Today is what many people refer to as Tax Day. It is more than the deadline to file our tax returns. This is the day we look around our state and reflect upon how our collective tax dollars benefit everyone. They fund our schools, roads, bridges, libraries, community centers, water systems, healthcare, police, fire departments, parks, and so much more.

Today is also an opportunity to have a little refresher about how our tax dollars are used. The Montana Department of Revenue’s biennial report is a good roadmap for learning about how tax revenue is invested back into our communities.

• More state tax dollars are used to support education in Montana than anything else. The money helps build and support Montana public schools, community colleges, universities, and tribal colleges. These investments make it possible for Montanans to compete in today’s global economy and helps businesses access the skilled workers they need to thrive.

• One-fifth of state spending helps build and maintain roads and bridges and supports the police and firefighters that protect our communities. Investments in infrastructure ensure that our highways and bridges are well maintained and safe to travel so we can get to and from work and further explore all of the beautiful places in our state.

• Almost 10% of spending protects Montana’s natural resources and environment, including the parks, trails, and forests we all enjoy. Both state and federal tax dollars maintain and conserve state parks and two national parks so we can continue to camp, fish, and hike throughout Montana.

Our tax dollars are the visual proof that Montanans come together to invest in the things that matter most.

Unfortunately, right now, Montana simply doesn’t have enough revenue, and our state has been forced to make cuts to nearly every part of our state budget. Some of the deepest cuts were to mental health services, schools, home- and community-based services for seniors and people with disabilities, and wages for direct care workers.

So on a day like Tax Day, we should talk about ways to bring adequate revenue to get our state back on track and make the tax code fairer.

Right now, we know that low-and-moderate income families pay a greater share of their income in taxes than wealthy residents, and tax breaks like the capital gains tax credit benefit large businesses at the expense of all Montanans. And the new federal tax law that passed in December makes our tax code even less fair.

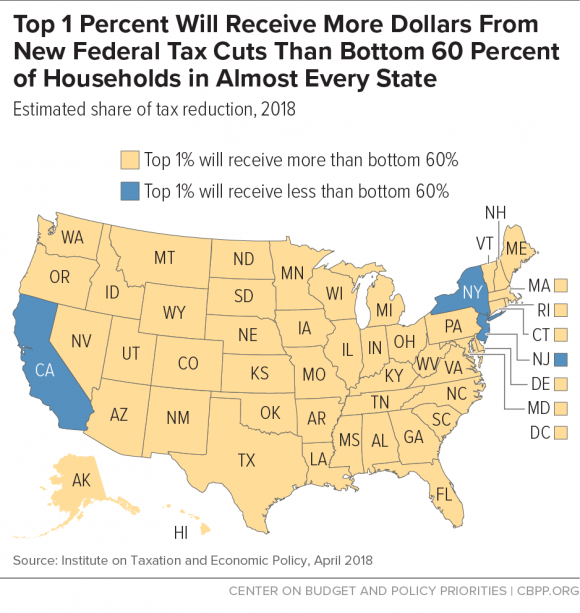

In Montana and most states across the country, the wealthiest families disproportionately benefit from the new federal tax law. In every state except three, the top 1 percent of households are receiving a bigger share of their state’s tax cut dollars than the entire bottom 60 percent.

The new law will lead to larger federal deficits — about $1.5 trillion over ten years — which congressional leaders may use to justify proposals for spending cuts to public services and assistance programs on which millions of families rely. Additionally, these cuts could add more pressure to the Montana state budget.

The new law will lead to larger federal deficits — about $1.5 trillion over ten years — which congressional leaders may use to justify proposals for spending cuts to public services and assistance programs on which millions of families rely. Additionally, these cuts could add more pressure to the Montana state budget.

Fortunately, we can do something about it. Read our recent report, Federal Tax Bill Creates Further State Budget Concerns, that not only outlines how the federal tax plan impacts Montana, and what the state legislature can do to make sure our state has enough revenue to turn Montana back around.

On this Tax Day, take a moment to consider just how much taxes improve you and your family’s well-being and what we can do to bring in sufficient revenue to invest in our communities.

If we love Montana, then we should fund Montana.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.