The 2023 Montana Legislature began at a breathtaking speed to move the governor’s tax package, with big, ongoing tax cuts for the wealthy and temporary tax rebates. Before committees had even seen the full budget, they had passed an ongoing tax cut for the wealthy and multiple one-time rebates that cost nearly $900 million but did nothing to help high housing and child care costs or any other policy solution. A disproportionately high share of the tax cuts went to white, wealthy Montanans. Overall, 93.4 percent of the benefit from the governor’s tax package went to white Montanans, who hold 90.2 percent of returns, while Indigenous Montanans received just 1.5 percent of the benefit.[1]

1. Big Winners from 2023 Tax Reform are White and Wealthy

Montana’s tax system already disproportionately benefits the white and wealthy.[2] Those living on the lowest incomes, who are disproportionately Black, Indigenous, and people of color (BIPOC), pay 20 percent more of every dollar in state and local taxes than the wealthiest. The 2023 Legislature made this worse by cutting Montana’s top income tax rate, in addition to numerous other regressive tax changes.

The governor’s ongoing income tax cut bill included dropping the top income tax rate from 6.5 to 5.9 percent, coupled with a small increase to the state earned income tax credit (EITC).[3] The EITC is a tax credit for working people with low incomes, and its targeted structure helps reduce the regressivity of our tax system. However, the boost to the EITC was the smallest piece of this bill, making up only 6 percent of the total cost.[4] A majority of lawmakers rejected efforts to expand the EITC further. Thus, the wealthiest 1 percent, with incomes of $650,000 and up, will get an average tax cut of nearly $7,000 each year, while those with incomes up to $81,000 annually will get about enough to cover a tank or two of gas, on average.[5] Seventy percent of this ongoing tax cut will go to the wealthiest 20 percent.

This tax cut is expected to cost the state upwards of $170 million each year once fully phased in.[6] This amount of revenue could have provided profound change in Montana. Prioritizing state investments could lift thousands of children out of poverty, resulting in adults with better educational outcomes, employment opportunities, and who are less likely to be on public assistance programs. As passed, Senate Bill (SB) 121 will seriously affect Montana’s ability to provide for the needs of communities into the future.

2. One-Time Rebates Prioritized Over Tax Fairness, Leaving Many Montanans Out

A big piece of that surplus, nearly $900 million, went to temporary tax rebates.[7] These rebates fail to solve any of Montana’s myriad of issues: housing, child care, health care, or workforce, and they eat up a huge piece of our revenue. Legislators chose to send out one or two-time payments in lieu of sustainable long-term policy improvements. The property tax rebates could have paid for eight years of the property tax credit, which would have reduced the effective property tax rate for those currently paying the highest rates of property taxes as compared to their income.[8] Not only that, but the one-time income tax rebates could have paid for 14 years of the proposed child tax credit, which has been proven to lift children out of poverty, helping families pay for food, clothing, and other basic needs.[9]

Montanans with the lowest incomes and families that rent their homes lose out. As the income tax rebates phase in with tax liability, they are not fully available to Montanans living on low wages, those who would benefit the most from a short-term bump in income. Despite the fact that renters pay property taxes through their rent, the property tax rebates require homeownership for eligibility, leaving out a large number of Montanans who are most impacted by the recent upswing in housing costs in the state. Over 81 percent of the richest 20 percent will receive a property tax rebate, while less than half of those in the bottom 80 percent of incomes are eligible.[10]

3. Skyrocketing Residential Property Taxes Remain Largely Unchanged

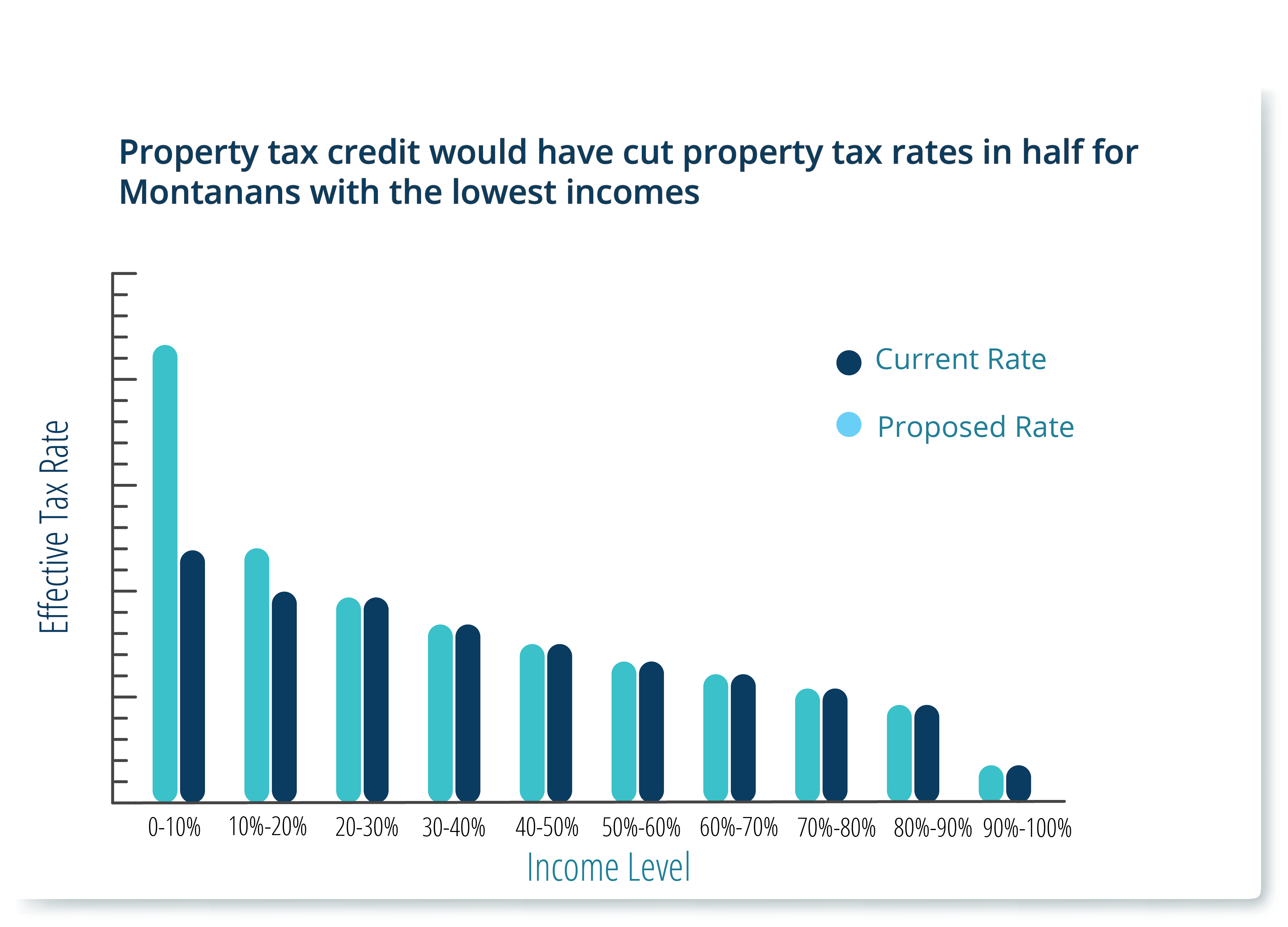

One of the biggest problems with throwing all that money out the window in tax rebates is that there wasn’t anything left over to deal with unsustainable property taxes and the resulting issues with housing affordability. Montana is experiencing a shortage of 18,538 homes available and affordable for renters with the lowest incomes, who make up 24 percent of all renters.[11] The legislative session began with a bill passed by the Revenue Interim Committee that would have reduced property taxes for those whose property taxes exceed a percentage of their incomes. SB 15 proposed targeted support for property owners and renters with exceptionally high property taxes, as tied to income, and allowed them an income tax credit to help even out the highest property tax rates currently paid by those with the lowest incomes.[12]

In fact, SB 15 was so targeted and effective that it would have chopped the effective property tax rate for Montanans with the lowest 10 percent of incomes in half, helping to even out the regressivity of our property tax system permanently, which currently asks the most from those with the least.[13] Unfortunately, the legislature tabled SB 15 while passing temporary property tax rebates.

4. Multinational Corporations’ Big Tax Break Helps Hide Income Overseas

4. Multinational Corporations’ Big Tax Break Helps Hide Income Overseas

Multinational corporations are estimated to continue to shift $300 billion each year in profits overseas for the foreseeable future.[14] Six states, in addition to Montana, currently require multinational corporations to include tax haven income in their corporate income tax filings.[15] This session, the Montana Legislature repealed the state’s vital and effective law put in place in 2003 to close a tax loophole that allowed large, multinational corporations to shift profits overseas tax-free.[16] Since 2003, Montana has been viewed as a leader in ensuring large, multinational corporations are paying their fair share, with several states following suit in subsequent years.[17]

Not only was repealing this law a revenue loser for the state, it creates a more uneven playing field between multinational corporations and Main Street businesses. By allowing multinational corporations to avoid taxes on profits shifting overseas, the passage of SB 246 gives them an even larger competitive edge over Montana’s small businesses. Main street businesses are Montana’s backbone, and SB 246 makes competing with multinational corporations even more difficult.

5. Private School Tax Credit Allows the Rich To Pay No Taxes

Montana’s Constitution states that “the legislature shall provide a basic system of free quality public elementary and secondary schools.”[18] Our strong public education system provides opportunities for rural and urban children across the state, allows flexibilities for locally elected school boards to adapt curriculum to the needs of the communities, and helps create a well-educated workforce.

In 2015, the Montana Legislature passed the first private school tax credit in the state, the tax credit for contributions to student scholarship organizations, allowing public dollars to be diverted to private education.[19] This credit was significantly expanded in 2021, increasing the original $150 per taxpayer limit to $200,000.[20] The 2023 Legislature continued this trend, increasing the maximum cost to the state for the credits by 150 percent, from $2 million to $5 million beginning in 2024.[21]

Private school tax credits divert funding from public schools, are expensive, and disproportionately benefit urban and wealthier families while reducing the Legislature’s ability to find state-based solutions for improving our education system.[22] The passage of HB 408 is a disservice to the future of Montana’s educational system.

6. The Biggest Losers from 2023 Tax Reform Are Hard-Working Montanans

The Montana Legislature spent over $1.5 billion in tax cuts through the 2027 biennium.[23] Nearly $900 million of this total was in temporary tax rebates that do nothing to change the sustainability of our property tax system or invest in our communities. The Legislature gave away hundreds of millions in a long-term, regressive income tax cut. Meanwhile, lawmakers did not increase Medicaid provider rates to the amount recommended in a non-partisan study of the issue, and refused to fund adequate solutions for affordable housing and safe, reliable child care.

Lawmakers made Montana’s regressive tax code that asks more from families living on lower incomes, who are disproportionately BIPOC Montanans, worse this session. The wealthy benefited the most from changes made by the 2023 Legislature, and these changes continue the state’s history of ongoing racist, biased, and discriminatory practices against BIPOC communities.

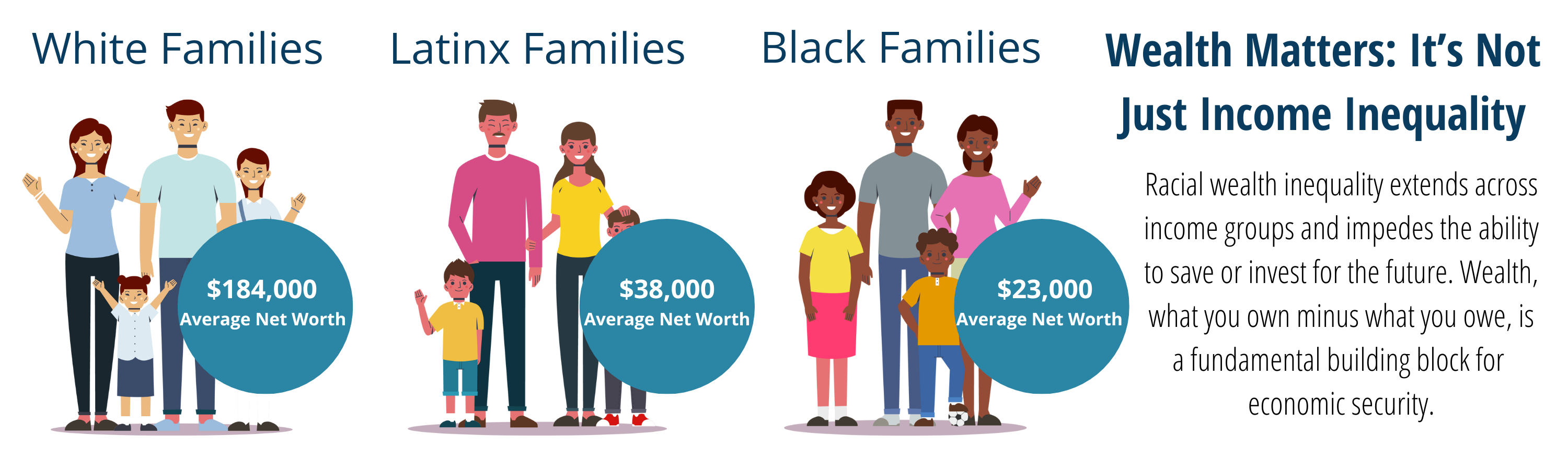

Regressive tax changes and a lack of state investment in communities like public education are integrally connected with the racial wealth gap. The racial wealth gap has roots in colonization, beginning with the trafficking and forced enslavement of Black people and the genocidal pillaging of land from Indigenous people. Our terrible beginnings have continued throughout the United States and individual state histories. Montana is no exception. While some look to these as stories from the past, the legacy of racism continues to exist in our tax code today, continuing this history that has kept BIPOC Montanans from growing wealth and participating in our economy on an even playing field.

Policy Proposals to Advance a More Equitable Tax Code

Future legislatures have ample opportunity to get Montana back on track and to help put our tax code in a place where those with the least are not paying more than the wealthy. Montana should reinstate a top income tax bracket on incomes in excess of $250,000. Montana should repeal many racist tax exemptions and credits throughout the tax code, including the tax credit for contributions to student scholarship organizations, the loophole that allows multinational corporations to avoid taxes on income held overseas, and other tax breaks that continue to help those with wealth who are disproportionately white.

Other proactive solutions Montana can pursue that would make our tax code less regressive include increasing our state EITC, creating a state child tax credit, and passing a property tax circuit breaker targeted to both renters and homeowners with high effective property tax rates.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.