Montana has an opportunity to invest high state revenues to support families and individuals and improve our tax system. State tax credits targeted to those in most need of assistance help Montanans struggling to afford necessities. By expanding the state Earned Income Tax Credit (EITC), establishing a refundable state Child Tax Credit (CTC), and passing a property tax credit, Montana can create a tax code that reduces inequality. As Montanans face rising costs for food and housing, these credits can help families and individuals afford everyday needs.

The 2021 Montana Legislature passed tax bills that lowered taxes significantly for those at the top of the income ladder and were projected to cost over $100 million in total state revenue each biennium. The vast majority of those cuts primarily benefitted the wealthy, exacerbating income inequality. For those living close to the poverty line, the state provided little to no additional assistance. One of the biggest tax cut bills cut the top individual income tax rate from 6.9 to 6.75 percent, primarily benefitting the wealthiest Montanans. Over 80 percent of the tax cut went to the wealthiest 20 percent of Montanans. The next phase of income tax cuts passed will further cut the top rate to 6.5 percent and change up our tax base, potentially opening Montana up to additional revenue volatility.

These changes failed to address Montana’s regressive tax system that requires Montanans living on low and moderate incomes to pay a higher share of their incomes in state and local taxes than the wealthy. The tax bills passed in 2021 increased the regressivity of our tax code. Wealthy taxpayers, who are disproportionately white, benefited more from these changes than taxpayers on low incomes, who are more likely to be Black, Indigenous, or People of Color (BIPOC). Rather than reducing inequity, the cut of the top income tax rate further reinforced the gap between wealthy taxpayers and those with lower incomes, as well as the racial wealth gap.

These changes failed to address Montana’s regressive tax system that requires Montanans living on low and moderate incomes to pay a higher share of their incomes in state and local taxes than the wealthy. The tax bills passed in 2021 increased the regressivity of our tax code. Wealthy taxpayers, who are disproportionately white, benefited more from these changes than taxpayers on low incomes, who are more likely to be Black, Indigenous, or People of Color (BIPOC). Rather than reducing inequity, the cut of the top income tax rate further reinforced the gap between wealthy taxpayers and those with lower incomes, as well as the racial wealth gap.

As Montana again looks to address the tax code, lawmakers should focus on solutions that help alleviate poverty rather than providing tax breaks for the wealthy. By expanding the state EITC, establishing a refundable state CTC, and passing a property tax credit, policymakers can help families meet their basic needs. Rather than worsen income inequality through tax cuts for the wealthy, these credits help families and individuals build a solid foundation.

The EITC helps support 72,000 working Montanans living on low incomes.[1] The amount of the credit is based on family size and earnings, with the amount gradually tapering off as earnings increase. This gradual decrease in credit helps prevent a steep drop off in credit amount as workers increase their income. Because the credit is refundable, EITC recipients who owe less in taxes than the credit amount can still receive the full credit.

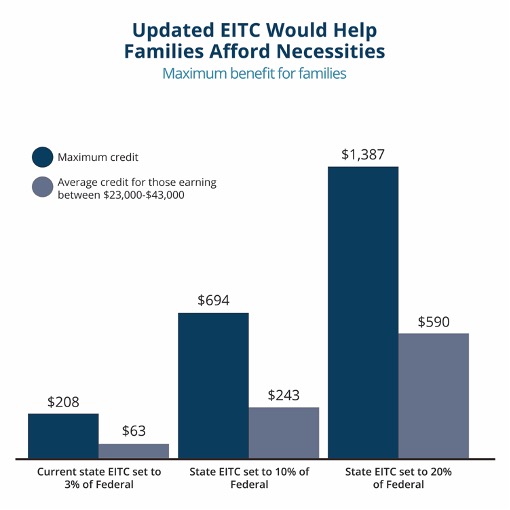

Set at 3 percent of the federal EITC, Montana has the smallest state EITC in the nation. For individuals without children, the maximum state benefit is only $16.80 annually.[2] A married couple with three children receives a maximum benefit of $208.05. This modest benefit, however, fails to cover a week’s worth of groceries for the same-size family.[3]

If the state were to expand the EITC to 10 percent of the federal level, families would be eligible for a maximum of $693.50. An EITC set to 20 percent of the federal credit would provide the same family with $1,387 to help make rent, pay for groceries, and meet other expenses. Coupled with the federal EITC, this amount would be equivalent to a wage increase of $4.00 an hour for a single parent raising three children.

The share of people working yet still living in poverty has grown since the 1980s. Nearly one in four American Indians who are employed in Montana live below 200 percent of the poverty line ($46,060 annual income for a household of three).[4][5] Historical policies, such as racial segregation in education and employment, as well as current problems, such as a lack of affordable housing or child care, have caused people of color to be overrepresented in the as those living in poverty.

An expanded state EITC can help reduce long-standing wage gaps for workers of color. A state EITC set to 20 percent of the federal credit would provide American Indian families living on the lowest 80 percent of incomes with an average credit of $480.[6] Because the EITC is well-targeted to those with low incomes, the credit can help reduce poverty for communities of color.

An expanded state EITC can help reduce long-standing wage gaps for workers of color. A state EITC set to 20 percent of the federal credit would provide American Indian families living on the lowest 80 percent of incomes with an average credit of $480.[6] Because the EITC is well-targeted to those with low incomes, the credit can help reduce poverty for communities of color.

The federal EITC helps lift millions of workers out of poverty every year.[7] As a two-generational approach to poverty, the EITC strengthens families by supporting adults and children simultaneously. While some interventions focus solely on parents or children, the two-generation approaches to poverty support the whole family.

The EITC helps supplement low wages many working adults receive. Workers receive the credit with their first dollar of earned income. As the credit increases with the amount of income (before gradually tapering off), workers are not penalized for working more hours or taking higher-paying jobs. This structure means the credit boosts employment, particularly among female-headed households.[8]

By increasing after-tax income, the EITC provides families with assistance for their children, with proven benefits. Refundable state EITCs are associated with lower rates of abuse and neglect, adult psychological distress, fewer children entering foster care, and fewer suicides of adults.[9] Children in families who receive the EITC have higher test scores, and down the line, are more likely to graduate high school and attend college.[10]

A state CTC can help expand the success of the EITC, by helping families with the costs of raising children. A refundable CTC is one of the best-targeted and most effective ways to reduce poverty via state-level credits.[11] Twelve states have enacted state CTCs, and ten others have introduced legislation to create or expand a state-level credit since 2019.[12] While 119,000 households in the state currently benefit from the federal CTC, Montana currently has no state CTC.[13]

While the EITC is based on a percentage of income, the federal CTC is a flat amount per child. A state CTC would help families with assistance in providing food, clothing, or school supplies for a child.[14]

Unlike the EITC, the CTC is not fully refundable at a federal level. If Montana made the credit fully refundable, families with the lowest incomes would benefit even more. Lawmakers can target the tax relief to make sure most of the credit goes towards people living on low incomes by making it fully refundable and phasing out the benefit for those living on high incomes.

made the credit fully refundable, families with the lowest incomes would benefit even more. Lawmakers can target the tax relief to make sure most of the credit goes towards people living on low incomes by making it fully refundable and phasing out the benefit for those living on high incomes.

The CTC helps more Montanans than high-income tax cuts and is a substantial investment in the state’s children. When the American Rescue Plan Act (ARPA) temporarily expanded the federal CTC, the impact on BIPOC children in Montana was significant. If the credit had been made permanent, it would have helped lift 45 percent of all Montana children and 59 percent of American Indian/Alaska Native (AI/AN) children in Montana out of poverty.[15],[16]

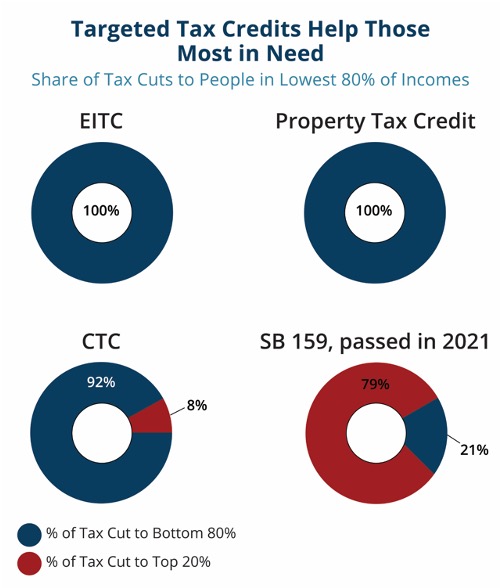

Even a small CTC set to $400 would benefit an estimated 149,000 Montana children, including 26,000 children living in or near poverty. [17],[18] American Indian children would especially benefit from a state CTC, as 2,660 AI/AN families in the lowest 80 percent of incomes would receive a credit. Nearly all (92-94 percent) of a refundable, targeted state CTC would go to the bottom 80 percent of Montanans in terms of income. A larger CTC would help lift even more families out of poverty.

A fully refundable state CTC would help continue the success the federal expansion had in addressing poverty caused by racial inequity. While tax cuts for the wealthy reinforce racial wealth disparities, a state CTC can help ensure all Montana families can provide for their children – no matter their race.

The temporary boost in the federal CTC in 2021 demonstrated the clear need for a larger CTC. Over half of Montana parents spent the funds on food for their family, resulting in fewer food-insecure families. The temporary increase in credit also helped families use the increase to pay down debt, manage bills, afford child care, and buy clothing and school supplies.[19]

The clear success of this temporary increase in the CTC is underscored by years of research on the benefits of the credit. A more substantial CTC not only moves parents and children out of poverty immediately; it has also been linked to better school performance and higher future earnings.[20] A state-level CTC would go even further in amplifying these benefits by providing relief to those who need it, rather than to corporations and the wealthy.

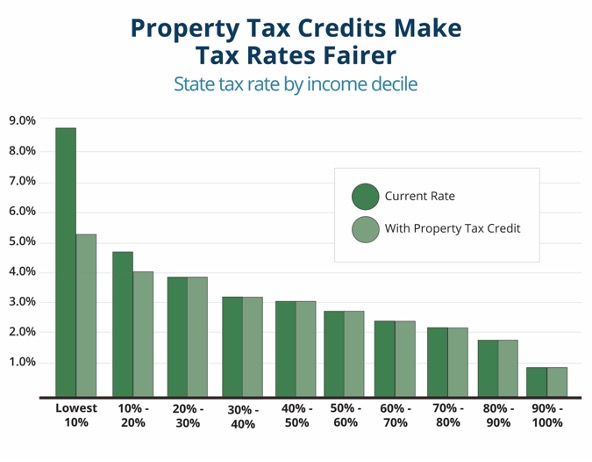

Property taxes are the most regressive part of Montana’s state and local tax system, meaning that families with low and moderate incomes pay a very large percentage of their income in property taxes, compared to wealthier households. Montana has some small property tax assistance programs for households living on extremely low incomes, the elderly, and veterans. With home values and property taxes rising at very high rates, broader targeted property tax assistance programs warrant a closer look in Montana. Expansions of current programs or a new, broader program could help to mitigate property tax bills for families paying a larger share of their incomes in property taxes.

Property tax assistance options come in two forms: tax breaks for all property owners or targeted property tax assistance to taxpayers with low or moderate incomes. A targeted property tax credit that assists families whose property tax bills, or rent-equivalent, exceed a percentage of their income is an effective way to reduce the regressivity of property tax at an affordable cost to the state.

Montana’s current elderly homeowner and renter credit is available for those 62 and older with a household income of less than $45,000.[21] The credit refunds property taxes over 5 percent or less of income, depending on income level, and is limited to $1,150 per household.[22] To help more Montanans achieve affordable housing, lawmakers should expand this credit to all ages.

Expanding the current elderly homeowner and renter property tax credit to all Montanans living on incomes less than $45,000 would start to even out the vast regressivity of our current residential property tax. Households with annual incomes less than around $30,000 currently pay nearly 9 percent of their income in property taxes. With this tax credit, the proportion of income paid would drop to around 5 percent. Although still more than those with higher incomes, the rate after a property tax credit is much more comparable.[23]

Expanding Montana’s current elderly homeowner and renter tax credit to all taxpayers who meet income thresholds regardless of age would provide property tax relief to an additional 48,406 Montanans.[23] The households who benefit from this targeted property tax credit would have incomes less than $45,000 annually, with the largest benefit going to those with the lowest incomes (those with incomes less than $30,000). This move could help more families across the state access affordable housing, and create more stable communities for all Montanans.

With housing supply not keeping pace with increases in the Montana population, homeownership and rent prices are at an all-time high.[24] One in four renter households in Montana are extremely low income, making it even more challenging to find an affordable place to live.[25] This issue is heightened for families of color due to a long history of housing segregation, redlining, and disinvestment in neighborhoods, along with ongoing discrimination, overcrowding, and evictions that force many families into unstable housing or homelessness.[26] A targeted property tax/renter credit is designed to reduce the property tax load on those hit hardest by the property tax.

Property tax credits targeted to those living on low incomes create stability in a volatile housing market and are a long-term investment in communities. Affordable housing can help improve the stability, as well as both the physical and mental health, of households.[27] When rent and mortgage costs are accessible, households have more resources to save and build wealth. Children especially stand to benefit, with food security being less common in families living on low incomes who have access to affordable housing.[28]

Property tax credits targeted to those living on low incomes create stability in a volatile housing market and are a long-term investment in communities. Affordable housing can help improve the stability, as well as both the physical and mental health, of households.[27] When rent and mortgage costs are accessible, households have more resources to save and build wealth. Children especially stand to benefit, with food security being less common in families living on low incomes who have access to affordable housing.[28]

The state could provide a substantial investment in low- and moderate-income Montanans by providing targeted tax credits. All, or nearly all, of a state investment in expanding the EITC, a refundable CTC, and a property tax credit, would benefit people living on the lowest 80 percent of incomes. In contrast, in 2021, four-fifths of the tax cut in one tax bill passed by the legislature (SB 159) went to households in the highest 20 percent of incomes.

Montana lawmakers should prioritize tax credits that improve the lives of Montanans living on low- and moderate-incomes, rather than tax cuts that widen the racial wealth gap. Tax credits that make housing affordable, assist in the cost of raising children, and increase the income of workers living on low ages can help boost economic security in Montana. Tax cuts for the wealthy are poised to benefit a select few, take opportunities away from thousands of Montanans, and are a setback for racial equality. Montana lawmakers should pass a state CTC, increase the state EITC, and pass a property tax credit to grant thousands of Montana families and households financial stability now, and set up future generations for success.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.