Most of our research at MBPC focuses on the state budget and how we can best invest our state resources to build a Montana where everyone has the resources they need to thrive. But our state budget is heavily reliant on the federal budget. In the past couple of years, the federal packages geared towards COVID relief, CARES and ARPA, have helped bring the role of federal spending to the forefront of our national dialogue.

Recently, we released two reports to help explain the role the federal budget has in Montana. The first report, Why the Federal Budget Matters to Montana, explains the role the federal budget plays in our state’s budget and economy. The second report, The Federal Budget Helped Create Inequality, explains the historical role our federal budget has had in our state’s current racial inequity.

Why does the federal budget matter to Montana?

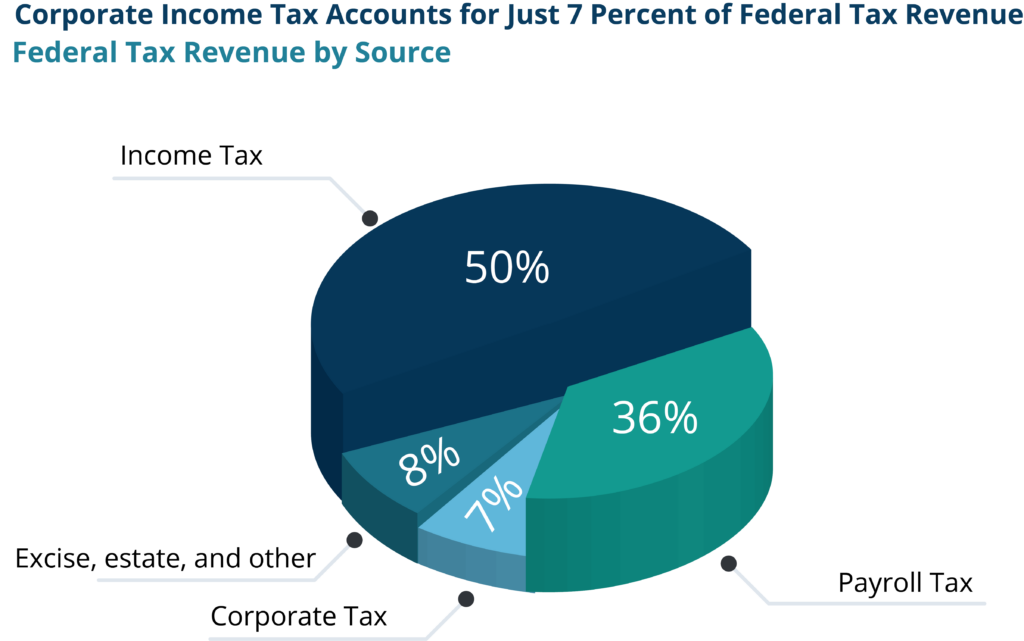

How we spend the federal budget matters because every day Americans fund it. In fact, corporate taxes only accounts for 7 percent of our federal budget – the majority of our federal revenue comes from personal income taxes.

Like most states, Montana receives more in federal funding than it sends in federal taxes. For every dollar Montana sends to Washington, we receive $1.47 in federal revenue.

Our state budget relies heavily on federal funding. Montana’s state budget is $12.6 billion for FY22 and FY23, nearly half (49%) of which comes from federal funding. Most of this funding flows through the Department of Public Health and Human Services (DPHHS) to fund Medicaid.

Not all federal funding flows through the state budget, however. Montanans also benefit from federal funds to county, local, and tribal governments and direct payments to individuals, such as Social Security. These funds help support our economy and strengthen our safety net.

What can the federal budget do for Montana?

While a vital part of Montana’s state budget, the way in which federal policymakers have historically allocated funds has helped to create racial inequity in our state. Federal policymakers have failed to recognize its’ trust and treaty obligations to tribal nations, including its’ legal responsibilities to provide health care and education.

Likewise, the federal government has continually underfunded the social safety net. This decision disadvantages Black, Indigenous, and other People of Color (BIPOC) who disproportionately rely on it due to the discrimination they have faced in employment, housing, and other sectors. In some instances, like in housing, the federal government has made this inequity worse through practices such as refusing to back mortgages in primarily Black neighborhoods or the allotment of land on reservations. Our new report “The Federal Budget Helped Create Inequality” discusses the impact of these practices in Montana in greater detail.

The federal budget, however, is a significant opportunity to improve the lives of Montanans. By honoring the treaties, strengthening the safety net, and providing reparations for the harm the federal government has caused, our federal policymakers can help ensure that all Montanans, regardless of their background, have the opportunities they need to be successful.

What is the state’s role?

Montana policymakers have a responsibility to accept and use federal funds available to them. Unfortunately, Montanans have not always been able to take advantage of the opportunities their tax dollars have paid for due to state lawmakers turning down federal funds. For example, Governor Gianforte turned down federally funded expanded unemployment benefits, denying thousands of unemployed Montanans much-needed assistance.

Not only do our state policymakers have a responsibility to fully implement federal funds, the state also has an obligation to build on these investments. Through state-level investments such as the Earned Income Tax Credit, Montana can futher promote equity in our state.

For the full reports, see Why the Federal Budget Matters to Montana and The Federal Budget Helped Create Inequality.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.