Congress has an opportunity to help Montanans not only recover from the effects of the coronavirus, but to create a nation that includes everyone in its growing economy. Now is the time to address the challenges faced by Montanans, especially Montanans living on low-incomes and Montanans of color. We have the opportunity now to rebuild a stronger country, if Congress makes permanent its changes to the Child Tax Credit.

The Child Tax Credit (CTC) can drastically and permanently reduce childhood poverty and hunger. It can also begin to address racial injustices in our tax code if the changes made earlier this year become permanent.

This summer, families received much-needed support through a one-time expansion of the CTC. The effects have been immediately noticeable – food insecurity has dropped, and families are better able to afford childcare.

Over 9 out of 10 children in Montana will benefit from the expansion. A permanent expansion of the CTC could reduce childhood poverty by 45 percent, meaning 10,000 fewer children in Montana would live in poverty. For families of color, who have long felt the burden of a discriminatory tax code, the changes could reduce child poverty even more. Up to 55 percent fewer children of color will live in poverty if Congress permanently expands the CTC.

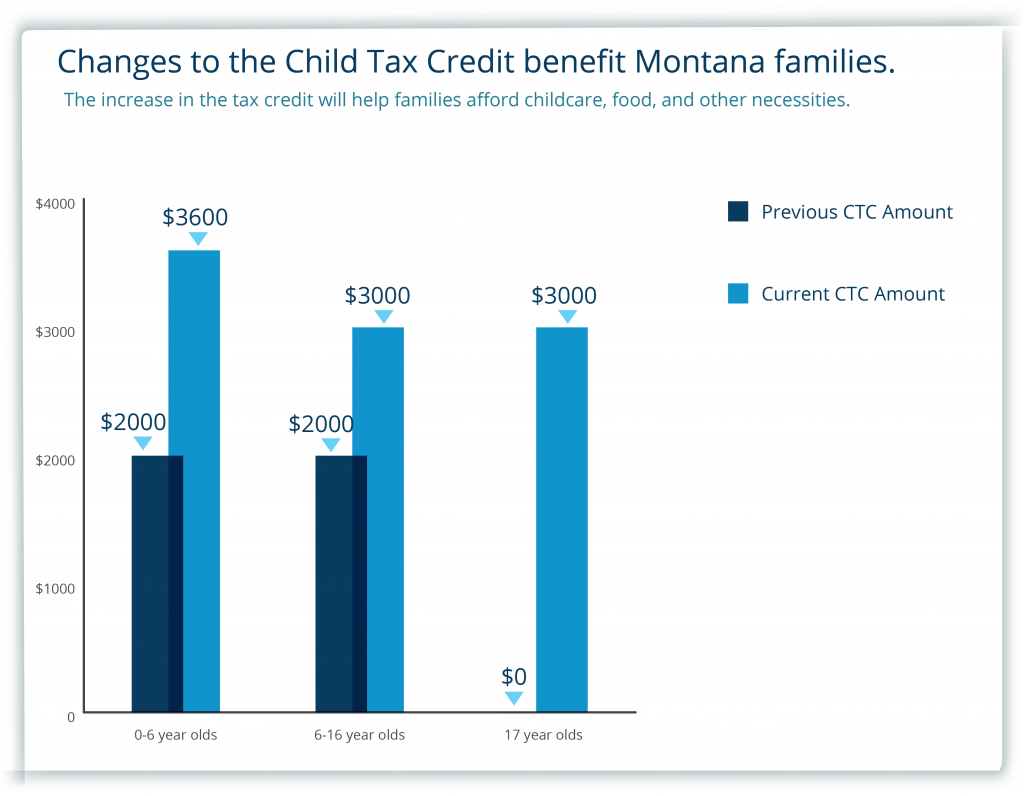

New, temporary changes to the CTC benefit families.

Before the American Rescue Plan Act (ARPA), the CTC was $2,000 for children 16 years and under. For the first time, the CTC includes 17-year-olds. Under the ARP, the CTC amount for children under 6 is $3,600, and for children aged 6 to 17, $3,000. Starting July 15, families began receiving monthly payments and will continue to receive them through the end of 2021. For each child under 6, this means a monthly check of $300 and $250 for those aged 6 to 17.

These credits can help significantly reduce the cost of raising children. For parents with a four-year-old, $300 a month can help cover roughly 40 percent of average monthly childcare costs, or it could equal up to a month’s worth of food for a child. Parents could also pay for other needs and opportunities, like new shoes or music lessons.

But while the dollar increase in the CTC has made the most headlines, it is not the only significant change.

Prior to this summer, the CTC was not completely available to families living on the lowest incomes. In the past, families did not receive the full tax credit if the amount they owed in taxes was less than the total credit. This meant higher-income families received a larger credit than families living on the lowest incomes.

For this year only, however, the tax credit is “fully refundable,” meaning families can receive the full amount, even if the amount they owe in taxes is less than the total credit received. This is a vital change for those families who need it the most and will be able to benefit from the full credit for the first time.

The refundability of the CTC reduces historical racial injustices.

American Indian families have suffered the consequences of discriminatory policies for generations. For example, the forcible transfer of land from American Indians to non-Indians in the late 19th and early 20th centuries destroyed opportunities to build generational wealth, creating lasting impacts today. American Indians have, and continue to be, discriminated against in education, housing, and employment opportunities, pushing many families into poverty. Due to inequitable policies, American Indians living in Montana experience poverty are 2.5 times more likely to live in poverty than white Montanans are.

Our tax code has doubled down on these injustices, as families living on the lowest incomes have not been eligible to receive the full CTC. This discrimination against those living on low incomes has served to perpetuate a cycle of poverty. But because the CTC is refundable for the first time, families living on low incomes can receive the full credit this year.

Refundability of the CTC is essential for families of color. Nationwide, the CTC expansion would lift 124,000 American Indians and Alaska Natives above the poverty line and 156,000 closer to the poverty line. In Montana, poverty for children of color would be reduced by 55 percent each year if these changes in the CTC were made permanent.

The CTC provided immediate impact and helped rural communities.

Food insufficiency in households with children dropped the week after families received the checks. Nearly half of respondents in a Census survey reported spending the credit on food. The CTC also helped families afford childcare – 17 percent of respondents with children under the age of 5 spent the credit on child care. With Montana facing a critical childcare shortage, the changes to the CTC can help more families afford quality care for their children.

As families spend their tax credit on their most urgent needs, they simultaneously stimulate their local economies, generating jobs and state and local tax revenue. The CTC provides a substantial benefit in rural states, like Montana, with smaller incomes and larger family sizes. The total expanded CTC, which brings in over $824 million to the state, could create 2,156 median wage jobs.

Refundability of the CTC should be permanent.

The changes to the CTC, including the increased benefit, expanded ages, and refundability, benefit over 90 percent of Montana children. But while the CTC has long been a source of support for families, the fact that families living on the lowest incomes could not receive the full credit especially children of color.

Allowing the CTC to return its previous state of non-refundability would discriminate against families of color who were driven into poverty by racially motivated discriminatory policies, like the forcible transfer of land and the underfunding of tribal colleges. Congress should act to make the refundability of the CTC a permanent feature to take steps in correcting this historical injustice.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.