than those with lower incomes, the tax code overall advantages white people through preferential tax treatment. Tax breaks, such as the mortgage interest deduction and lower tax rates for investment income, disproportionately benefit white and wealthy taxpayers because they are more able to access wealth-building opportunities, such as homeownership.

A home is the largest and most significant part of most Americans’ wealth portfolio.[41] Black, Indigenous, and people of color have not had the same opportunities to own homes as white people due to government-sanctioned discrimination. Discrimination within housing loan programs until 1968 meant Black people had fewer opportunities to buy homes.[42] Despite federal protections, Black families today still face discrimination through lower home valuations, even in neighborhoods with homes of similar quality.[43] As discussed earlier, American Indians also face greater challenges in owning a home due partly to the patchwork ownership of reservation land. For example, 47 percent of residents on the Fort Belknap reservation own their own home, compared to 69.5 percent of households in Montana.[44],[45]

The tax code offers significant benefits to taxpayers who own their own home through the mortgage interest tax deduction. As Dorothy Brown argues in “The Whiteness of Wealth,” other tax code policies, such as how the government classifies gains and losses from the sale of homes, have a greater impact on wealth. Homeowners who sell their home at a profit can receive $500,000 of that sale gain tax-free. Homeowners who sell their homes at a loss do not receive a tax break, a tax code that disadvantages people of color in neighborhoods deemed less desirable.23

Wealth is more accessible to white Americans who have been able to accumulate it over generations, because they face less discrimination in the labor and housing market. Wealth is also treated favorably in our tax code. The tax cuts of 2017 favored the wealthy by making it easier to pass wealth onto heirs by increasing the amount which can be distributed in gifts and estates tax-free. The richest 20 percent of Americans, who are disproportionately white, received nearly three-fourths of the tax cuts.[46] In Montana, the top 1 percent of income earners saw their tax bills reduced by $43,950 compared to $20 for the lowest 20 percent. This move cost our country $324 billion in 2020. This change makes it easier for families who already have wealth to continue to accumulate it, a move that benefits white and wealthy families and widens the gap for those without familial wealth.23

While the wealthy receive tax breaks, workers earning low wages face relatively high payroll taxes. Payroll taxes are regressive, meaning lower-income workers spend a greater share of their income in payroll taxes than the wealthy.[47] Due to discrimination in the workforce and unequal access to education, people of color are also more likely to work in jobs that pay low wages.[48] At the same time, income garnered from investment, known as capital gains, is taxed less than income earned from wages, increasing racial wealth disparities.[49]

The United States faces a stark racial wealth gap. The federal budget has historically protected the interests of the white and wealthy. Centuries of federal policies and budgetary decisions have perpetuated and institutionalized inequity. A system that was built to protect the interests of a few, in turn, harms all Americans, regardless of their background or identity.

Advancing equity and opportunity for all Americans requires the federal government to right its wrongs. By investing in health care, social infrastructure, safe housing, and education, the federal government can help correct problems it has helped create. Reparations, or the act or process of acknowledging and addressing harm and injustice, come in different forms. They are commonly thought of as cash payments to harmed people, but they can also come as wealth-building opportunities like college tuition. The United States has a tremendous opportunity to make reparations to BIPOC. Below are just several examples.

Federal policymakers must take steps to address the harm of racially motivated budget decisions. Reparative policy must begin by funding programs at equitable levels that also address the consequences of past underinvestment. For example, health care spending in Indian Country must be sufficient to address health care needs specific to Indian Country and a lack of access to food outlets or affordable housing.

The federal government should also end racially motivated punitive practices like work requirements in the social safety net. Because federal safety net spending is often allocated to the states, Montana policymakers should prioritize maximizing access to the safety net, rather than restricting it. Likewise, Montana can also work together with community members and stakeholders to provide training, increase representation, and improve access to the safety net for those who need it.[50]

Federal policymakers should address these disparities in the tax code. By preferencing wealth in our tax code, the federal government continues to prioritize the interests of the white and wealthy and increases the racial wealth gap. By taxing wealth the same as income, federal policymakers can take steps to begin to address racial wealth inequity.

The federal government should also make financial reparations to people of color. Individual payments, college tuition and student loan forgiveness, assistance for down payments, and business grants are avenues the federal government can use to address years of inequity in the federal budget.[51]

Racial inequalities in the United States have resulted from hundreds of years of oppression, racism, prejudice, and discrimination in the use of federal funds. The racial wealth gap is a stark reminder that historical policies and budgetary decisions impact the lives of BIPOC today. To address the racial inequality the country still faces, policymakers must use the federal budget for reparative policy that address the harm of past financial decisions

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.