Tribal self-sufficiency and self-government depend upon a tribe’s ability to raise revenue and regulate its territory—and the power to tax plays an essential role in this.[1] These revenue streams help tribes perform government functions and provide essential services to their communities. Perhaps surprisingly, taxation authority in Indian Country has been one of the most litigated issues between tribes, states, and local governments. In response, a coalition of tribes, intertribal organizations, and federal officials have been pushing for the clear articulation of federal Indian tax policy that would eliminate jurisdictional questions and reinstate tribal governments’ exclusive taxation authority on reservations, among other things.[2]

While the state of Montana has been the setting for several important court battles over on-reservation taxation authority, it has also been a more recent leader in seeking resolutions through detailed state-tribal revenue sharing agreements. Until Congress passes legislation to preempt state taxation on reservations, revenue sharing agreements can provide state and tribal governments with some level of certainty concerning the division of revenue while safeguarding against costly litigation. This, and the fact that agreements can be crafted in mutually beneficial ways that respect tribal sovereignty, make them an effective, if temporary, solution to the ongoing taxation competitions between sovereigns.

This is the second in a two-part Policy Basics series on taxes in Indian Country. Part 1 provides a brief overview of the taxes that individual Indians in Montana pay.[3] Part 2 focuses on tribal governments and the taxes they pay and assess. It begins by delving into the critical role taxes play in creating a reliable revenue stream that can support government services and operations, as well as encouraging certain behaviors and economic climates through tax incentives and exemptions. This is followed by a review of the state-tribal revenue sharing agreements made between the seven reservation governments and the Montana Departments of Revenue and Transportation. The report concludes with a set of policy recommendations to state and tribal policymakers and agency personnel for maximizing the benefits of revenue sharing for their respective governments.

Functions of Taxation

Taxes Support Important Government Services and Encourages Certain Behaviors

Tax dollars represent our collective effort to invest in our communities and citizens. Our taxes fund public services like improvements in roads, bridges, schools, sewer and water systems, provide public safety, and ensure that our most vulnerable neighbors are protected.

Governments can also use taxation to create beneficial social and economic conditions. For example, taxing risky public health behaviors like smoking can help limit tobacco use among citizens. Likewise, providing tax incentives in the form of deductions, exclusions, or exemptions from a tax liability can promote economic development and increase job opportunities. For example, the mortgage interest deduction rewards homeownership and New Markets Tax Credits incentivize investing in low-income communities.

While federal, state, and local governments regularly utilize federal tax and financing tools, they are oftentimes difficult for tribes to use due to restrictive compliance and reporting requirements. For example, in the case of issuing tax-exempt bonds tribes must meet all the same requirements as states, as well as additional requirements applicable only to tribes. This includes the condition that funds can be used only for projects that relate directly to the performance of essential governmental functions—a criterion that states do not have to meet.[4]

Further complicating matters for tribes, the 1987 Omnibus Budget Reconciliation Act limited the term “essential governmental function” to exclude functions that are not generally performed by state and local governments. Before this, tribal essential governmental functions could include the commercial and industrial activities that many tribal governments regularly undertake in their efforts to generate revenue.[5] Likewise, dual taxation of certain on-reservation commercial transactions by both tribes and states makes it difficult for tribes to attract businesses to their reservations by offering tax incentives. This is because the tribal tax immunity can never fall below the existing state tax, thus offering no additional incentive to doing business on reservations.[6]

Federal, State, Local, and Tribal Government Services and Revenue Sources

To understand the complex relationship of tribal governments to taxation, it is important to understand the scope of services tribes provide and the functions they perform. Additionally, the state and federal governments also play a role in providing services to American Indians residing both on- and off-reservation. A brief description of how the various levels of government fund these services concludes each section.

Federal Government

In very broad terms, the federal government funds services that include health care, education, environmental protection, disaster and emergency relief, federal judicial systems and prisons, national parks, national highway construction and maintenance, airports, postal service, and military defense.[7] The federal government provides some of these services directly and also transfers federal dollars to states to offset a portion of states’ costs to provide various services.

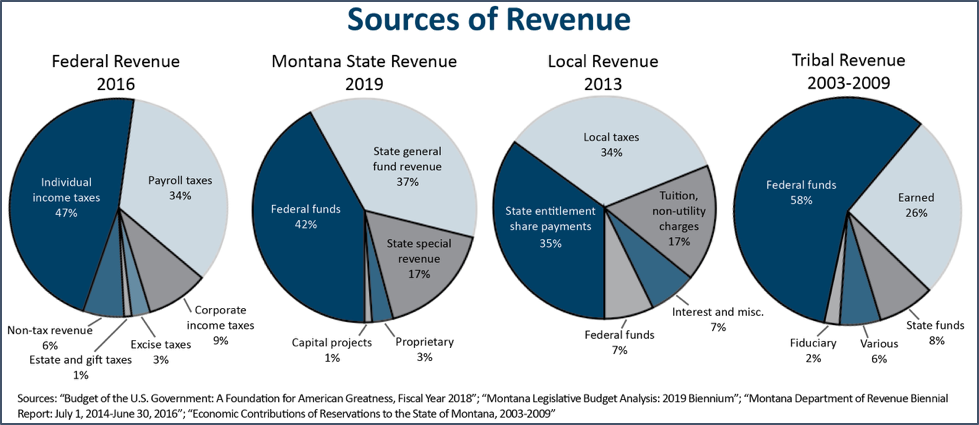

In 2015, 92 percent of the $3.18 trillion in total federal revenue came from taxes.[8] The largest share derived from individual income taxes (47 percent) followed by payroll taxes (34 percent), then corporate income taxes (11 percent). The rest was comprised of excise, estate and gift taxes, and customs duties.[9]

State Governments – Montana

State governments commonly provide services that include K-12 and post-secondary education and health care. They build and maintain roads and bridges, provide law enforcement, corrections programs, district courts, natural resource management, and assistance for low-income families.[10]

For the 2017 biennium, the largest source of revenue (42 percent) for Montana is federal revenue, which the state then appropriates through the state budget. The second largest source of revenue (37 percent) is state general fund revenue, which consists of taxes the state collects. The three largest sources of state general fund revenue are individual income tax (56 percent), property tax (12 percent), and corporate income tax (six percent). Montana also collects certain fees and excise taxes which are earmarked for specific purposes through state special revenue accounts.[11]

Local Governments – Montana

Counties, cities, and towns comprise local governments in Montana. Generally, local governments provide law enforcement, public schools, fire protection, and emergency services. They also conduct elections, keep official records, provide housing, municipal courts, public transportation, parks and recreation services, and public works like sewer and street maintenance, snow removal, and road signage.[12]

Local governments rely primarily on transfers from federal and state governments, as well as local property taxes to obtain revenue.[13] In Montana, 35 percent of local government budgets came from entitlement share payments from the state and 34 percent came from of local taxes in 2013. The lion’s share of this local tax-based revenue was derived from property taxes (96 percent).[14]

Entitlement Share Payments are annual state payments to local governments to provide “replacement” funding for lost revenue due to legislative action that restructured the collection and administration of various taxes and fees in the state of Montana.

-Source: Montana Code Annotated 15-1-121

Part of the revenue that counties receive from the state is shared with school districts, cities, and towns. Fifty percent of entitlement share payments to counties are passed through to cities.[15]

Tribal Governments – Montana

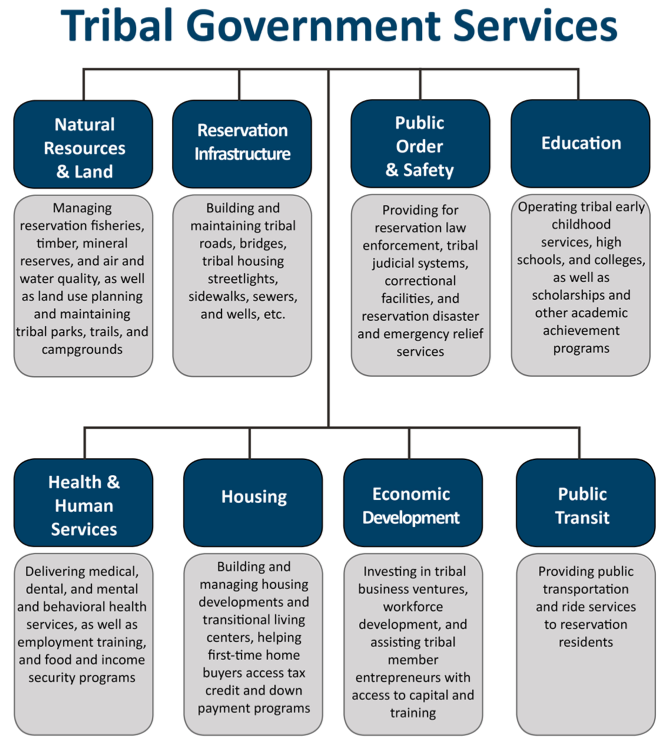

Tribal governments are fully functioning governments that provide an array of services similar to those of federal, state, and local governments. Many of these services (like reservation infrastructure) are provided to the benefit of all reservation residents, including non-Indians. Other services (such as tribal healthcare and housing) are provided to eligible American Indians from any tribe, while others (like scholarships for education) are provided specifically to tribal members from that particular reservation.

In general, tribal government responsibilities include managing tribal land and resources, maintaining tribal roads, bridges and other reservation infrastructure, providing housing, conducting elections, and maintaining public order and safety (see graphic).

Like other governments, tribal governments have elected officials and employ a sizeable workforce in order to perform essential functions and provide services. In fact, tribal governments are oftentimes the largest employers in their geographic areas. Thus, like any government, tribes require revenue to meet their obligations to their members.[16]

While tribal governments operate many of the same public services as other levels of government, they must operate without the usual tax revenue other levels of government rely on. This is because state and local governments have successfully challenged in court tribal governments’ exclusive right to levy taxes within their reservation boundaries to the point that tribal taxation authority is greatly diminished today. Thus, many tribes must rely on their natural resources and tribally owned business enterprises as their only source of revenue outside federal dollars.[17] Even here, states have fought for the ability to co-tax certain economic activities and natural resource development involving non-Indians in Indian Country, extracting wealth from impoverished communities and creating a system of dual taxation that can confound reservation economic growth.[18] These issues are addressed later in this report.

Among the few taxes that tribal governments in Montana assess are excise taxes on the on-reservation sale of alcohol, tobacco, fuel, and severance taxes on natural resource development. However, as a result of revenue sharing agreements made between the seven reservation tribal governments and the state Departments of Revenue and Transportation, revenue derived from these taxes is shared with the state of Montana. In 2016, total statewide revenue collected from these taxes totaled $347.6 million, with $10.6 million being remitted to tribal governments.[19]

The most recent data shows that between 2003-2009, the combined revenue for all eight tribal governments in Montana totaled more than $6.6 billion. The largest source of revenue was federal funds (58 percent). This includes federal transfers for public schools located on reservations and other education funding, Indian Health Service (IHS), tribal colleges, housing, and Bureau of Indian Affairs (BIA). More than a quarter (26 percent) of all tribal revenue was earned, while the rest was comprised of transfers from the state of Montana (eight percent), various sources (six percent), and fiduciary (two percent).[20]

Federal Transfers to Tribes Stem from Federal Trust Responsibility, Treaty Agreements, and Government Contracts/Compacts

Federal transfers to tribes are somewhat similar to federal transfers to states for Medicaid and education or state transfers to counties to support school districts—but with one significant exception: a majority of federal transfers to tribes are a direct result of the federal-tribal trust relationship and treaty agreements. Additionally, many funding transfers are made as part of tribal self-determination contracts and self-governance compacts wherein the federal government contracts and compacts with tribal governments to administer a variety of federal programs serving their reservations. This includes Indian Health Service programs and others such as Bureau of Indian Affairs land management or housing.[21] Portions of the transfers also stem from public assistance programs that are available to all other Americans.

Through treaties, tribes ceded control of millions of acres of their homelands to the U.S. in exchange for compensation that oftentimes included annuities, medical services, education, and housing, among other things.

Tribes receiving federal dollars to carry out self-determination contracts and self-governance compacts are subject to annual audits. They are also subject to annual trust evaluations to monitor their execution of the federal trust functions they are performing on behalf of the federal government.[22] Although tribes receive federal dollars for this work, chronic, inadequate funding requires them to regularly supplement program budgets with their own resources.[23] Thus, as tribes assume more local responsibility, their need for revenue increases as well. And, as stated earlier, tribal governments’ ability to build a tax base to support their essential functions and services has been significantly usurped by state and local governments. This is discussed at length in the section on page 7.

Taxes Tribal Governments Pay

Income Taxes

Federally recognized tribal governments do not pay state income taxes because, in accordance with federal law and U.S. Supreme Court rulings, states cannot tax Indian tribes in Indian Country.[24] Thus, federally recognized tribes receive the same income tax exemption as federal and state governments. However, income generated by state-recognized tribes or through tribal corporations chartered under state law is subject to federal and state income taxation.[25] To be exempt, federal law stipulates that tribal government revenue must be earned though a tribally owned corporation chartered under section 17 of the Indian Reorganization Act (regardless of whether the income was earned on- or off-reservation).[26]

Property Taxes

As discussed in Part 1 of this series, the U.S. Supreme Court has found that state legislatures can elect to tax on-reservation fee land owned by a tribe or tribal member. Because many states, including Montana, have opted to exercise this ability, tribal governments must pay property taxes on any fee land they own, even when it is located within the exterior boundaries of their own reservation.[27]

Federal Payroll Taxes – FUTA, FICA

As employers, tribal governments are required to pay into either the Federal Unemployment Tax Act (FUTA) taxes or the State Unemployment Tax Act (SUTA) taxes on behalf of their employees.[28]

Tribal governments must also withhold from their employees’ gross wages federal income, social security, and Medicare taxes, also called Federal Insurance Contribution Act (FICA) taxes. Under FICA, tribes must match their employees’ social security and Medicare contributions.[29] Unlike state and local governments, tribal governments may be required to pay the same FICA taxes as employers in the private sector.[30] (See text box for more information.)

Other Impacts to Tribes Related to Federal Payroll Tax Issues

The Pension Protection Act of 2006 established that tribal government retirement plans did not qualify as “government” plans unless one hundred percent of tribal employees are engaged in essential government functions. Because numerous tribes rely heavily on their natural resources and tribal business ventures to produce government revenue, they tend to have employees engaged in seemingly commercial activities. As a result, retirement plans for those employees are governed by the same laws and Internal Revenue Service (IRS) codes as employer-sponsored plans in the private sector.I Thus, tribal governments may be forced to administer two separate employee retirement plans—one for workers performing essential government functions and another for those performing commercial activities—resulting in increased costs for the tribe.

IRS section 457 provides an exception allowing certain state and local governments and non-profit employers to create deferred compensation plans for their employees engaged in commercial activities. Tribal governments, however, are not recognized as eligible governments and cannot sponsor a 457 governmental plan.II In the end, many tribes elect to offer their employees 401(k) retirement savings plans, which often yield less than traditional pension plans partly because management and investment fees are higher, and partly because professional managers of pooled pension funds tend to get higher returns than employees who manage their own 401(k) plans.III These limitations can put tribes at a disadvantage when it comes to attracting and keeping qualified employees, to whom a job with good benefits and a secure retirement income is important.

Furthermore, although the IRS acknowledges that tribal members employed to serve as council representatives are in fact tribal employees whose wages are subject to federal income tax assessments, they also hold the contradictory view that tribal council member service is not “employment” for FICA withholding purposes. Thus, tribal council members must pay federal income taxes on their wages (which they can have voluntarily withheld by the tribe), but they cannot contribute to or receive social security and Medicare benefits in relation to their service on the council.IV A bill currently before Congress (S. 1309/H.R. 2860) seeks to remedy this situation by allowing tribal councils to enter into agreements with the Commissioner of Social Security to obtain social security coverage for their service to their tribal nations.

Excise (or Selective Sales) Taxes

The federal government has granted state and local governments full exemption from federal excise tax liabilities, but because the U.S. Constitution refers to tribal governments as sovereign entities, tribes are subject to some federal excise taxes.[31] This includes taxes on gaming wagers, foreign insurance policies, harbor maintenance, and taxes on machine guns, destructive devices, and certain other firearms.[32.

In most instances, however, tribes are treated like state and local governments in relation to federal excise tax exemptions, but with one major stipulation. In order to meet the exemption criteria tribal governments must be engaged in “essential governmental functions,” while state and local governments are not held to the same standard.[33]

Overview of Taxation Authority on Reservations

Tribal Governments Retain their Sovereign Power to Tax

The power to tax is an inherent right of self-government and is one of many rights still retained by American Indian tribes. While tribal governments once held exclusive taxation authority on their reservations, including over non-Indians, state and local governments have repeatedly challenged this authority. As the information provided below attests, the state of Montana and the tribes located here have been active participants in these debates, as well as working together to find reasonable solutions to which both governments can agree.

The resolution of disputes over on-reservation taxation authority generally depends upon the specific details of each case and the weighing of federal and tribal interests against those of the state according to a complex set of “tests” developed by the U.S. Supreme Court.

Below is an overview of tribal and state taxation authority in Indian Country, as well as a review of the taxes that tribal governments commonly do and do not assess today. It is important to note that this area of tribal law is fluid and dynamic, ever affected by the evolving makeup of the U.S. Supreme Court and state and tribal leadership.

Tribal Taxation Authority Over Tribal Members on Reservations

Due to their sovereign status, tribal governments can unilaterally impose taxes on their own members residing on their reservation. However, there are very few tribes that tax their member populations.[34] These taxes are discussed in the following section of this report.

Tribal Taxation Authority Over Non-Indians on Reservations

Federally recognized tribal governments do not pay state income taxes because, in accordance with Over the past few decades, tribal taxation authority over non-Indians on reservations has been heavily contested and significantly limited by a series of U.S. Supreme Court rulings. In 1981, in an important case involving the Crow Tribe and the state of Montana, the court formalized the extent of tribal authority over non-Indians on reservations across America.

These resulting “Montana exceptions,” when applied to taxation, provide that tribes can impose taxes on non-Indians via commercial transactions that occur on reservation trust land. They can also impose taxes on non-Indians via commercial transactions occurring on reservation fee land when:

State Taxation Authority Over Indians on Reservations

In accordance with federal law and U.S. Supreme Court rulings, states cannot tax tribes or tribal members on their own reservations.[36] One exception is property taxes on reservation fee land owned by a tribe or tribal member.[37]

State Taxation Authority Over Non-Indians on Reservations

Although states cannot impose taxes on tribes or tribal members on their reservations, federal courts have found that states can levy certain taxes on non-Indians in Indian Country when:

Examples of these taxes are discussed in the following section of this report.

Concurrent State-Tribal Taxation Authority on Reservations

Adding to the complexity of jurisdictional questions, the U.S. Supreme Court has also found that in certain circumstances both tribal and state governments have the right to tax the same instance.[39]

This finding has resulted in numerous complications, including dual taxation. For non-tribal members doing business on reservations, having to pay tribal and state taxes on the same activity results in higher costs. This can drive away businesses and reduce commercial activity on reservations. It also limits tribes’ ability to develop a tax base to sustain reservation infrastructures, economies, and essential tribal government functions and services, which increases tribes’ reliance on federal dollars.

A review of taxes that tribal governments commonly do and do not assess today is below.

Taxes Tribal Governments Assess

Income Taxes

Income taxes are the primary source of revenue for many governments. Tribal governments, like federal and state governments, have the right to tax the income of their own members, but few, if any, actually do. Each tribe has its own reasons stemming from its unique history and cultural views on the matter. However, widespread poverty and high rates of unemployment common on many reservations plays into the unfeasibility of taxing tribal member income.

In 2015, more than 28 percent of all American Indians living on reservations in the U.S. lived below the poverty line.[40] This number increased to 36 percent for families with children.[41] In Montana, the combined average of reservation-residing American Indians living in poverty between 2011 and 2015 was 34 percent.[42] Likewise, the Bureau of Indian Affairs estimates that tribal member unemployment was as high as 70 percent on some reservations in the state in 2005.[43]

Property Taxes

Besides taxing income, property is another major source of tax revenue for state and local governments. Tribal governments, however, are unable to derive revenue by taxing reservation land. This is because the title to most reservation land falls into one of two types of status: trust or fee.

Land owned collectively by the tribe, as well as land allotted to individual tribal members, is called trust land and is held in trust for tribes by the federal government. Trust land cannot be taxed.[44] In Montana, reservation trust land constitutes as much as 100 percent of some reservations.[45]

Further, due to the forced allotment of many reservations there are now parcels of fee land that are privately owned and subject to property tax assessments. Absent an exemption under state law, the U.S. Supreme Court has found that it is state and county governments—not tribes—that can tax fee lands on reservations.[46]

| Reservation | % Trust Land (Tribal & Individual) | % Fee Land |

| Blackfeet | 63 | 36 |

| Crow | 68 | 32 |

| Flathead | 56 | 32 |

| Fort Belknap | 97 | 3 |

| Fort Peck | 46 | 54 |

| Northern Cheyenne | 99 | 1 |

| Rocky Boy’s | 100 | 0 |

Source: Tribal Nations in Montana: A Handbook for Legislators, 2016

Hotel Occupancy Taxes

Tribes have exclusive authority to impose hotel occupancy taxes on all patrons, including non-Indians, who stay at tribally-owned hotels and private hotels located on tribal trust land within their reservation boundaries.[47] A 2002 district court ruling confirmed this when the Montana Department of Revenue sued the Confederated Salish and Kootenai Tribes for failing to collect and remit the state bed tax from non-Indian patrons staying at the tribal KwaTaqNuk Resort. The court found that the state lacked authority to impose its tax in tribal hotels, even when the tax falls on non-Indians.[48] Tribes cannot, however, impose their hotel occupancy tax in reservation hotels owned by non-Indians operating on fee land.[49] Patrons staying at these hotels are instead subject to paying state bed taxes.

Utility Taxes

A Ninth Circuit Court of Appeals case involving the Crow Tribe affirmed the right of a tribe to impose utility taxes on companies that have entered into a contractual relationship with a tribe.[50] Because utility taxes are business activity taxes, they can be passed on to all ratepayers, Indian and non-Indian alike, within a service area. Thus, non-Indian consumers living on reservations (including on fee land) must pay tribal utility taxes whenever the taxes are passed through by utility companies with which the tribe has a contractual relationship.

Today, several tribes across the country have imposed utility taxes on services such as telecommunications, railroads, solid waste collections, and electrical power. In Montana, the Blackfeet Nation, Crow Tribe, and the Fort Peck Tribes each assess various tribal utility taxes.[51]

Severance Taxes

Tribal governments can impose severance taxes on natural resource development occurring on their reservations. Further, in a 1985 precedent-setting case involving the state of Montana and the Blackfeet Tribe, the U.S. Supreme Court found that states cannot tax royalty payments received by tribes from natural resource development leases with non-Indians.[52] Following this decision, the U.S. Supreme Court ruled in Crow Tribe v. Montana that states also cannot impose severance or gross proceeds taxes on tribal mineral leases with non-Indians when a tribe has retained mineral rights to the land, including on former tribal land now located off-reservation.[53]

Retail Sales and Use Taxes

Tribes can levy retail sales and use taxes on Indian and non-Indian consumers alike on transactions occurring on reservation trust land.[54] Likewise, state retail sales and use taxes cannot be imposed on transactions entered into by Indians on their own reservations or on products produced and sold by a tribe.[55]

There is not a statewide retail sales tax in Montana, nor do any of the seven reservation-based tribal governments in Montana assess retail sales or use taxes.

Use taxes are sales taxes on out-of-state purchases that would have been subject to a state sales tax had they been made in-state. While retailers submit sales taxes to state revenue departments, residents are required to track and submit use taxes.

Excise (or Selective Sales) Taxes

As described above, tribes have the right to levy excise, or selective sales, taxes on commercial activity on their reservations. In a series of U.S. Supreme Court cases including one involving the Confederated Salish and Kootenai Tribes, the court established that in certain instances (such as cigarette sales) states can impose their tax on non-Indians making purchases on reservations regardless of whether or not the transactions occur on trust land.[56] In these instances, non-Indian consumers are subject to both the tribal and state tax, resulting in dual tribal and state taxation of the same activity.

Additional Dangers of Dual Taxation

States that choose to levy taxes on non-Indians in Indian Country regardless of the existence of a tribal tax system effectively undermine the tribal tax, putting tribes in a difficult position. Tribes must choose between foregoing their tax and the oftentimes much-needed revenue or imposing their tax and potentially driving both people and businesses from their reservations.

Dual taxation also limits a tribe’s ability to offer tax incentives, as the tribal tax immunity could never fall below the existing state tax, thus, offering no added incentive for doing business on-reservation.

Further, the U.S. Supreme Court has found that states can require tribal businesses to collect and remit validly imposed state excise taxes on purchases made by non-Indians on reservations.[57] However, the court also found that tribal sovereign immunity protects tribes from lawsuits by state and local governments for the collection of state sales taxes. The court offered several suggestions, including states and tribes entering into agreements for the collection of these taxes.[58]

In 1993, this suggestion led the Montana legislature to amend the 1981 State-Tribal Cooperative Agreements Act to specifically include cooperative tax agreements with tribes.[59]

Montana State-Tribal Revenue Sharing Agreements

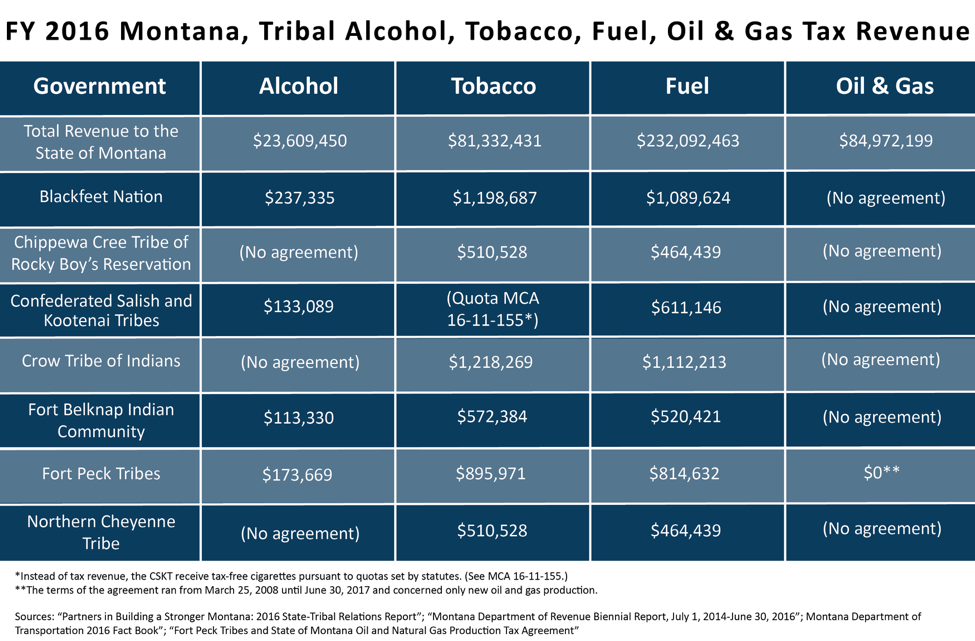

The state of Montana and the seven reservation tribal governments have negotiated eleven revenue sharing agreements for excise taxes on the on-reservation sale of alcohol, tobacco, and fuel, and in one instance, oil and natural gas production.[60] As the chart on page 14 depicts, not every tribal government has entered into an agreement for each of these taxes.

Although each revenue sharing agreement is independent of the others, they are all similar. Each one states that its general purpose is to avoid legal controversy, possible litigation, and dual taxation. The agreements also contain sections detailing applicable state and tribal tax laws, the collection and administration of the tax, and termination and duration of the agreement. Although a couple do not, most of the agreements are set up to automatically renew if the parties do not meet prior to the expiration date. Many of the agreements also include mutual limited waivers of state and tribal or only tribal sovereign immunity. Many but not all agreements also contain a stipulation that venue and jurisdiction for enforcement of terms will be the U.S. District Court, or if that court lacks jurisdiction, Montana District Court.[61]

In Montana, excise taxes on alcohol and tobacco are imposed at the distributor level and included in the sale price of the item. Generally, the state pre-collects all taxes on alcohol, tobacco, and fuel sold on the reservations and then remits a portion of each tax to the tribal governments.

Tribes receive a portion of the taxes on liquor, beer, wine, and hard cider consumed on their reservation, which is an approximation of the on-reservation sales to enrolled tribal members. Alcohol tax refunds to tribes are determined by multiplying the state general fund portion of tax receipts statewide by the number of enrolled tribal members living on the reservation.[62] (Sixty-nine percent of the overall statewide tax receipts goes into the general fund, from which the tribal share is taken. The remaining 31 percent goes to the Montana Department of Public Health and Human Services for treatment, rehabilitation, and prevention of alcoholism and chemical dependency.[63])

Like with alcohol taxes, tribes receive a portion of the taxes on cigarettes and tobacco products consumed on their reservation, which, again, is an approximation of sales to enrolled tribal members. Tobacco tax refunds to tribes are calculated by multiplying 150 percent of the Montana per capita tobacco tax collected by the total number of enrollment tribal members living on the reservation.[64]

Fuel tax refunds to tribes represent a portion of the gasoline license tax collected on-reservation, and are again, approximations of sales to enrolled tribal members living on the reservation. Fuel tax refunds to tribes are based on the statewide per capita gasoline license tax receipts multiplied by the number of enrolled tribal members residing on the reservation, minus a one percent administration fee retained by the state. The per capita gasoline license tax is based on the prior fiscal year’s gross total of gasoline license taxes collected by the state, adjusted by any refunds, credits, corrections, audits, minus any statutory and legislative allocations (such as the 16 percent set aside to local governments).[65]

On-reservation tribal population counts are determined (and, in many cases, verified by affidavit) in a number of ways. Most agreements rely on the tribe’s official enrollment office records, however, some require additional records such as proof of address for individual tribal members or the tribe’s most recent voting list for tribal elections.[66]

The only oil and gas revenue sharing agreement active in 2016 was between the Fort Peck Tribes and the state, and it concerns only new oil and natural gas production. (This agreement expired on June 30, 2017.) This breakdown of revenue was determined differently than in the other revenue sharing agreements. Here, it was divided equally between the tribe and state. This is based on the stated reason that both the Fort Peck Tribes and the state share equal taxation authority over the on-reservation oil and natural gas production by non-tribal members.[67]

In 2016, total revenue to the state of Montana from tobacco and alcohol tax was $104.9 million while the total combined tribal government share was $5.7 million.[68] Total revenue to the state from gross motor fuel taxes was $232 million and the total combined tribal share was $5.1 million.[69] Neither the state of Montana nor the Fort Peck Tribes derived any revenue from new oil and natural gas production on Fort Peck in 2016. However, total revenue to the state from oil and natural gas production taxes was $84.9 million that fiscal year.[70]

The chart below depicts the breakdown of Montana and tribal government alcohol, tobacco, fuel, and oil and natural gas tax revenue in 2016.

Benefits and Dangers of Intergovernmental Revenue Sharing Agreements

Montana’s state-tribal revenue sharing agreements have successfully eliminated the threat of dual taxation and costly litigation while providing state and tribal governments with a degree of certainty regarding the division of revenue. However, there is room for innovation.

Every assertion of state and local taxes in Indian Country results in a corresponding decrease in a tribe’s potential tax base, not to mention an encroachment on tribes’ once-exclusive taxation authority on their own reservations. But this is not to say that tribes have nothing to gain by entering into revenue-sharing agreements with states, particularly given the current state of federal Indian tax policy and federal court rulings. At minimum, these agreements enable tribes to achieve certainty on intergovernmental tax issues. They also protect current tribal taxation authority by eliminating, or “preempting,” additional legal challenges.[71]

In terms of benefits to states, revenue sharing agreements enable the assertion and collection of state taxes in Indian Country that would otherwise prove difficult to achieve due to unresolved legal questions and/or tribal sovereign immunity.

Achieving these ideals, however, requires that both state and tribal governments understand the short- and long-term implications of their agreements, adhere to the principles of fair apportionment, and fully comprehend the dangers of extracting wealth from Indian Country without at least equal reinvestment on the part of the state.[72]

States and tribes can reduce some of these dangers by employing flexibility in determining terms including the methods used to calculate state and tribal shares. For example, if a tribe is actively working to create or implement a long-range economic development plan or valuable social program, the revenue sharing agreement terms can be crafted to support this effort. The state may agree to accept a smaller share of tax revenue during a critical phase or agree to reinvest its share into the project for a specified period of time. The goal of ensuring that the wealth taken out of Indian Country gets reinvested there can be furthered by exploring new areas of on-reservation taxation agreements where state and local governments currently have sole taxation authority. (One example is property taxation of on-reservation fee land.)

After 40 years of litigation (referenced earlier) over whether or not Montana can tax the off-reservation production of coal owned by the Crow Tribe, the two sides came together in a way that demonstrates the range of possibilities for crafting intergovernmental tax agreements. Part of the agreement entails the tribe repealing its severance tax on the coal, enabling the state to impose its tax. In exchange, the state agreed to remit to the tribe the severance and gross proceeds tax revenue it collects on the tribe’s coal.[73]

The fact that agreements can be flexibly crafted in innovative and mutually beneficial ways that respect tribal sovereignty make them an effective, if temporary, solution to the ongoing taxation competitions between sovereigns.

Policy Recommendations to State and Tribal Policymakers and Agency Directors

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.