A zero-sum game is a situation in which one person or group’s gain corresponds with an equal loss for another person or group. After the losses and gains, the net effect on both sides equals zero.

Property taxes at the local level are an example of a zero-sum game. When one type of property is declared exempt from taxation by the legislature, a different kind of property must make up the lost taxes. Schools do not cost less to run when large corporations get a tax abatement, water and sewer are not cheaper when property loses value, nor do roads need less plowing when the legislature lowers property tax rates.

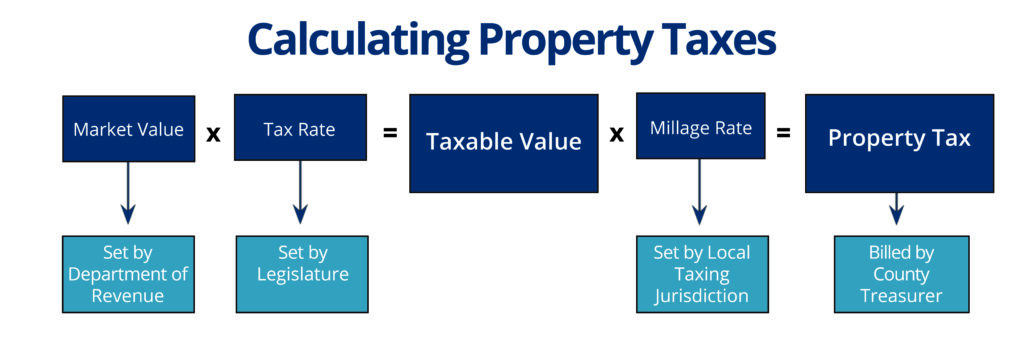

Let’s dig in a bit more into the basics of property taxes.

Step 1 - The Montana Department of Revenue appraises or values the property.

Step 2 - The Montana Legislature has created 15 classes of property, each with a specific tax rate.

Step 3 - Each property value is multiplied by its tax rate to arrive at its taxable value.

Step 4 - Local taxing jurisdictions – schools, cities, and counties – determine what millage they must levy to reach their budget levels.

Step 5 - The local mills are combined with the statewide mills to get the total millage.

Step 6 – Counties multiply a property's taxable value by its millage rate (mills divided by 1,000) to arrive at a property tax bill.

The Montana Legislature restricts schools, cities, and counties to inflationary limitations when setting budgets. However, when taxable values fall by either legislative decisions to exempt or reduce tax rates for some classes of property, local taxing jurisdictions must increase millage rates to meet their budgets. For example, today, residential property taxpayers pay over 50 percent of property taxes which has increased from 38 percent in 1995. This shift is due in part to decisions by the legislature to reduce tax rates and create exemptions for other classes of property and in part due to value changes. Some liken this to splitting up a bill. If one party pays less of the bill, the rest of the parties, in this case residential property taxpayers, must make up the remainder.

For more information on Montana’s property tax system, check out our Property Tax Policy Basics Report.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.