Montanans care deeply about the well being of their families and communities. They want a hopeful and prosperous future for their children and neighbors, safe communities, and a strong state economy that supports quality jobs and thriving businesses. As Montanans, we have come together at many pivotal moments in our state’s history to collectively build toward these goals. Together, we have considered not only what we can afford to accomplish today, but also the investments we must make to protect our future.

During Montana’s 2017 legislative session, elected officials should be focused on wisely increasing and using the state’s resources to help build opportunities and a path to prosperity for all Montanans through the budget creation process. A recent, but short-term, decline in state revenue, caused primarily by declines in corporate income and oil and natural gas taxes and slower than anticipated growth in individual income taxes, has created significant challenges for the state’s elected officials.

The proposed executive budget creates a responsible blueprint for addressing these challenges through a balanced approach that includes a combination of difficult cuts and targeted revenue enhancers that bring more tax fairness to our system and ensure adequate levels of revenue. Unfortunately, key legislative leaders have indicated a dangerous unwillingness to accept this balanced approach and have instead started the budget process by imposing additional deep, unnecessary, and harmful cuts.[1]

Declining Revenue and What It Means for the 2019 Biennium Budget

Recent revenue declines are threatening Montana’s ability to adequately invest in the public structures and services that educate our children, keep our communities safe, protect our land and water, and provide health care and other services when Montanans struggle to make ends meet. Revenue for the current 2017 biennium is expected to be roughly $300 million lower than the 2015 Legislature anticipated. At the conclusion of the 2017 budget cycle, the ending general fund balance is expected to be $79 million, or $236 million less than was projected in 2015.[2] In general, that reduction must be made up with some combination of budget cuts, revenue enhancers, or fund transfers.

The Proposed Executive Budget Offers a Balanced Approach to the State’s Revenue Challenges

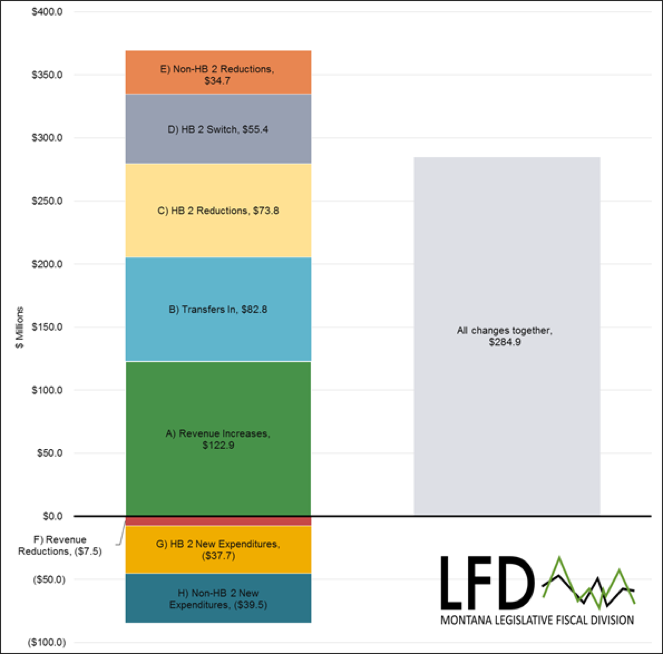

Before every legislative session, the governor proposes a budget for the next biennium based on projected revenue estimates for the same period. That executive budget is evaluated by the legislature’s staff before the session and serves as a starting point for legislative changes to the budget.[3] The governor’s proposed budget for the 2019 biennium includes a package of budget cuts, revenue enhancers, and fund transfers.[4]

These measures include approximately:

Note that without the executive’s proposed revenue enhancements, roughly $156 million in additional general fund cuts from the proposed budget would be necessary to achieve a $300 million ending fund balance for the 2019 biennium.

Early Legislative Action Troubling for Montana Communities and Families

Both the Montana Senate and House have committees dedicated to reviewing, changing, and voting on House Bill 2 and other appropriations bills before the bills go to the floors of their respective chambers. Those committees are the Senate Finance and Claims Committee and the House Appropriations Committee. At the beginning of each session, budget subcommittees with representatives of both committees are formed to look closely at each of the main areas of the budget and make preliminary decisions about what should be added, cut, or moved from the governor’s proposed budget.[6]

This year, majority leadership directed each of the subcommittees to both accept the governor’s proposed reductions and make further reductions of over $40 million in general fund cuts in the first set of motions taken on the budget.[7] These cuts included reductions to nearly all agencies, including an additional 2% “vacancy savings.”[8] In the budgeting process, elected officials and their analysts tend to pay particular attention to the state general fund. The general fund is the state’s primary and most flexible funding source, and it is the fund for which both structural balance and adequate ending fund balances are targeted by governors and legislators alike. Targets for starting points by the joint appropriation subcommittees were focused entirely on general fund and state special revenue spending, but in the Department of Public Health and Human Services (DPHHS) and Department of Transportation (DOT) budgets, the effects of those cuts are magnified by even larger losses of federal matching funds. Across all agencies, additional legislative reductions in general fund result in over $102 million in total funding cuts beyond what was proposed in the executive budget.

In total, the early motions adopted by the joint appropriation subcommittees have resulted in a starting point for House Bill 2 that is over $449 million below the 2017 base budget in total funds, including over $114 million in general funds and $254 million in federal funds.[9] See Appendix B for a preliminary analysis of the cuts taken by the joint appropriation subcommittees.[10]

These early cuts include:

Legislators on the budget subcommittees that adopted these starting motions have suggested that additional changes will be made and that some funding may be added back into the budget before the legislative session ends.[17]

However, the legislature cannot restore cuts and rebuild the ending fund balance without finding additional revenue, either through the governor’s proposed revenue raisers, alternative proposals, and/or by adopting new revenue projections with higher estimates. Any new spending or continuation of priorities previously funded as one-time-only appropriations would also require corresponding cuts or increased revenue.

One-Time-Only Funding from This Biennium Is Not Included in the Base Budget

In the budget creation process, most appropriations are designated as ongoing expenditures, meaning that the legislature and executive assume they will continue to be funded beyond the next biennium. Those ongoing appropriations are used to create the next base budget. The preliminary reductions discussed above are cuts to that base budget.

However, the legislature and executive sometimes fund additional programs and services as one-time-only (OTO) expenditures.[18] In the current 2017 biennial budget, approximately $69 million of general fund expenditures were designated as one-time-only.[19] The programs supported by those OTO appropriations are not included in the base budget and thus are not included in the summary of reductions provided above. However, failure to restore the OTO funding will likely be experienced as cuts to the people and constituencies currently benefiting from those programs. Examples of programs and services that are funded partially or entirely by OTO funding include[20]:

Some of the OTO expenditures are included in the governor’s proposed budget as new proposals. Those new proposals would need to be adopted by the legislature in order to be included in the 2019 budget. In general, any continuation of OTO funding would need to be funded with a corresponding cut in another area of the budget or the adoption of new revenue.

Present Law Adjustments Will Affect Agencies Differently

With few exceptions, the joint appropriations subcommittees have not yet adopted present law adjustments included in the governor’s budget. Present law adjustments are the funding changes needed “under present law to allow maintenance of operations and services at the level authorized by the previous legislature.”[21] Some present law adjustments are statutorily required increases based on funding formulas and inflationary or deflationary adjustments. As a result, the effects of present law adjustments vary widely in the governor’s proposed budget and, if adopted, will either increase or further decrease the funding compared to the base budget. For example, within the budget for the Office of Public Instruction (OPI), present law adjustments for local assistance to K-12 schools represents an increase of approximately $73 million in total funds.[22] Even factoring in the reductions within the starting point motions, the OPI budget would increase by approximately $49 million.

Other state agencies are facing present law adjustments that represent reductions from the amount appropriated in 2017 biennium. For example, agencies such as the Department of Commerce and Department of Labor & Industry are experiencing negative present law adjustments.[23] While the Department of Public Health and Human Services sees an overall net positive within its present law adjustments, some divisions within the agency are facing reductions. For example, the present law adjustments to the Senior and Long-Term Care Division of DPHHS would further reduce that budget by approximately $26 million in total funds. If acted upon, this adjustment would come in on top of the over $52 million in cuts already taken in the starting point motion adopted by the Joint Subcommittee for Health and Human Services Appropriations.[24]

Early Cuts Demonstrate Need for a Balanced Approach that Includes Revenue

The early cuts to the public programs that help make our communities safe, healthy, and educated are as unnecessary as they are damaging. These cuts will have potentially devastating impacts on students, vulnerable Montanans, and communities across the state. Our elected leaders have other choices available, including passing a number of sensible bills that would increase state revenues by closing tax loopholes and making sure that all taxpayers pay their fair share. Building long-term and widely shared prosperity in our communities, providing adequate services for Montana’s seniors and people with disabilities, and ensuring opportunity for all Montana’s students, will require a willingness to entertain a balanced approach to the state’s current revenue challenges.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.