Nearly every session a bill comes before the Legislature seeking to exempt social security income from all Montana income taxes, and every session the Montana Budget & Policy Center opposes.

Why?

To start with, Montana already has a good system that has been in place for a long time. We mirror the federal structure, in how we exempt social security income, exempting a greater amount of social security income for those on lower and moderate incomes.

A critical component of our system is that those living on the lowest incomes do not pay any tax on their social security income. So those who need it the most can stretch their checks even farther. In tax year 2015, 75 percent of social security income was exempt from tax.

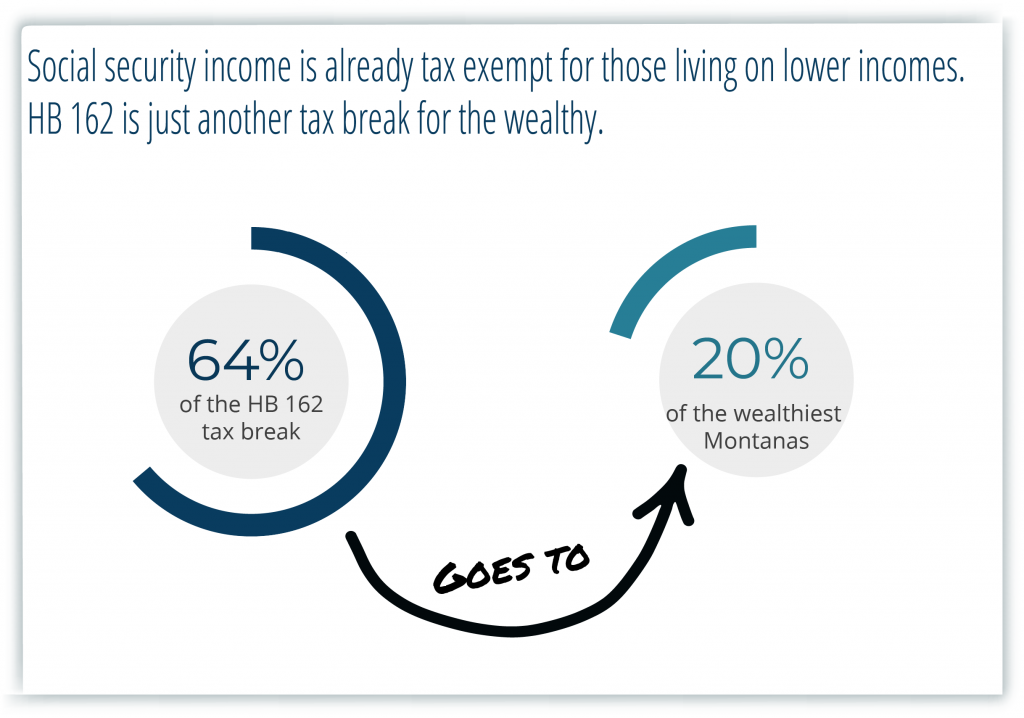

There are many problems with HB 162. It makes Montana’s regressive tax system worse by providing an additional tax break to those making the most. Over two-thirds of the proposed tax break in HB 162 would go to the richest 20 percent of households.

In addition, this bill is very expensive. It would cost our state $100 million each year. Legislators on the budget committees have already proposed reducing the health and human service budget by nearly $1 billion over the next biennium, threatening critical services that help Montanans with disabilities, Montanans struggling with mental health, and seniors. These are the same programs that bore the brunt of similar cuts in 2017. As we try to restore this funding, we cannot be giving even more tax breaks away to those with the highest incomes.

Let’s be clear. Social security received by Montanans living on lower social security incomes is already exempt.

Montanans have just begun to see the light at the end of the tunnel. HB 162 is not only bad policy but it is also something our state just cannot afford. Cutting state revenue by $100 million a year will hurt the families struggling the most and only prolong our economic recovery.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.