Montana’s path to economic recovery and future prosperity is dependent upon the state budget, made up with tax revenues. While MBPC helped kill numerous tax cut bills that would have resulting in over $900 million in lost revenue each biennium, once fully phased in, the 2021 legislature passed tax cut bills that will cost over $100 million in lost revenue each biennium.

Individual Income Tax

The largest revenue losers were individual income tax cuts, packaged together as SB 399 and SB 159. SB 159 lowered the top income tax rate from 6.9 to 6.75 percent until tax year 2024. This tax cut primarily benefits the wealthiest, with over 80 percent of the tax cut going to the top 20 percent of Montanans.

SB 399, which goes into effect as SB 159 phases out, drops the top income tax rate even further to 6.5 percent. As a result of this bill, there are over 100,000 Montanans, spread across the income spectrum, who will see tax increases. This bill also opens Montana’s tax system up to additional volatility by increasing the number of provisions in the federal tax code that Montana’s tax system is tied to. In part to these volatility concerns, only 5 states remain that tie into the federal tax code in the same way as SB 399. This bill moves Montana in the wrong direction.

In addition, SB 399 eliminates 17 tax credits with little opportunity for the legislature to consider the merit of each credit. While tax simplification is a laudable goal, more forethought is needed for an efficient tax system.

Business Equipment Tax

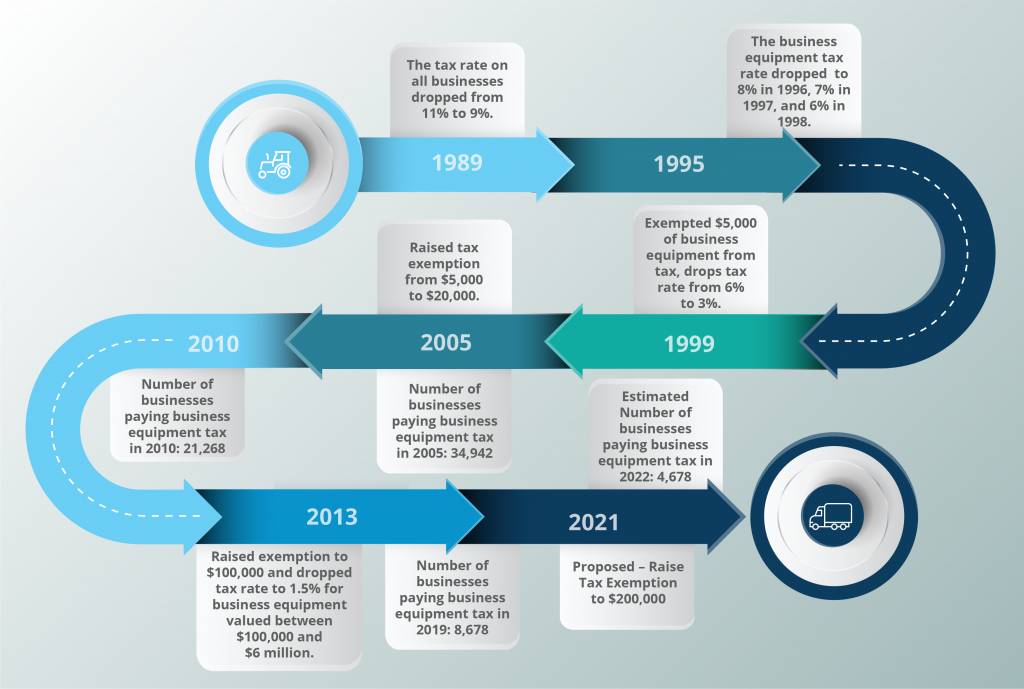

Another costly bill was HB 303, which increased the property tax exemption for business equipment tax. Business equipment tax has been cut numerous times in Montana’s recent history.

As a result of these changes, the numbers of businesses paying business equipment tax have dropped from over 36,000 in 2000 to less than 9,000 before the passage of HB 303. Homeowners in Montana have seen their property tax obligation grow in relation to owners of business equipment in the last 20 years.

In the end, the 2021 legislature passed over 20 tax cut bills. Unfortunately, the vast majority of these bills preferentially benefit the wealthy, exacerbating income inequality in this state. Legislators have chosen to prioritize those who already have more than they need over those struggling to get by. Thankfully, Montana saw $100 million in tax cuts this session rather than $900 million. Going forward, MBPC will continue to educate legislators and the public about the effects of tax cuts already passed and any yet to be proposed.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.