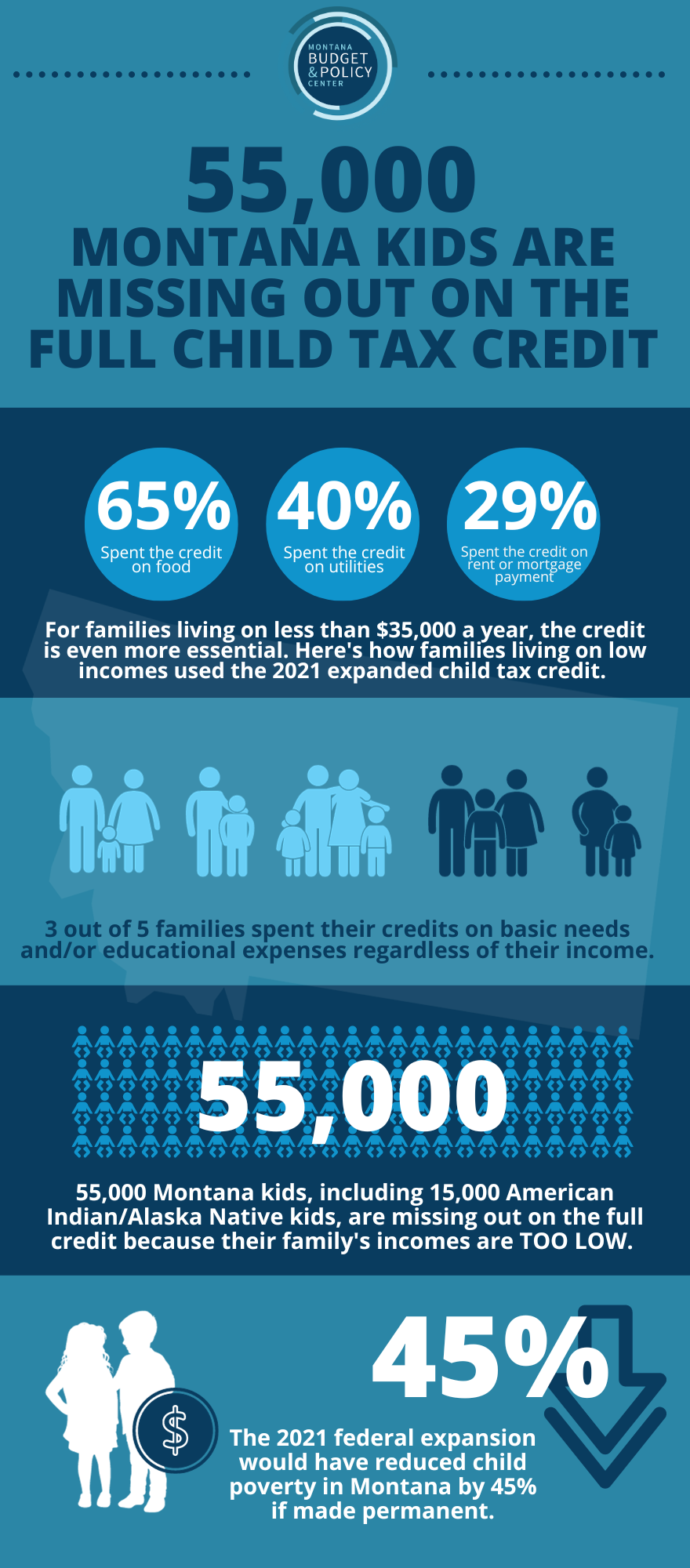

Families do better when they have adequate resources to meet basic needs like housing and healthy food. Luckily, it’s not too late to expand the federal child tax credit and help tens of thousands of Montana families afford basic necessities. The 2021 child tax credit (CTC) expansion fixed a flaw in the tax code that bars families with low incomes from receiving the full amount of the credit. But this fix expired, and there are currently 55,000 Montana kids, including 15,000 American Indian/Alaska Native kids in Montana who are left out of the full child tax credit because their families make too little money. Fixing this flaw would help to reduce differences in poverty rates by race.

If the temporary federal expansion of the CTC had been made permanent, it would have made meeting basic needs easier for a lot of Montana families by lifting 45 percent of all Montana children and 59 percent of American Indian/Alaska Native children in Montana out of poverty. Children who live in households with poverty-level incomes often experience lower academic success than their peers, which carries forward into their lifelong economic outcomes. Policy choices like a CTC that lifts a great number of children out of poverty can help improve lifelong economic success for Montana kids, which has a positive impact on the Montana economy as well.

Over half of Montana parents spent the 2021 CTC expansion funds on food for their families, resulting in fewer families without food security. Families also used the money to pay down debt, manage bills, afford child care, and buy clothing and school supplies. Lawmakers must consider the needs of our children and their families. The most effective tax policy to make a difference in the lives of Montana families is fixing the flaw in the CTC so that families with low incomes can receive the full credit.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.