The 2021 Montana Legislature has the opportunity to address longstanding inequities in Montana’s tax code that have made life harder for many families. Previous legislatures have chosen to balance the budget by cutting needed services for our seniors, Montanans with disabilities, and those struggling with mental health instead of finding common-sense solutions to fairly increase revenue.

These choices have exacerbated income and racial inequality in Montana. Unfortunately, despite the lessons of the past and the new hardship brought on by COVID-19, a steady stream of tax cut proposals are making their way through the 2021 Legislature that will yet again cut taxes for the wealthiest while also cutting services for those struggling to get by.

Statewide revenue solutions are necessary to put Montana on a path to economic recovery and progress. A fair tax code would ask that those with the most – and who have continued to benefit from both state and federal tax breaks over the years - to pay as much of their incomes in taxes as those who are living on more moderate means. Revenue gained from a fairer tax code could be used to fund better public schools, affordable housing solutions, or support the many needed services for our aging population.

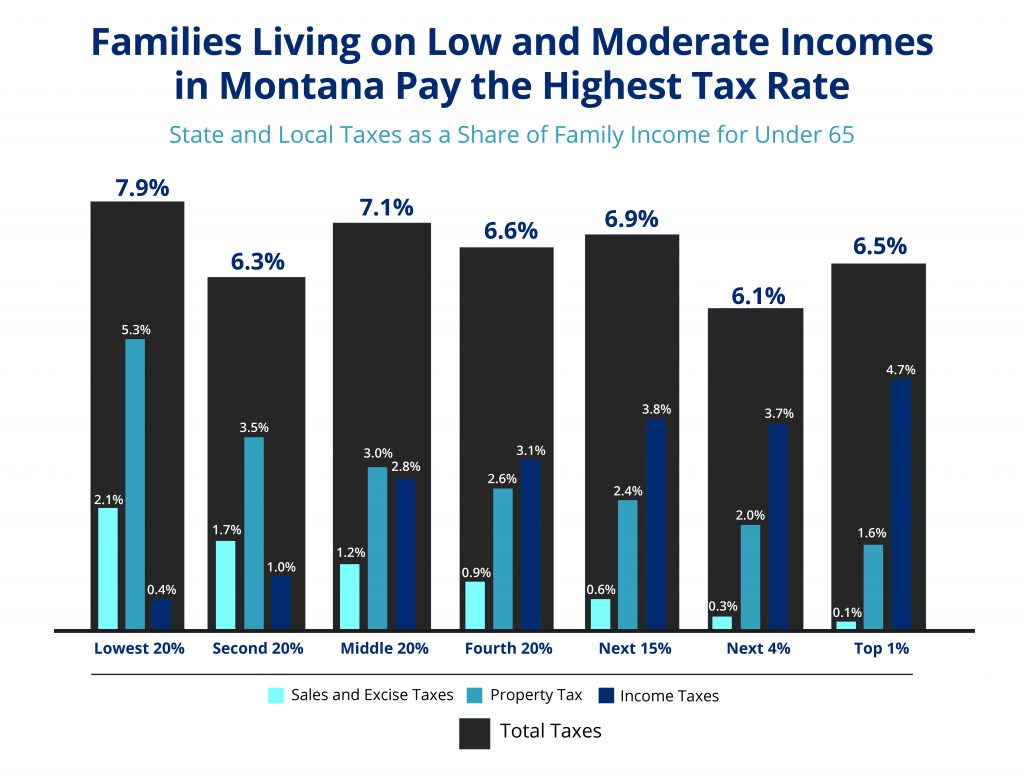

Montana’s tax system is regressive, meaning families living on lower and moderate incomes spend a larger percent of their incomes than the wealthy on state and local taxes. However, Montana’s tax system is less regressive than 42 other states because it relies on a progressive income tax structure and not a statewide sales tax that costs those with lower incomes the most.[1]

Montana’s Income Tax Helps Offset Other Regressive Taxes

While Montanans with the lowest incomes pay more in taxes than those with higher incomes, Montana’s current income tax structure helps offset the regressivity of property tax and various excise taxes like lodging, gas, and alcohol taxes. The proposed income tax cuts will not only benefit wealthier households; they will also make Montana’s entire tax system less fair.

Cutting the Top Income Tax Rate Benefits Wealthiest Households the Most

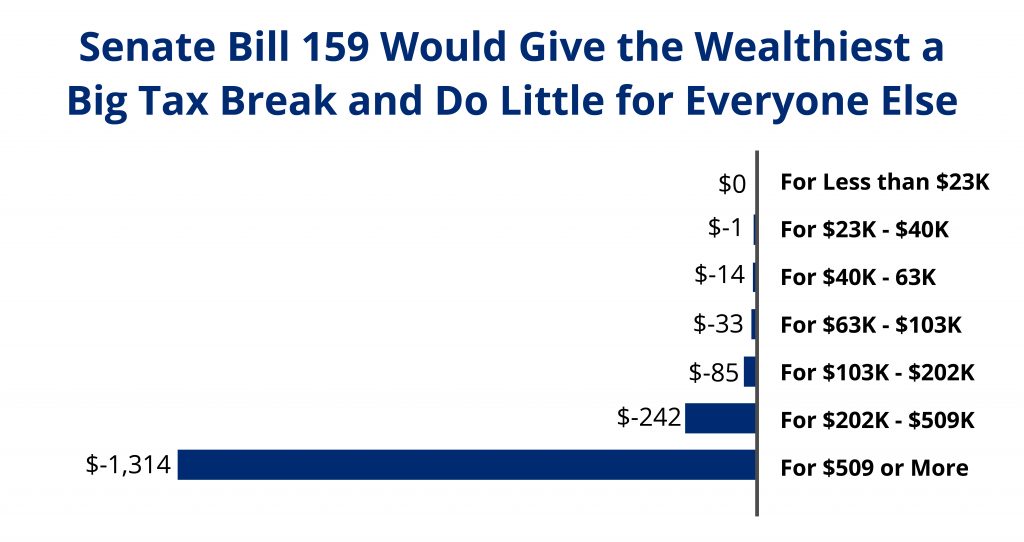

Senate Bill 159 would decrease Montana’s top individual income tax rate from 6.9 percent to 6.75 percent. While many Montanans would see little to no tax benefit, the wealthiest 20 percent would receive the lion’s share of this tax cut (almost 80%) and cost the state $28-30 million a year in revenue.[2],[3] Those making over $509,000 in income would receive, on average, $1,314 each year in tax cuts, but those earning between $23,000 and $40,000 would receive, on average, just $1. Those tax savings would allow the wealthiest Montanans to buy a new refrigerator but barely allow those with lower incomes to buy a cup of coffee. This proposal is sending Montana in the wrong direction. It chooses costly tax cuts for the wealthy over investing in our children and caring for our aging citizens.

Other Tax Cut Proposals Further Benefit the Wealthiest Individuals and Businesses

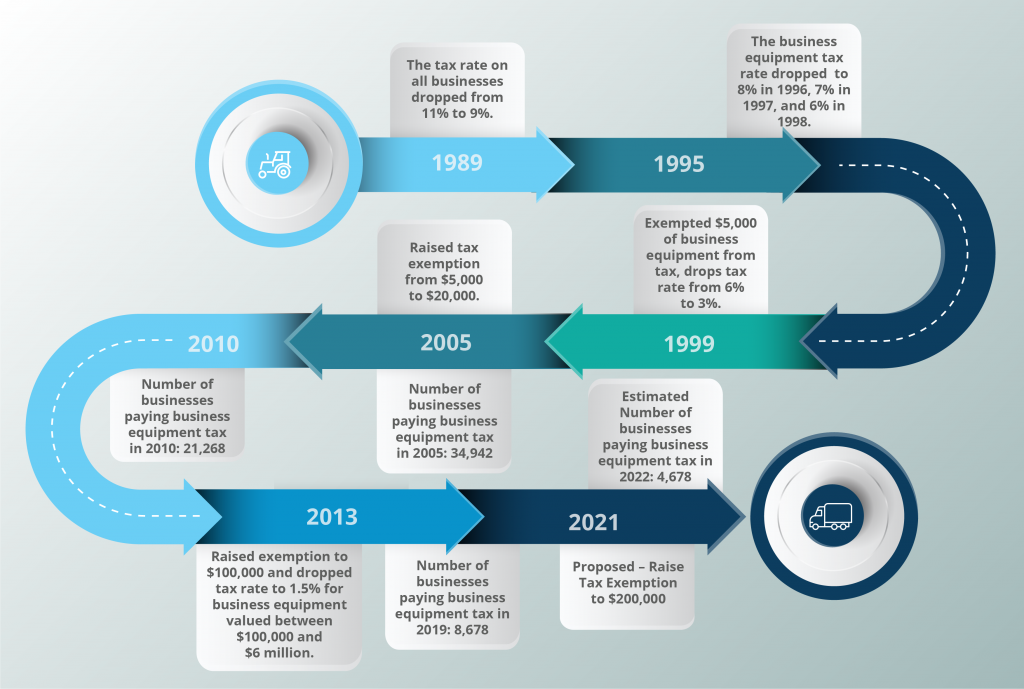

Several other proposals put forward by Governor Gianforte and the legislature are skewed to benefit high-income households and large businesses, while again providing little to no benefit for most Montanans. The number of businesses subject to the business equipment tax has fallen significantly as a result of policy changes over several decade. Yet House Bill 303 proposes further exempting business from this tax, which will cost the state millions more in lost revenue. The business equipment tax is a property tax paid on the value of personal property used in business. In the last three decades, the business equipment tax exemption has increased substantially, and the tax rate has decreased. In 1989, the tax rate on business equipment was cut from 11 percent to 9 percent for all companies.[4] Between 1995 and 1997, the rate was cut from 9 percent to 6 percent, decreasing by 1 percent each year. In 1999, the rate was further reduced from 6 percent to 3 percent and the legislature established an exemption to the tax for the first $5,000 of equipment. The 2005 legislature increased the exemption level from $5,000 to $20,000. The exemption was raised again in 2013 to $100,000 and the tax rate was lowered to 1.5 percent for business equipment valued between 100,000 and $6 million.

As a result, the number of businesses paying business equipment taxes has fallen sharply– from over 36,000 businesses in 2000 to less than 9,000 today.[5] HB 303 proposes increasing the business equipment exemption to the first $200,000 in value, eliminating another 4,000 businesses large businesses from the remaining 9,000 paying the tax.

Another proposal moving forward, SB 184, will create a new tax loophole in the state for businesses selling stock, further rewarding wealth over work. SB 184 would completely exempt some companies from tax on their long-term capital gains from the sale or exchange of capital stock of a corporation. This proposal goes even further than Montana’s already beneficial tax treatment of selling stock (compared to earning money through wages) under the capital gains credit, by completely exempting these types of capital gains from taxation. Tax breaks on capital gains income are very regressive proposals, and SB 184 is no exception. [6] Over 78 percent of taxpayers did not benefit from the capital gains credit in 2017, and SB 184 would certainly benefit the wealthy over everyone else.[7] Continuing to reduce income taxes on investment income over income from wages worsens exiting income inequalities and makes the state’s tax code even less fair.

Historic and current injustices, through public policy and social discrimination, have resulted in vast disparities in income across race and ethnicity in Montana, and new tax cuts for the wealthy will only worsen these disparities. Median annual income for Montanans who are white is $56,282, compared to $33,535 for Montanans who are American Indian or Alaska Native and $44,614 for Montanans who are Black.[8] Montana’s tax system already deepens racial and ethnic inequities because it asks the most, as a share of income, of households living on lower incomes, who are disproportionately households of color. Because Montana’s income tax offsets some of the regressivity of Montana’s excise and property taxes, reducing income taxes worsens racial inequities by disproportionately benefiting taxpayers at the top, most of whom are white.

While an analysis of the proposed income tax cuts in Montana by race is not available, evidence from other states show that cuts to income taxes do not promote equity, but rather, can worsen racial inequities. In an analysis of tax cuts that took place in North Carolina, the vast majority of benefit went to white families – at a disproportionate rate – exacerbating the wealth gap among white families and families of color. [9] Furthermore, cuts to income taxes often result in cuts in investments in programs designed to reduce inequity and support families living on low-incomes. As seen in the COVID-19 recession, states also need revenue to keep small businesses and families afloat during lean times.

The irresponsible tax proposals do not stop there. SB 182 proposes a dangerous structure of revenue and ending fund triggers for reductions in the top Montana individual income tax rate.[10] Other states that have enacted similar laws in recent years have experienced a multitude of problems, including financial problems, inadequate information about future revenues and expenditures, a lack of foresight for future economic conditions, and no accountability for lawmakers.[11] In most of the states with triggered income tax cuts, the trigger fails to factor in inflation, population growth, or other factors like natural disasters and pandemics that affect the cost of state services. This lack of consideration can lead to a state without enough revenue to cover necessary services.

None of the states that have enacted triggered income tax cuts estimated the cost of providing existing services over the full period in which the tax cuts were in place. Missouri considered a proposal similar to SB 182 for which state policymakers lacked sufficient projections for the possible impact of income tax reductions on the state’s ability to provide services over the long-run. Independent analysis showed that growth in demand for public services would exceed the projected revenue levels, putting Missouri in a precarious place when tax cuts were triggered. Given our lack of knowledge about what services will cost in future years, the current legislature should leave important tax and spending decisions to future legislatures, who will have more information about the state economy, costs of services, and actual revenue levels, and who will actually be accountable to their constituents.

Additionally, these triggers can take effect amidst economic downturns or other times in which revenue is low. In Oklahoma, a tax cut was triggered amidst a state economic downturn caused by low oil prices.[12] Some triggers can be met in a single year, resulting in tax cuts that can take place just as a state’s economy starts recovering from a recession, even with revenues well below pre-recession levels. These triggers typically do not require enough cushion to assure that the state will have economic conditions good enough to withstand the corresponding decrease in revenue.

In 2003, the Montana Legislature passed a significant tax cut for the wealthiest households and other harmful changes to the tax system via SB 407.[13] The changes included collapsing income tax brackets and creating a tax cut for capital gains income, making our tax system more regressive, and costing the state nearly a billion dollars in revenue between 2005 to 2016.[14] Taxpayers with incomes over $250,000 received, on average, $10,000 more each year, while taxpayers with incomes below $100,000 received less than $50.[15] Contrary to arguments and promises from some lawmakers, a Department of Revenue study found no evidence that the tax cut (or SB 407 more broadly) brought more high-income earners or other taxpayers to Montana.[16]

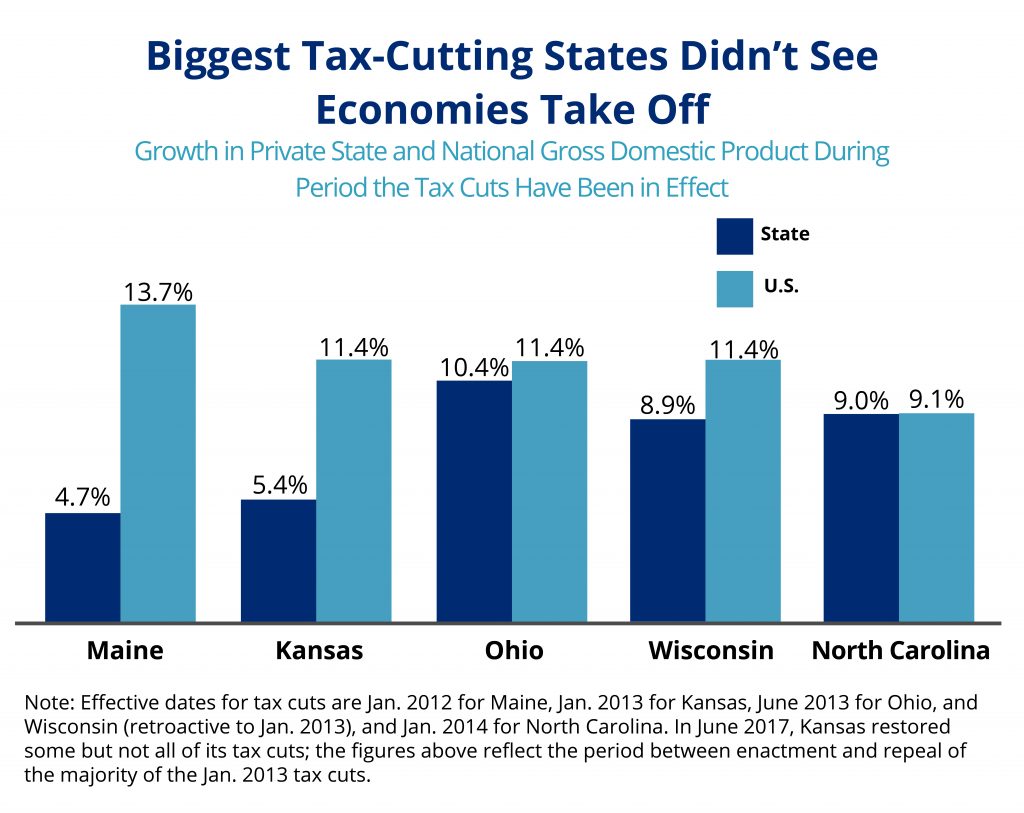

Analyses of other states’ economies following large income tax cuts have found slower-than-expected growth in private-sector gross domestic product (GDP).[17] In the early 2010s, Kansas, Maine, North Carolina, Ohio, and Wisconsin cut personal income taxes significantly, and four of the five states experienced both slower than average growth in GDP and in private-sector jobs. Additionally, evidence shows that increasing income tax rates, in particular for high-income households, does not harm a state’s ability to compete economically with neighboring states.[18]

This legislative session we have a choice. Instead of giving yet another tax cut to the wealthy, we should choose to fund our communities’ needs. There are a variety of common-sense revenue proposals that can ensure our tax code is fair and give our state the revenue we need to get Montana back on track – for everyone.

Times were tough for many Montana families before the pandemic. Then March 2020 came and their lives, and the lives of so many more, were made even more difficult. Tens of thousands filed for unemployment, small businesses struggled to get by, and families were forced into incredibly difficult decisions about how to work and take care of their children. We learned how important it is to pull together and help each other get through this. Our state plays a critical role in how we move forward and into a better future to build more resilient families and communities by investing in great public schools, community infrastructure, and a public health system that we can count on.

The tax cut proposals moving through this legislative session do not follow the values of Montanans – fairness, equity, and concern for our neighbors and communities. Let us keep an eye out for our fellow Montanans and pass legislation that improves lives, rather than valuing the wealthy over the rest of us.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.