The Growth & Opportunity (GO) Trust: An Overview

- MBPC Staff

- Aug 11, 2025

- 9 min read

Updated: Dec 2, 2025

Download Report PDF

This past session, the Legislature passed HB 924, which establishes the Growth and Opportunity (GO) Trust, which will transfer roughly $930 million over the next four years into a state special revenue account, with interest to be used for several longer-term investments, including affordable housing, water and bridge infrastructure, public pensions, and early childhood initiatives.[1] This over 50-page bill passed with bipartisan support and represents a significant investment of state general fund dollars for future spending. But what does this mean for these initiatives in the short term, and how will this trust work? This report provides an overview of the funding that will be deposited into the fund and subaccounts, how much funding will be available over the next several years, and the uses of that funding. MBPC wants to acknowledge the work of the Legislative Fiscal Division (LFD), which has also provided a helpful summary of the GO Trust.[2]

Money Into the GO Trust

There are several mechanisms for deposits into the larger GO Trust. First, HB 924transferred general fund dollars into the trust for the first three fiscal years (FY25 – FY27). Transfers starting in 2026 will occur twice during the fiscal year, with the first half by November 1 and the second half by May 1.

Following these initial transfers, starting in 2028, the GO Trust will receive a portion of what the Legislature is considering “volatile revenue.” This revenue comes from three sources: tax on capital gains income, tax on partnership income, and the interest the state earns from treasury cash.[3] HB 924 establishes a calculation for how much of each of these sources will go into the GO Trust. Each biennium, the Legislature will project how much revenue it expects for each of these sources. If that projected amount exceeds the lowest level of revenue from that source over the last seven years (adjusted for inflation), the difference will be considered “volatile revenue.” Initially, 35 percent of this “volatile revenue” will be transferred into the GO Trust. In 2035 and subsequent years, 20 percent of volatile revenue will be transferred.

These revenue sources are indeed volatile. It is hard to predict how much revenue the state will see in any given year, and these three sources tend to fluctuate a lot year over year. As LFD’s report indicates, the state typically generates steady levels of revenue from other sources, such as income tax from wage income, while capital gains income can see a year-over-year change of 50 percent (positive or negative).[4] The idea of HB 924 is that the state would factor into its annual budget level the amount of revenue from these sources that aligns with the past seven years (adjusted for inflation), and in years where these revenue sources will come in higher than that, a portion of that additional revenue (“volatile revenue”) would be diverted to the Trust.

In this upcoming year, LFD projects approximately $61.5 million in capital gains volatile revenue, $118 million in partnership volatile revenue, and $65 million in volatile interest earnings, for a total of $244.5 million. If this was the amount calculated for 2028, 35 percent of that, or $85.6 million, would be transferred into the GO Trust ($42.8 million in November 2027, $42.8 million in May 2028).

The GO Trust will also receive a percentage of “excess revenue” once the budget stabilization reserve fund (BSRF) and the capital developments long-range building program account reach their capped amounts.[5]

Money Out of the GO Trust

HB 924 establishes six subaccounts, sets out how those funds can be used, and provides appropriation authority to state agencies. State agencies cannot expend more than is available in the fund. In other words, what is important is the balance of the fund, not necessarily the appropriation authority. The funds available to spend are twofold. First, in the first one to three years, certain subaccounts will receive a one-time transfer of funds. Second, the subaccounts will receive a percentage of the interest earned off the bigger GO Trust. (The Pensions Fund and Housing Fund will operate a little differently: they receive a direct allocation of volatile revenue, and for the Housing Fund, it will retain its own interest.)

For most subaccounts, it is the interest allocation that is important: that is the amount that agencies will have on an on-going basis to invest. We don’t know exactly how much interest the GO Trust will earn, but assuming current revenue levels and projected deposits into the GO Trust, LFD estimates the total interest to be about $23 million in FY26 and about $28 million in FY27, with a percentage of this interest deposited into certain subaccounts as discussed below.[6]

Pensions Fund

The largest subaccount is the pensions fund, which received a general fund transfer of $250 million in FY25 and will receive $48 million in FY26 and $36.8 million in FY27.[7] The fund will receive 40 percent of the volatile revenue deposited into the GO Trust and 50 percent of the interest earned on the GO Trust.[8]

The money deposited into the Pension Fund must be used in instances when the state-administered pension funds are projected to have a rate of return that falls below what is necessary to cover future pension payments. State-administered pension funds include the teacher retirement fund and the public employees’ retirement fund. In addition to establishing the Pensions Fund, HB 924 also increased the employer contribution for both the teacher retirement fund and the public employees’ retirement fund by 0.10 percent each year for the next 20 years. According to the fiscal note for the legislation, it is assumed that the projected rates of return for state-administered pension funds are above the adopted assumed rate, so there are no transfers projected over the next four years at this time.[9] Funds remain in the Pensions Fund until needed, and the Fund is capped when the balance reaches $1 million.

Montana Housing Fund

The Housing Trust is the second largest investment in the GO Trust. It will receive general fund transfers in the next two fiscal years: $12 million in FY26 and $9 million in FY27, and a transfer of $10 million from the capital development account in FY26. HB 924 also transfers $115 million in existing housing loans that were previously in the Coal Trust Fund. That funding has already been obligated, but as those loans are paid off, the money will go into the new Housing Fund. In subsequent years, the Montana Housing Fund will receive 10 percent of the volatile revenue deposited into the Trust, and it will retain its own interest. (The Housing Fund will not receive an allocation of interest earnings from the overall GO Trust).

The housing fund encompasses three existing affordable housing programs, which have primarily been used to provide loans for affordable housing projects and home ownership programs: (1) the multi-family housing loan program; (2) the veterans home mortgage program; and (3) the Housing Montana Fund. New funds into the Montana Housing Fund can be used for any of these three programs. The Montana Board of Housing will administer the Montana Housing Fund and will go through the rulemaking process over the next several months to provide more detail on how resources will be used.[10]

Funding within HB 924 for the Housing Montana Fund is in addition to funding provided under the Montana housing infrastructure revolving loan fund, established in 2023. The 2025 Legislature added an additional $50 million into this fund, which now sits with a balance of $163 million at the end of FY25.[11, 12] HB 505 also provides for this fund to retain its own interest, and the Montana Board of Investment may use the interest income to support residential ownership of mobile home parks or other multifamily housing.

Tax Relief Fund

The Tax Relief Fund received a one-time transfer of $20 million and will receive 20 percent of the interest earned on the GO Trust balance. Once the Tax Relief Fund reaches a $50 million balance, the fund is used to provide one-time property tax rebates to primary residential homeowners. Factoring in the transfer and estimated interest, it is unlikely the fund will reach that threshold for the next several years. HB 924 subaccount for property tax relief is in addition to the Legislature’s passage of HB 231 and SB 542, providing significant property tax reforms in 2025 and 2026. In total, these proposals will cost the state more than $300 million over the next four years.[13]

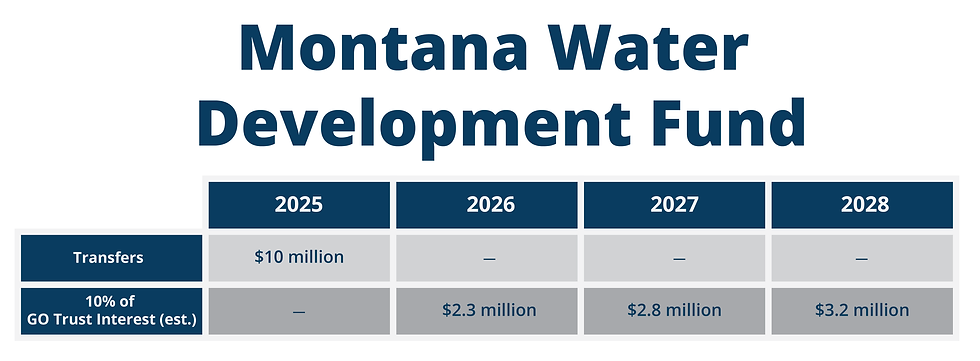

Montana Water Development Fund

The Water Development Fund will receive a one-time transfer of $10 million and then 10 percent of the interest earnings off the GO Trust. This money will flow into two existing programs: (1) 90 percent will go toward the water storage account; and (2) 10 percent will be used for water storage pilot programs and dam inspections within the existing natural resources project account. Both existing water development accounts receive funding from other sources. At the end of FY25, the water storage account had a balance of $2.8 million.[14] The natural resources project account had a balance of $21 million (after $30 million in disbursements in FY25). The Department of Natural Resources and Conservation (DNRC) administers both funding streams.[15]

Better Local Bridges Account

The Better Local Bridges Account will receive a one-time transfer of $10 million and then 10 percent of the interest earnings off the GO Trust.[16] HB 924 also indicated that $50 million of the first year of volatile revenue would be directed to local bridges. The Better Local Bridge Account will be used for grants to support local governments with engineering and construction costs for off-system bridges. Local government must provide a 20 percent local match to access funds. The Department of Transportation (MDT) will enact rules to implement and distribute the funds.

Funding within HB 924 for bridges is supplemented with new investments in the larger state budget bill, HB 2. The Legislature appropriated $20 million for the 2027 biennium to support local bridge infrastructure and 19 new FTE within MDT to develop a bridge replacement and rehabilitation project list and five-year implementation plan and staff to support bridge maintenance and inspections.[17] MDT also received $58 million in statutory general fund appropriations within the Local Road and Bridge Account.

Montana Early Childhood Account

The Montana Early Childhood Account will receive a one-time transfer of $10 million and then 10 percent of the interest earnings off the GO Trust.[18] The use of funds will be determined by a newly created board, administered by the Department of Public Health and Human Services (DPHHS). HB 924 sets out several possible uses of funds, including: recruitment and retention grants to support the child care workforce; quality improvement initiatives; supports for infants, toddlers, and children with special needs; and affordability initiatives, including expansion of the state child care subsidy program. The governor will appoint members of the newly-formed board, which will include several state agency officials, two members representing state or local community organizations, two child care providers, and a parent.

Conclusion

The enactment of HB 924 and the GO Trust represents an important step in allocating a portion of revenue for longer-term infrastructure investments and providing a mechanism to earn interest from the larger trust structure to fund these investments. For some areas, such as housing, water, bridges, and property tax assistance, HB 924’s initial transfers and ongoing allocations were also coupled with 2027 biennial budget investments or policy changes, allowing the state to leverage more than one funding stream to support these specific infrastructure investments. Moving forward, it will be important to track the total amount spent each year and to look at how the GO Trust mechanism can be coupled with policy change and meaningful, ongoing budget investments.

Endnotes

[1] Montana 69th Legislature, “An act generally revising state finance laws,” HB 924, enacted June 19, 2025. HB 924 was amended in the Senate, but the fiscal note was not updated. To find estimated cost over the four year period, see: Legislative Fiscal Division, “General Fund Outlook,” June 3, 2025.

[2] Legislative Fiscal Division, “Summary of HB 924 (2025 Session): Montana Growth and Opportunity Trust,” June 10, 2025.

[3] Legislative Fiscal Division, “Summary of HB 924 (2025 Session): Montana Growth and Opportunity Trust,” June 10, 2025.

[4] Legislative Fiscal Division, “Summary of HB 924 (2025 Session): Montana Growth and Opportunity Trust,” June 10, 2025.

[5] Montana 69th Legislature, “An act generally revising state finance laws,” HB 924, enacted June 19, 2025.

[6] Legislative Fiscal Division, “HB 924: Money Inflow from the General Fund,” June 19, 2025, on file with author.

[7] Montana 69th Legislature, “An act generally revising state finance laws,” HB 924, enacted June 19, 2025.

[8] Legislative Fiscal Division, “Summary of HB 924 (2025 Session): Montana Growth and Opportunity Trust,” June 10, 2025.

[9] Governor’s Office of Budget and Program Planning, Fiscal Note, HB 924, Apr. 11, 2025. [10] Montana Board of Housing, “Public Meeting – June 9, 2025,” retrieved on Jul. 28, 2025. [11] Montana 69th Legislature, “An act providing that the Montana housing infrastructure revolving loan fund may be used to secure bonds and provide financing for eligible projects and retaining all interest and income in the accounts,” HB 505, enacted May 13, 2025.

[12] Legislative Fiscal Division, “SSR Account Information,” MBPC information request, received on Jul. 16, 2025, on file with author.

[13] Legislative Fiscal Division, “General Fund Outlook,” June 3, 2025.

[14] Legislative Fiscal Division, “SSR Account Information,” MBPC information request, received on Jul. 16, 2025, on file with author.

[15] Mont. Code Ann., Title 85, Chapter 51, and Title 85, Chapter 1, 2023.

[16] Montana 69th Legislature, “An act generally revising state finance laws,” HB 924, enacted June 19, 2025.

[17] Legislative Fiscal Division, “HB 2 Narrative: Section C (Natural Resources & Transportation),” retrieved on June 28, 2025.

[18] Montana 69th Legislature, “An act generally revising state finance laws,” HB 924, enacted June 19, 2025.

Comments