The Truth is in the Data: Montana Renters Need Relief

Montana is facing a housing affordability crisis. Too many families with low or moderate incomes in Montana cannot afford a home due to rising housing costs and a lack of housing supply. In addition to the lack of housing affordability, many people experience further barriers to finding housing like renter discrimination. This report will dig into these factors and how they affect the lives of many renters across Montana.

Montana is facing a housing affordability crisis. Too many families with low or moderate incomes in Montana cannot afford a home due to rising housing costs and a lack of housing supply. In addition to the lack of housing affordability, many people experience further barriers to finding housing like renter discrimination. This report will dig into these factors and how they affect the lives of many renters across Montana.

Housing is Unaffordable for Many Montanans

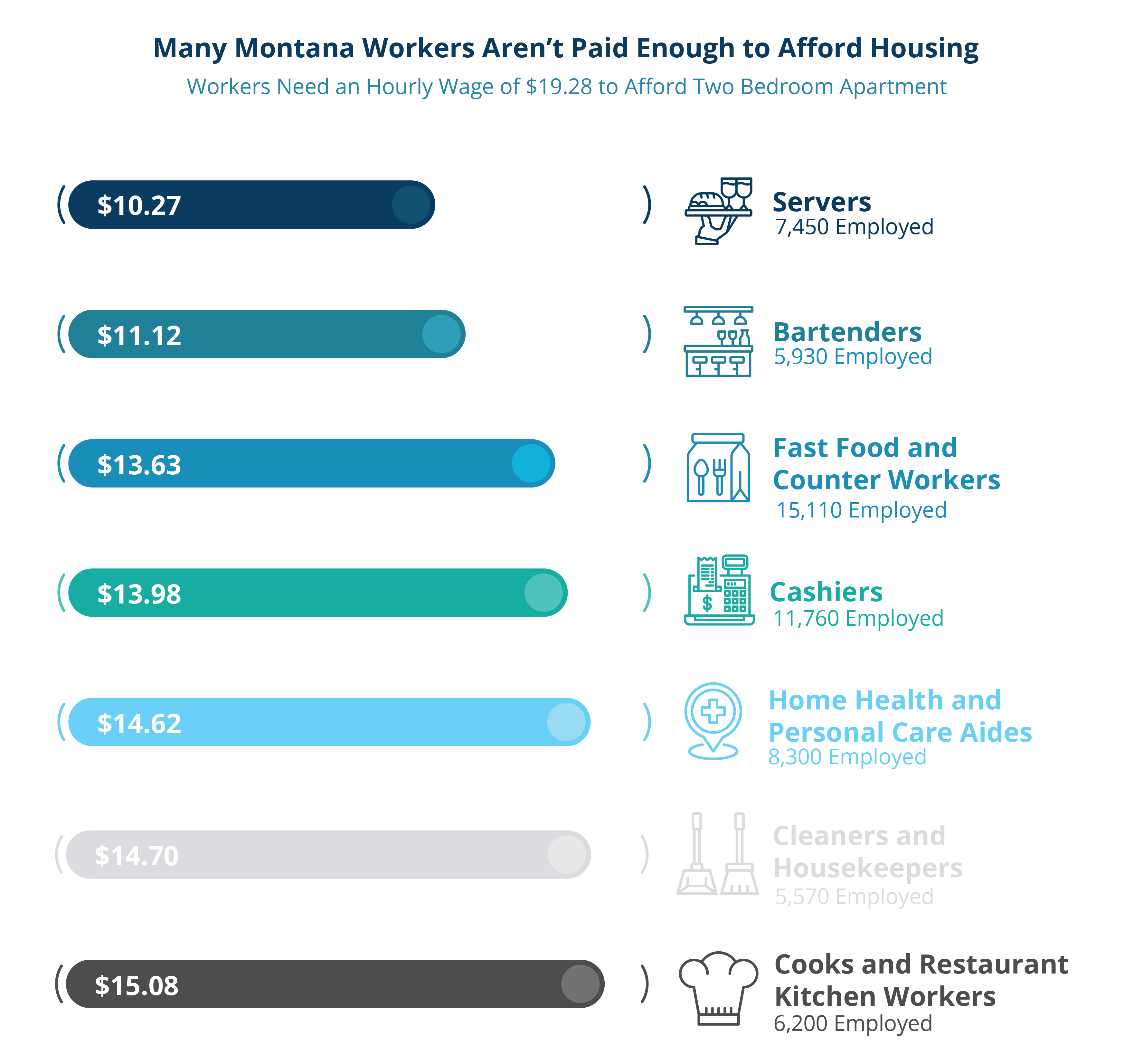

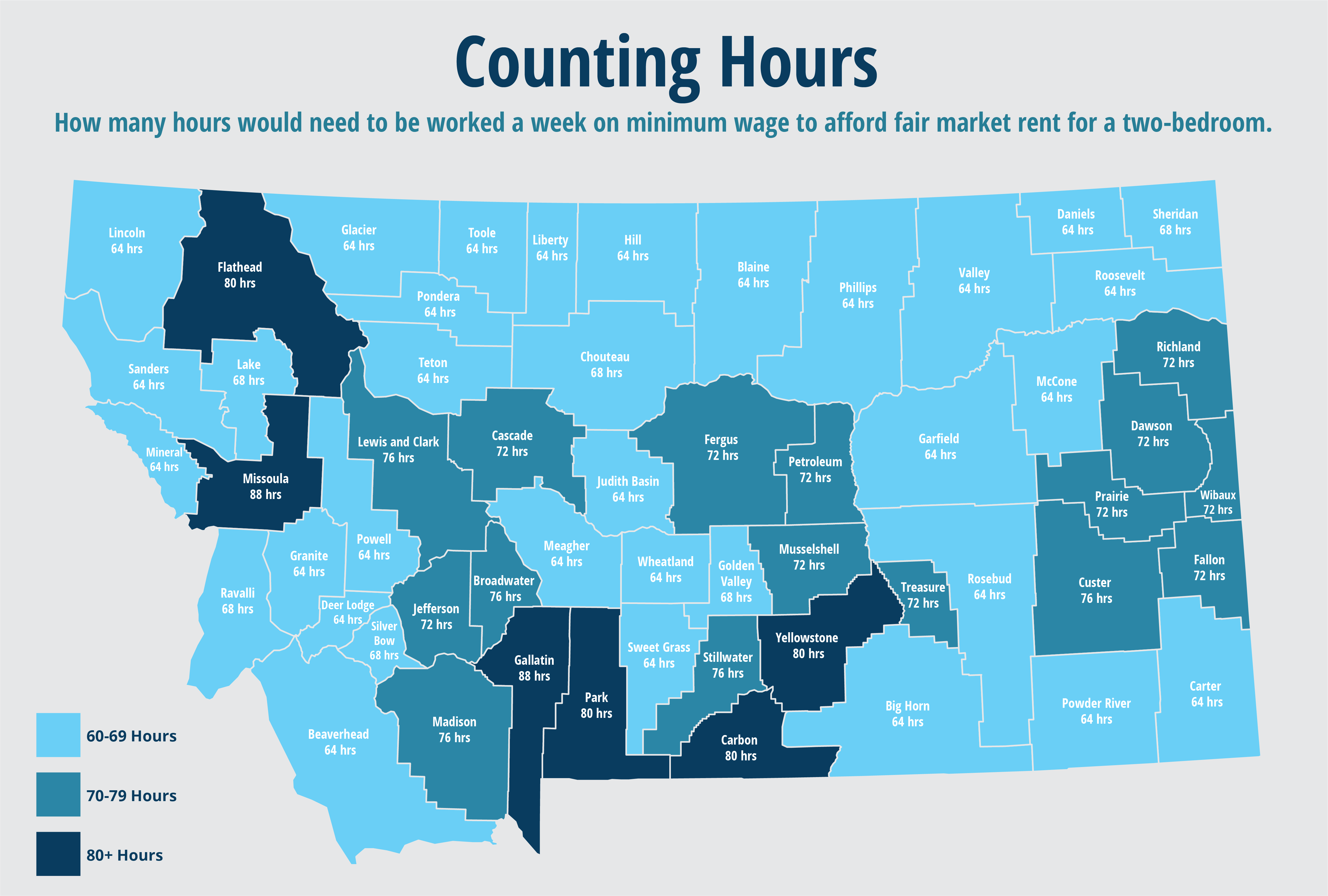

Since 2020, Montana’s population has grown by almost 36,000 people, including many high-income renters (those with incomes over $75,000).[1] The tight housing market has left these renters unable to move into first-time homeownership, further constricting the rental market. Affordable rental scarcity has caused many to be severely cost-burdened by rental costs. In Montana, the median renter household income is $45,018 per year.[1] A significant portion of renters in Montana, 21 percent, are severely cost-burdened (27,985 households). To afford the fair market rent for a two-bedroom apartment in Montana, $1,002 per month, someone with the median renter household income would need to work 77 hours a week or earn $19.28 per hour.[2] This wage leaves out many essential workers in Montana, such as nursing assistants, who earn a median hourly wage of $17.83.[3] People living on low incomes face an unfair burden of using a high proportion of their incomes to afford a place to live.

Montana Needs More Homes to Fill Housing Needs

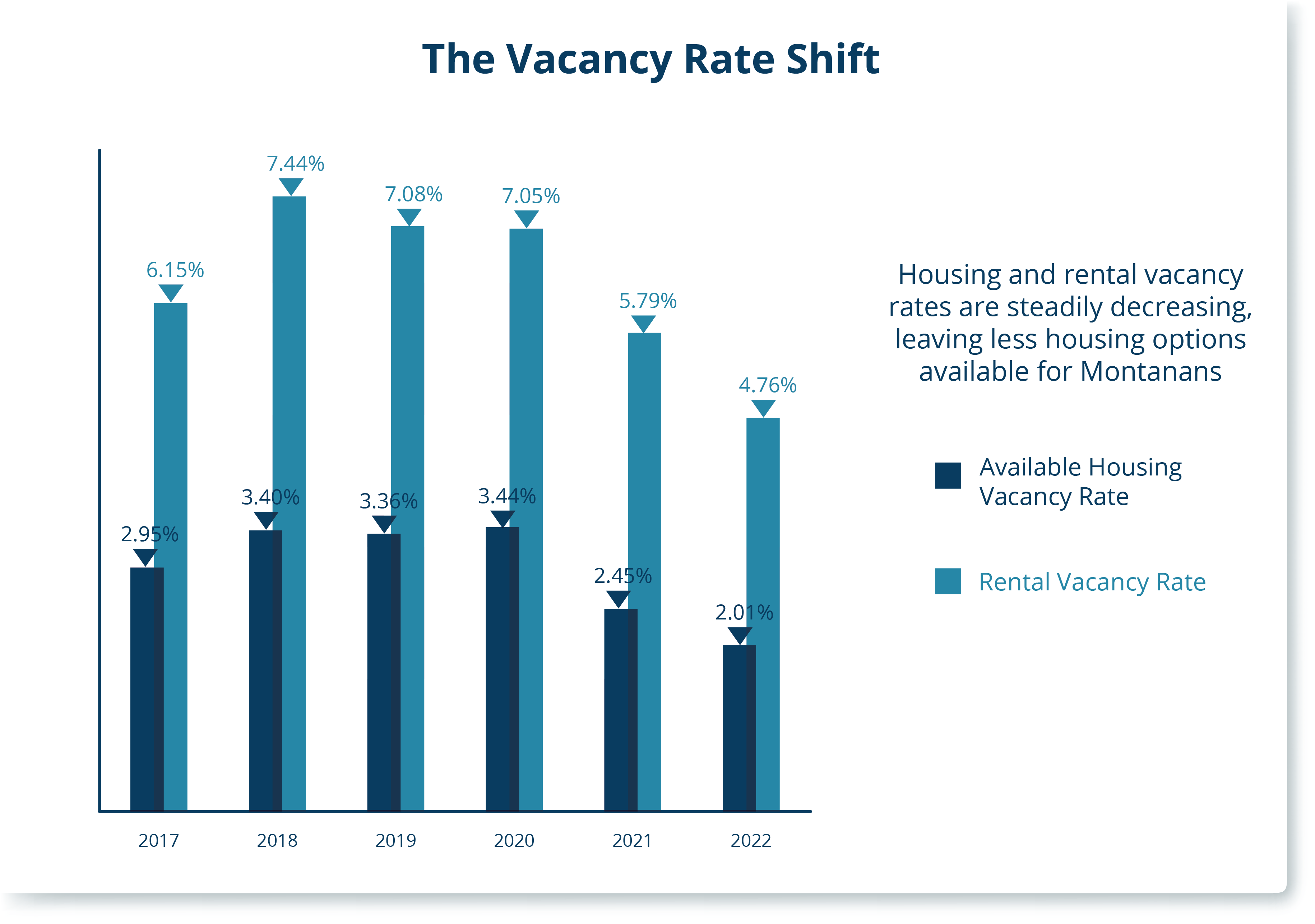

Today, the United States has a shortage of 7.3 million affordable rental homes available to renters with extremely low incomes.[3] In Montana, there is a deficit of 16,629 affordable and available rental units for individuals living on extremely low incomes. For individuals at or below 50 percent area median income ($1,139 monthly), there is a deficit of 14,487 units.[4][5] Montana’s housing shortage is getting worse. Montana’s overall housing vacancy rate decreased by 3.8 percent between 2018 and 2022.[2] Many local and statewide initiatives are helping to simplify the process of creating and developing affordable housing. But Montana needs more funding to help fill the housing deficit.

Today, the United States has a shortage of 7.3 million affordable rental homes available to renters with extremely low incomes.[3] In Montana, there is a deficit of 16,629 affordable and available rental units for individuals living on extremely low incomes. For individuals at or below 50 percent area median income ($1,139 monthly), there is a deficit of 14,487 units.[4][5] Montana’s housing shortage is getting worse. Montana’s overall housing vacancy rate decreased by 3.8 percent between 2018 and 2022.[2] Many local and statewide initiatives are helping to simplify the process of creating and developing affordable housing. But Montana needs more funding to help fill the housing deficit.

BIPOC Montanans Face More Barriers to Affording Housing

Decades of systemic barriers and discrimination have disproportionately affected people of color, increasing their likelihood of surviving on extremely low incomes compared to white households, particularly when it comes to housing costs.[6] For example, in the United States 20 percent of Black workers and 19 percent of Latinx workers earned less than $15 per hour in 2022. According to Census data from 2022, the average income for white Montanans is $68,005 annually, while the annual income for Indigenous Montanans is only $39,077 and $50,676 for Black Montanans.[7] Not only is renting in Montana unaffordable to a large number of individuals, but many are also facing inequities due to years of structural racism and discrimination.

There are numerous examples of federal housing policies that disproportionately benefit white families over BIPOC. Federal housing policies often favor white families over BIPOC families, reflecting systemic biases that carry on gaps in access to housing resources. In 1949, the American Housing Act of 1949 expanded funding and use of the eminent domain to relocate housing for families with low incomes in favor of development.[8] By 1974, 2,100 urban renewal projects were created, which subsequently forced 300,000 families to move - more than half of whom were BIPOC. Historically, racist policies have had lasting effects, persisting into the present day. For instance, in 2020, the termination of the Affirmatively Furthering Fair Housing Act by the Housing and Urban Development Office stopped efforts aimed at preventing housing discrimination, taking apart segregation patterns, and promoting inclusive communities. Thankfully, this act was restored in 2021. Policymakers must step up and thoroughly look over both past and present housing legislation to guarantee they actively prioritize inclusion and equity promotion.

The use of federal housing subsidies by renters can lead to discrimination in housing. This is because landlords often prioritize leasing units at market rates, which enables them to bring in higher rental income. Montana does not have protection around ‘income discrimination’, meaning property management can choose not to accept certain forms of income. In a recent survey done by the Montana Department of Commerce, landlords in Montana were asked if they would recommend participation (of Housing Choice Vouchers or Emergency Housing Vouchers) to other landlords and 35 percent answered “no” for reasons such as payment issues and a difficult implementation process[9]. There are few incentives for landlords to rent to voucher holders, and they legally are not required to do so in Montana.

Legislative Suggestions and Priorities

Community knowledge about the lack of affordable housing in Montana is growing. We must use this knowledge, and our shared experiences and stories to create change. There are many ways to help increase accessibility to housing in Montana.

[1] Montana Department of Commerce, “Montana Housing Situation Report,” 2022.

[2] National Low Income Housing Coalition, Montana State Fact Sheet, Mar. 2024. The 77 hours a week estimate is based on a minimum wage of $9.95.

[3] National Low Income Housing Coalition, Out of Reach Montana, Mar. 2024.

[4] National Low Income Housing Coalition, “Montana,” Mar. 2024.

[5] National Low Income Housing Coalition, “The Gap: Montana,” Mar. 2024.

[6] National Low Income Housing Coalition, “The Gap,” 2024.

[7] U.S. Census Bureau, "Median Income in the Past 12 Months, 2022 American Community Survey 5-Year estimate, Table S1903," accessed on May 16, 2024.

[8] Almeida, La-Brina., “A History of Racist Federal Housing Policies,” Massachusetts Budget & Policy Center, Aug. 2021.

[9] Cohen, C., “Voucher Utilization for Rental Assistance Programs,” Montana Department of Commerce, Mar. 2024.

[10] Godbey, A., HB819: Bridging the Gap to Affordable Housing,” Montana Budget & Policy Center, “ Apr. 2024.

[11] Bender, R., “Policy Basics: Property Taxes in Montana,” Montana Budget & Policy Center, Sept. 2023.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.