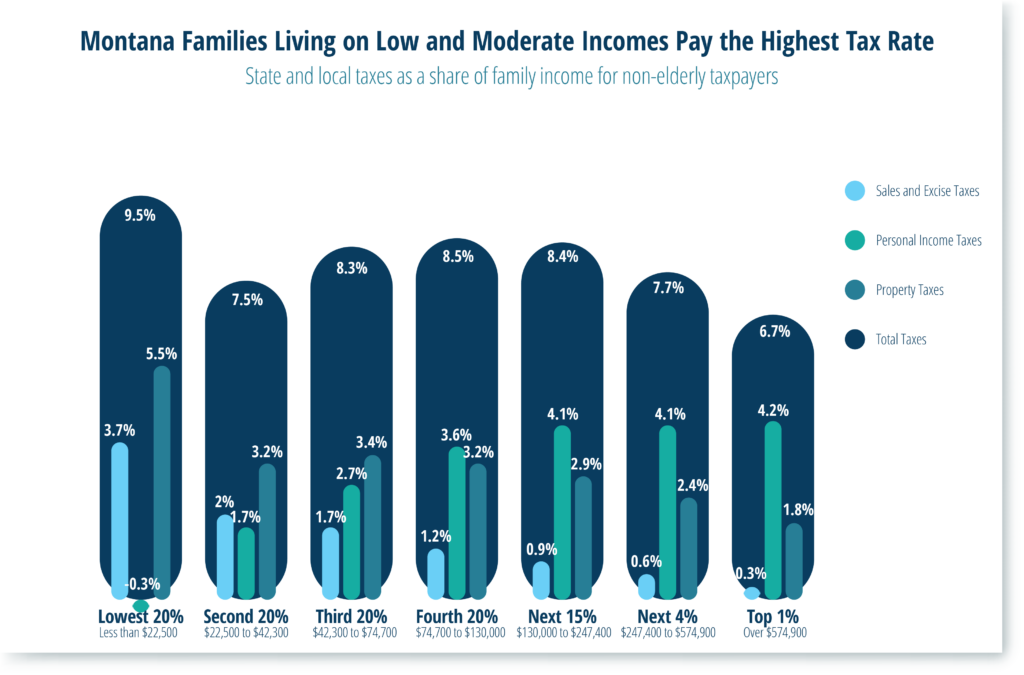

State and local taxes fund K-12 education for all Montana kids, provide reliable infrastructure like roads and bridges, and improve public health and economic well-being. While it’s important that taxes help fund programs and services that benefit all Montanans, it’s also important to ask — who is paying these taxes? The results are in: Montana families with the lowest incomes are paying an effective state and local tax rate 42 percent higher than the wealthiest one percent. While Montana families with annual incomes below $22,500 are paying 9.5 percent of their income in state and local taxes, those with incomes over $574,900 only pay 6.7 percent of their income in these taxes.

The Institute on Taxation and Economic Policy just released its 7th edition of the Who Pays Report, which evaluates effective state and local tax rates by income level for each state. The vast majority of states have regressive tax systems that ask residents living on lower incomes to pay higher state and local tax rates than the wealthy. In recent years, states like Washington have passed taxes on the wealthy and improved the fairness of their tax systems with the enactment of a new tax on capital gains and a tax credit for low and moderate-income families. Other states, like Arizona, have done the opposite by cutting taxes for the wealthiest in the state, resulting in taxes falling even more heavily on the lowest-income residents.

Montana’s tax system is becoming more reliant on lower and moderate-income Montanans. Lawmakers passed income tax cuts that disproportionately benefit the wealthy in the last two legislative sessions. At the same time, Montana’s property tax system is drawing more and more heavily on residential homeowners, shifting taxes away from other types of business property. The combination of these two factors has led to a great tax shift. Today, Montana has a state and local tax system that is more heavily reliant on Montanans with lower and moderate incomes, as opposed to the wealthy.

Luckily, there are proven solutions to mitigating Montana’s regressive tax system. Lawmakers must pass a Housing Fairness Credit, targeted to families with low and moderate incomes who pay high property tax rates. A Housing Fairness Credit is the most affordable proven solution to even out Montana’s regressive property tax system and stop the unsustainable increases in property taxes hitting both renters and homeowners. Looking at Montana’s income tax system, the legislature must end the recent cycle of cuts to the top income tax rate which disproportionately benefits wealthy households. Maintaining our current income tax system would keep income taxes stable, as opposed to additional income tax cuts which provide thousands of additional dollars each year for the state’s wealthiest residents at the expense of the rest of Montanans. These two changes could start to turn the tide of the great tax shift, which is slowly and steadily shifting Montana’s tax bill onto the backs of Montanans with lower and moderate incomes.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.