A State Earned Income Tax Credit: Helping Montana’s Families and Economy

Erica Donohue | December 2020 | Presented by the Montana Budget & Policy Center

- The Earned Income Tax Credit (EITC) is one of the most sensible aspects of our tax code. It is a tax credit for working people with low incomes. Giving struggling families this kind of break makes sense not just for them but also for our communities and our economy, since when they spend, it helps businesses. The EITC is a common-sense tax policy that most of us can get behind.

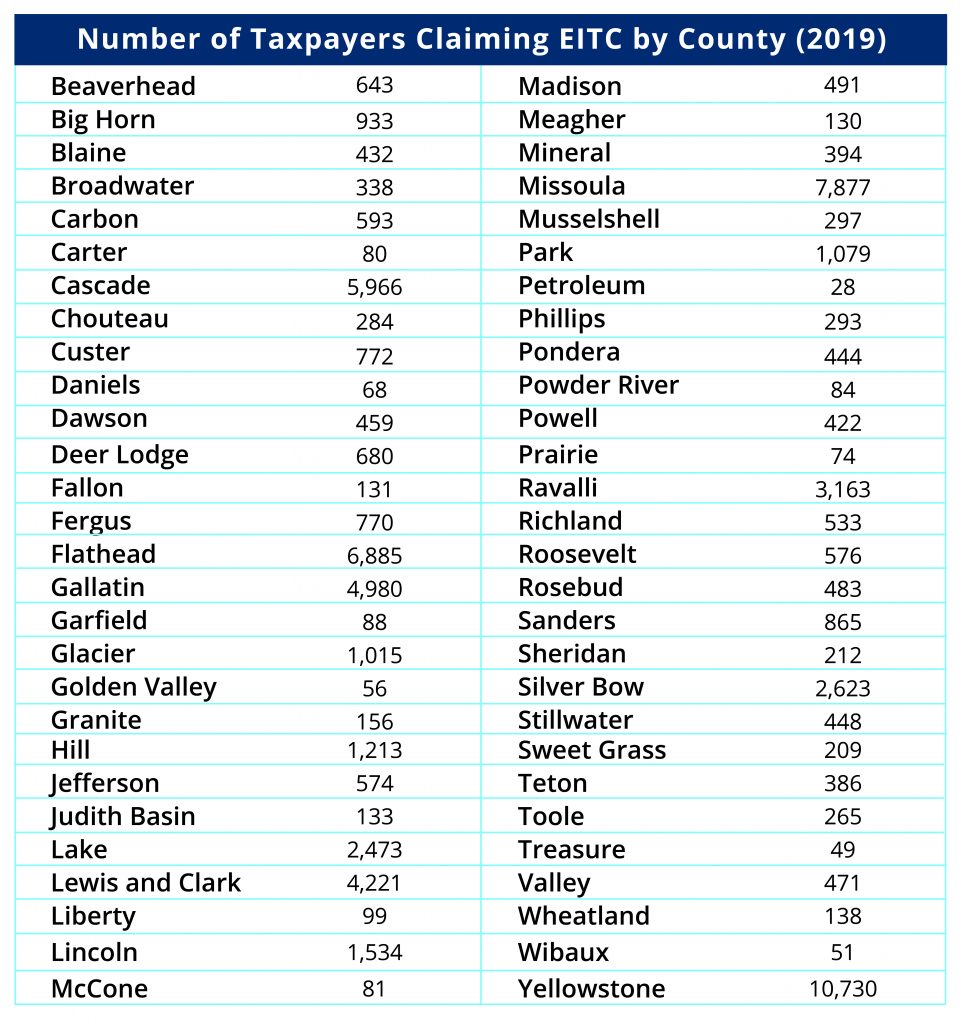

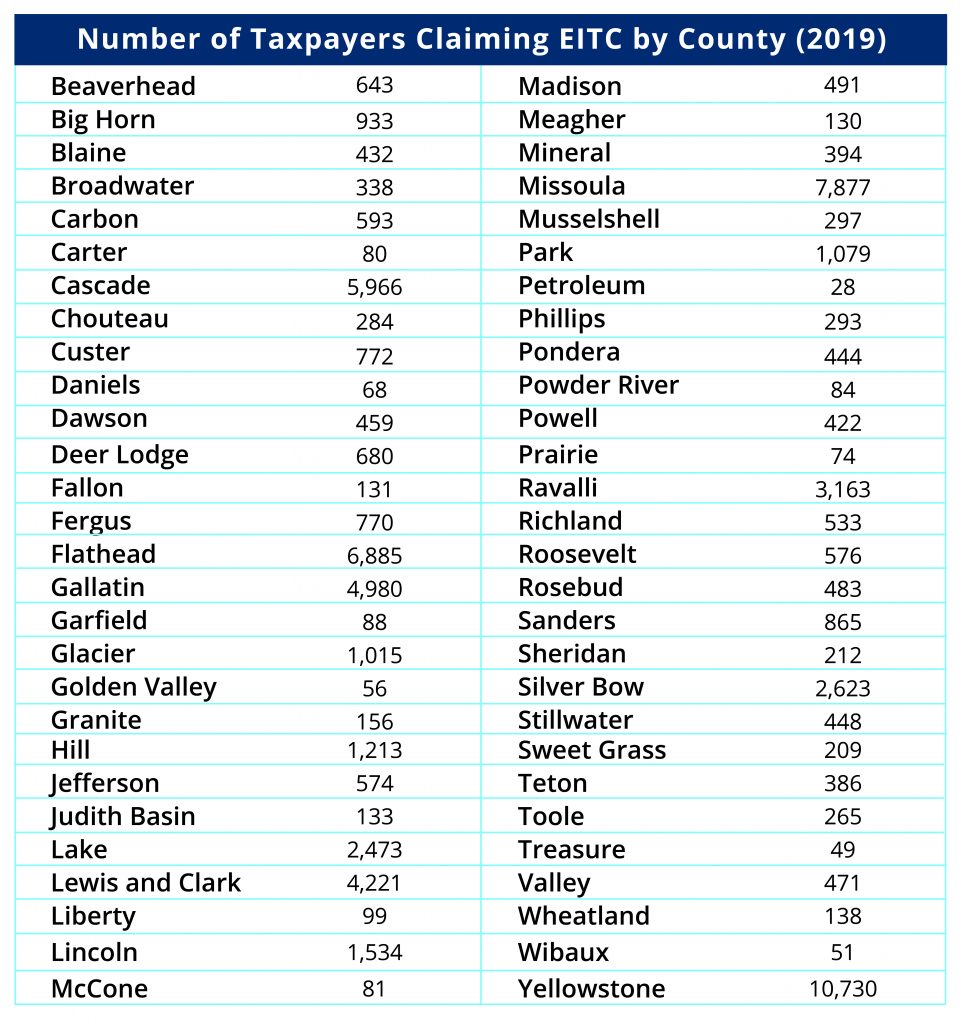

- In 2017, the Legislature passed a refundable state credit on a bipartisan vote. It is set at 3 percent of the federal EITC, effective for the 2019 tax year.In 2019, the first year that the state EITC could be claimed, 71,473 working Montanans with low incomes benefited.[1]

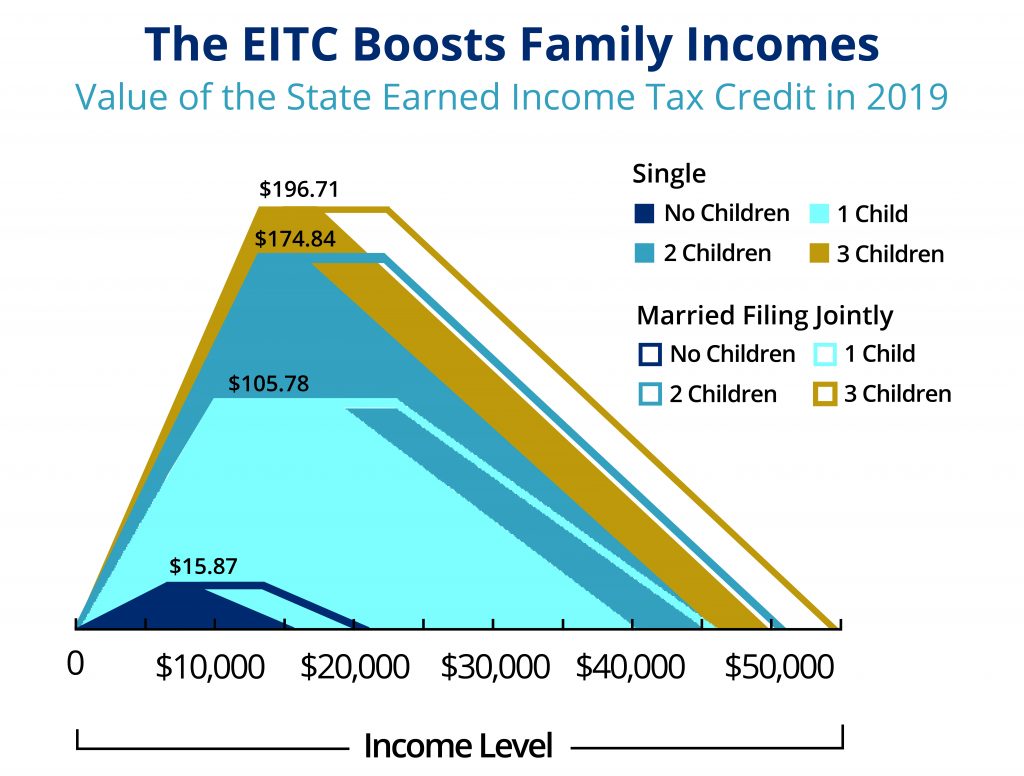

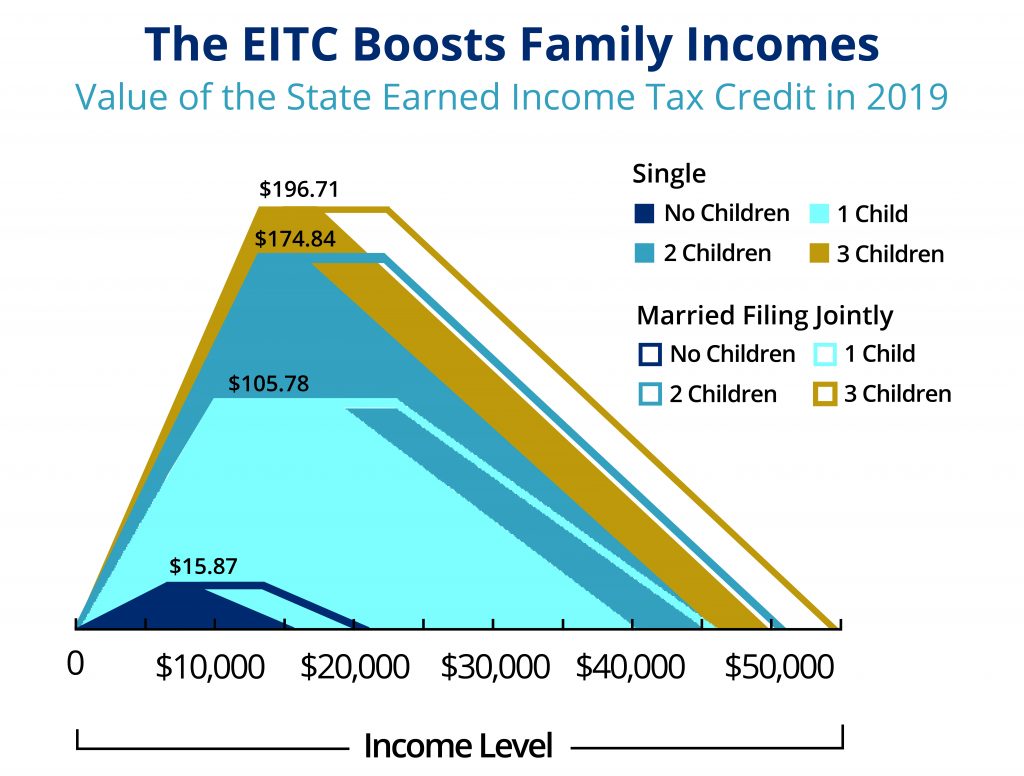

- The phased-in EITC boosts wages for working families on low incomes. A state EITC set at 3 percent of the federal credit offers a maximum benefit of $196.71 a year[2]. When combined with the federal credit, this is the equivalent to a wage increase of $3.25/hour for a single parent of three.

- For most families, the EITC is a temporary tax break that allows people to provide for their families. The majority of recipients receive the credit for one to two years. The few hundred dollars can help them stay current on bills, afford a car repair so they can get to work, or buy school supplies.[3]

- For families with two children and two parents experiencing poverty, Montana has the third highest tax liability of any state in the nation. For single-parent families with two children, Montana has the fourth highest tax. [4] A state EITC restores tax fairness by reducing the overall taxes the lowest-income workers’ pay.

- A state EITC reaches families and communities in all 56 counties to help support even the smallest communities, families, and small businesses. In 2017, 65 percent of EITC participants lived outside of the seven biggest Montana cities.[5]

- The EITC is an economy-boosting policy that raises the floor on wages and benefits to help make sure that average people have enough money and security to keep up the basic spending on which the economy depends. The federal EITC injected $173 million into Montana’s economy in 2014.[6]

- EITC administrative costs are less than 1 percent of the benefits provided. Errors are primarily due to the complexity of rules surrounding the credit, not fraud.