The House-passed health care bill, the American Health Care Act (AHCA), will result in tens of thousands of Montanans losing coverage, increased health care costs for many Montana families, and the loss of billions in federal Medicaid funds to provide coverage for Montana children, elderly, and people with disabilities. Those who are living in Montana’s rural communities are at even greater risk of increased costs and loss of coverage.

Medicaid plays a significant role in not only providing health coverage but also paying for care in rural areas. Threats to dismantle Medicaid and cut federal support will disproportionately harm rural Montanans and rural health providers, like critical access hospitals. Furthermore, rural Americans have benefited greatly from the tax credits and subsidies provided through the Affordable Care Act to access health insurance on the marketplace. The proposed tax credit under the House plan would no longer factor in regional disparities in costs of insurance and represent dramatic cuts to assistance for individuals, particularly older Montanans.

Medicaid plays critical role in rural Montanans’ access to health services.

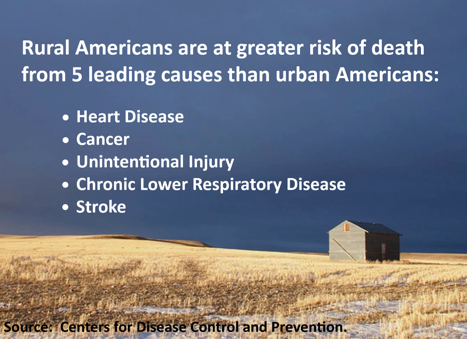

Over 240,000 Montanans access health care coverage through Medicaid, nearly half of which are children in the Healthy Montana Kids program (Montana’s children’s Medicaid and CHIP program). Montanans residing in rural counties are more likely to access coverage through Medicaid than Montanans residing in urban areas.[1] Medicaid has provided greater access to primary physicians and preventative care, such as cancer screenings, diabetes screenings, and dental services. Individuals in rural areas are more likely to die from heart disease, cancer, unintentional injury, chronic lower respiratory disease, and stroke, than their urban counterparts.[2]

Furthermore, Medicaid expansion has become a critical financial lifeline for many rural hospitals. Prior to Medicaid expansion, Montana hospitals reported nearly $400 million in uncompensated care costs in 2013, with many critical access hospitals serving high numbers of uninsured Montanans feeling the greatest pressure.[5] Since the passage of Montana’s Medicaid expansion, the uninsured rate in the state has plummeted, to 7.4 percent in 2016 compared to over 15 percent in 2015.[6] Payments to Montana health care providers have increased, and many providers are already reporting fewer uninsured patients and lower uncompensated care costs.[7] Nationally, in states that expanded Medicaid, uncompensated care costs as a share of hospital costs fell by about half between 2013 and 2015.[8] If Congress ends Montana’s Medicaid expansion, providers would face increased uncompensated care costs, putting many rural providers in financial peril. If a rural hospital closes, it hurts an entire community.

AHCA provides woefully inadequate tax credits for rural Montanans to access marketplace health insurance.

The AHCA will be most devastating for older Montanans wanting to stay in their rural hometowns. Statewide, Montana’s rural communities tend to be older and sicker. For example, a 60-year-old man from Chouteau County with an income of $30,000 would receive nearly $8,140 less in tax credits under the House bill than under current law. Factoring in premiums under AHCA, the total cost of insurance on the marketplace would be $13,170 more than coverage under the ACA, a 531 percent increase in cost.[11]

Conclusion

Montana’s rural communities play an important role in our state’s economy. Medicaid coverage and access to health care tax credits and subsidies provide many Montana families – especially those in rural Montana - the ability to access affordable health services. Montana’s Medicaid expansion has provided much-needed support for rural health providers, which allow hospitals to expand services, increase hours, or simply keep their doors open. The House-passed health care bill puts the health of rural Montanans and our communities in jeopardy.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.