For decades, Montana has failed to sufficiently fund communities’ needs, resulting in a revenue system where local communities are picking up the tab. However, recent efforts to enact legislation to allow local governments to implement local sales taxes would disproportionately impact families living on lower and middle incomes, while also further disadvantaging Montana residents living in rural communities, particularly those in Indian Country. Insufficient funding for communities is a statewide problem and deserves a statewide solution. Raising revenue at the state level and funding local services is a more equitable solution to the challenges faced by our local governments both big and small.

This report will provide an overview of the local option sales tax proposal, the potential impact on families living on lower and moderate incomes, and the opportunity to exclude rural communities.

Local option sales taxes (LOST) are sales taxes levied by county or city governments on specific goods and services. All of the 37 states[1] that allow LOST also have general statewide sales taxes, with the exception of Alaska.

Local option sales taxes could raise revenue for some large communities and those heavily reliant on tourism. But a LOST would disproportionately affect Montanans living on lower and middle incomes. It would deepen economic inequality in the state even further by requiring rural people to subsidize urban areas when they travel to buy goods and services. Local option sales taxes are a tool that would empower some communities while doing nothing for, or even hurting, others.

Families Living on Lower and Middle Incomes Pay More

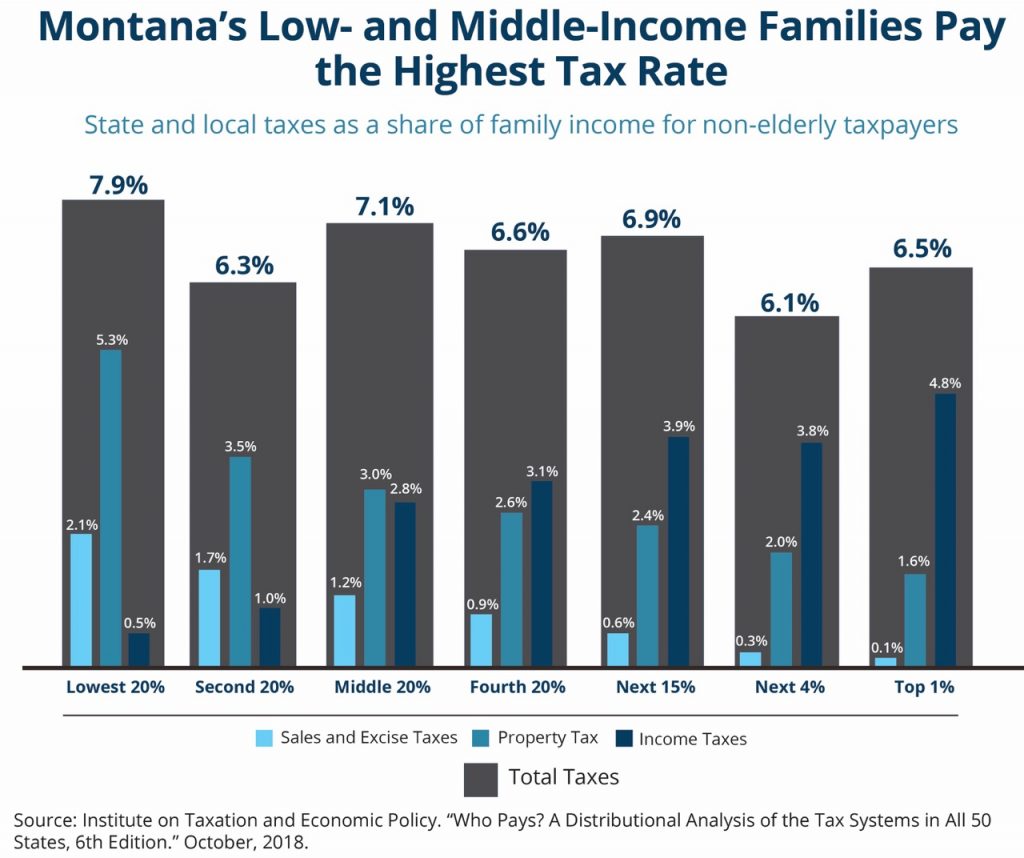

Montana’s tax system is regressive, meaning families living on low and middle incomes pay a larger share of their income in state and local taxes than the wealthy.[2] However, Montana’s tax system is less regressive than most other states, much of which is due to our lack of a statewide sales tax. Montanans living on low and middle incomes spend a larger proportion of their income on goods and services than higher-income Montanans. While Montana imposes selective sales taxes on certain goods (e.g., fuel, alcohol, and accommodations), the impact of these taxes is much smaller on Montana’s overall tax system than a general statewide sales tax.

Local option sales taxes would further exacerbate the regressivity of Montana’s tax system, requiring families with lower incomes to pay an even greater share of income in taxes than the wealthy. Sales taxes are by far the most regressive of all the tax types, and on average are significantly more regressive than property taxes.[3]

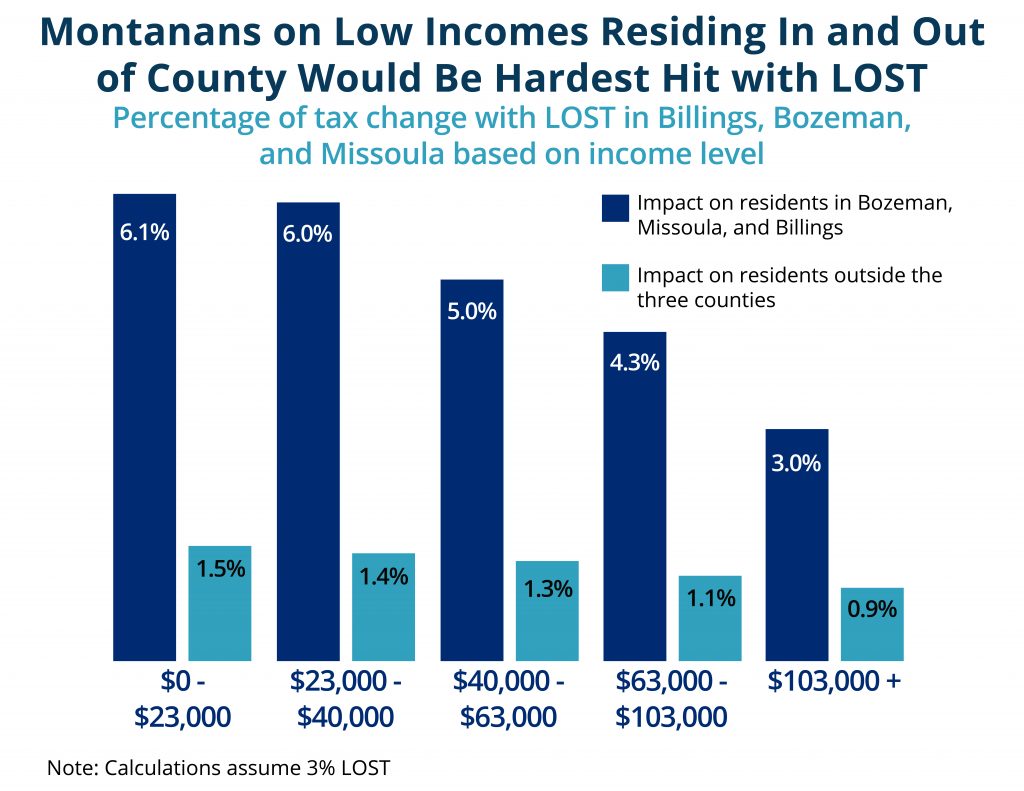

A 3 percent LOST on three major urban centers in Montana (Billings, Bozeman, and Missoula) would disproportionately increase taxes on the families living on the lowest incomes, both inside and outside of those three communities. The first chart below shows the increase in the share of state and local taxes paid by income level with a LOST for the residents of those three urban centers. Families earning less than $23,000 annually see a 6.1 percent increase in their taxes paid as a percentage of income.[4] The increase in taxes decreases as incomes rise, with households with annual incomes of over half-a-million dollars seeing only a 1 percent increase.

Montana residents outside of Billings, Bozeman, and Missoula often travel to these urban areas to shop, dine out, attend events, and visit family and friends. They too would see an increase in their state and local taxes paid. Unfortunately, they would not have the added benefits of more revenue for their own communities. All Montana families earning less than $23,000 annually and living outside of these major, urban centers would see an increase in taxes of 1.5 percent of income, on average.[5] The percentage increase in taxes decreases as incomes rise, with households with annual incomes over half-a-million dollars seeing only a 0.3 percent increase.

Local Governments Lack an Effective Mechanism to Reduce the Impact on Lower-Income Families

While the regressivity of the sales tax is a well-known problem among policymakers, some states have implemented tax credits to help offset some of the regressivity of a sales tax, like Maine’s refundable sales tax fairness credit.[6] However, with a LOST, local governments do not have an effective mechanism for administering refundable credits to offset the regressivity of a LOST. While local governments do have the ability to offset sales tax revenue with a reduction in property tax mills, most of the benefit from mill reduction benefits large, centrally assessed taxpayers, not local residents.

Local Option Sales Tax Creates Further Revenue Disparities Across the State

As many rural residents travel to urban areas for their day-to-day needs, a LOST would require them to contribute money toward the better-resourced urban area’s services while their communities went without. Local option sales taxes result in revenue flowing from lower-resourced communities to higher-resourced communities, with the citizens in the losing county paying for the more prosperous county’s roads, schools, and social services.[7]

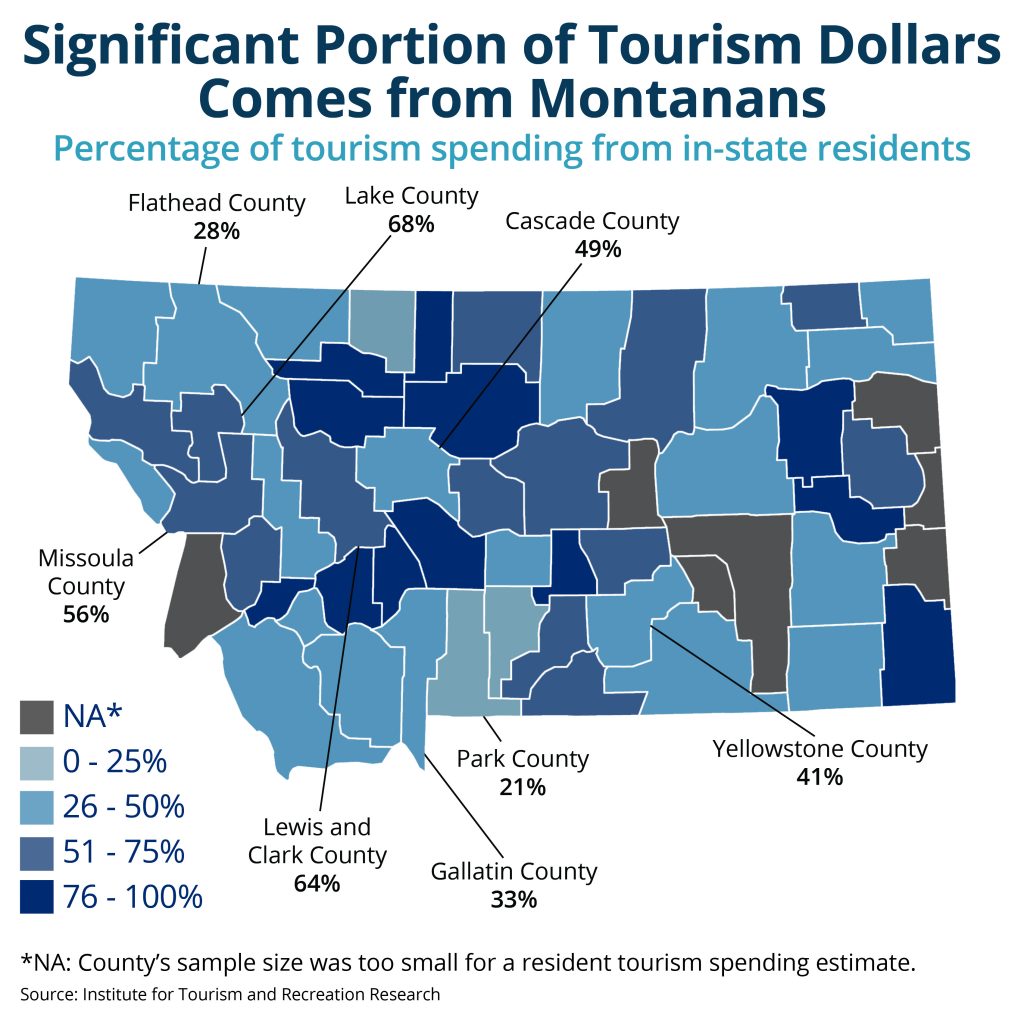

While proponents of LOST highlight out-of-state tourism, the reality is that many counties are heavily reliant on in-state residents traveling and spending money. One of the arguments for a LOST in Montana is that out-of-state tourists would contribute to the roads, emergency services, and any other public services they access during their visits. However, on a statewide level, nearly half of all tourism spending in Montana is done by in-staters when traveling to other cities in the state for business, recreation, sports tournaments, shopping, and more.[8] The share of tourism spending from in-staters varies by county. The following map shows the portion of tourism spending by in-staters by county.

A majority of counties in the state have a high share of tourism from in-state residents, although the amount greatly varies by county. Counties close to national parks attract a larger share of their tourism spending from out-of-state residents while many other urban centers get almost half or more of their tourism spending from in-staters. Park and Gallatin counties see a much lower proportion of their tourism from in-state residents than Yellowstone County, a regional shopping hub, for example. Other larger communities that do not border national parks, like Yellowstone County, draw in more rural residents for shopping, basketball tournaments, and the like, seeing around half of their tourism spending from in-state residents. Many more rural counties see greater than 70 percent of their tourism spending coming from Montana residents, as they see less tourism spending in general, and correspondingly visitors from out-of-state.

These estimates are the portion of total travel spending from in-staters, and do not consider the share of spending that residents of each county do, and which would be subject to a LOST.

Disproportionate Impact on American Indians

Montanans who are American Indians, living both on and off reservations, would disproportionately feel the negative impact of a LOST. Barriers to higher education and employment and ongoing discrimination have resulted in lower than average incomes for American Indians in Montana. While 13 percent of Montanans live in households earning less than the federal poverty level, 35 percent of American Indians live in households earning less than the federal poverty level.[9] Families living on lower and moderate incomes pay a higher share of local option sales taxes than the wealthy. As American Indian families are more likely to be living on lower incomes, American Indians would pay a disproportionately higher share of local option sales taxes.

To compound matters, a number of factors hamstring reservation economic opportunity, including a limited access to grocery stores and retail stores. This is due, in part, to the historical injustices of colonists that isolate reservation communities from mainstream economic life and make developing reservation economies challenging.[10] The legacy of this past requires families living on reservations to travel to regional shopping centers for their everyday needs for food, clothing, school supplies, and more. According to one estimate, on some reservations, nearly 80 percent of dollars flow out of the tribal economy without cycling even once, meaning those dollars do not circulate in or benefit the tribal economy.[11]

On average, counties with an American Indian population greater than the state average have access to 2.4 food outlets per 1,000 people while counties with a lower percentage of Indigenous people have access to 3.1 food outlets per 1,000 people.[12] Because of discrimination and lack of public or private investment in Indian Country, this trend of less access to food and other necessities in areas with large concentrations of American Indians continues for all types of retail outlets. Being unable to shop for groceries locally results in a disproportionate number of indigenous Montanans traveling from their own communities to urban areas to purchase necessities, potentially being subject to local option sales taxes that do not benefit their communities, and further depressing local economies.

Montana Needs a Statewide Revenue Solution

As communities across the state struggle to provide adequately for their residents, state policymakers should consider more equitable and statewide revenue sources that can help restore needed funding to local governments to provide services. Montana should consider fairer options such as closing corporate tax loopholes, restoring a top income tax breaket, and eliminating the capital gains tax credit which allows investors to pay a lower tax rate than wage-earners.

Revenue raised should be responsibly invested where communities need it most such as funding school infrastructure, investing in community health needs like mental health support, and supporting affordable housing solutions. Together, we can find solutions without disproportionately burdening rural Montanans, families living on lower and middle incomes, and Montanans who are American Indian.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.