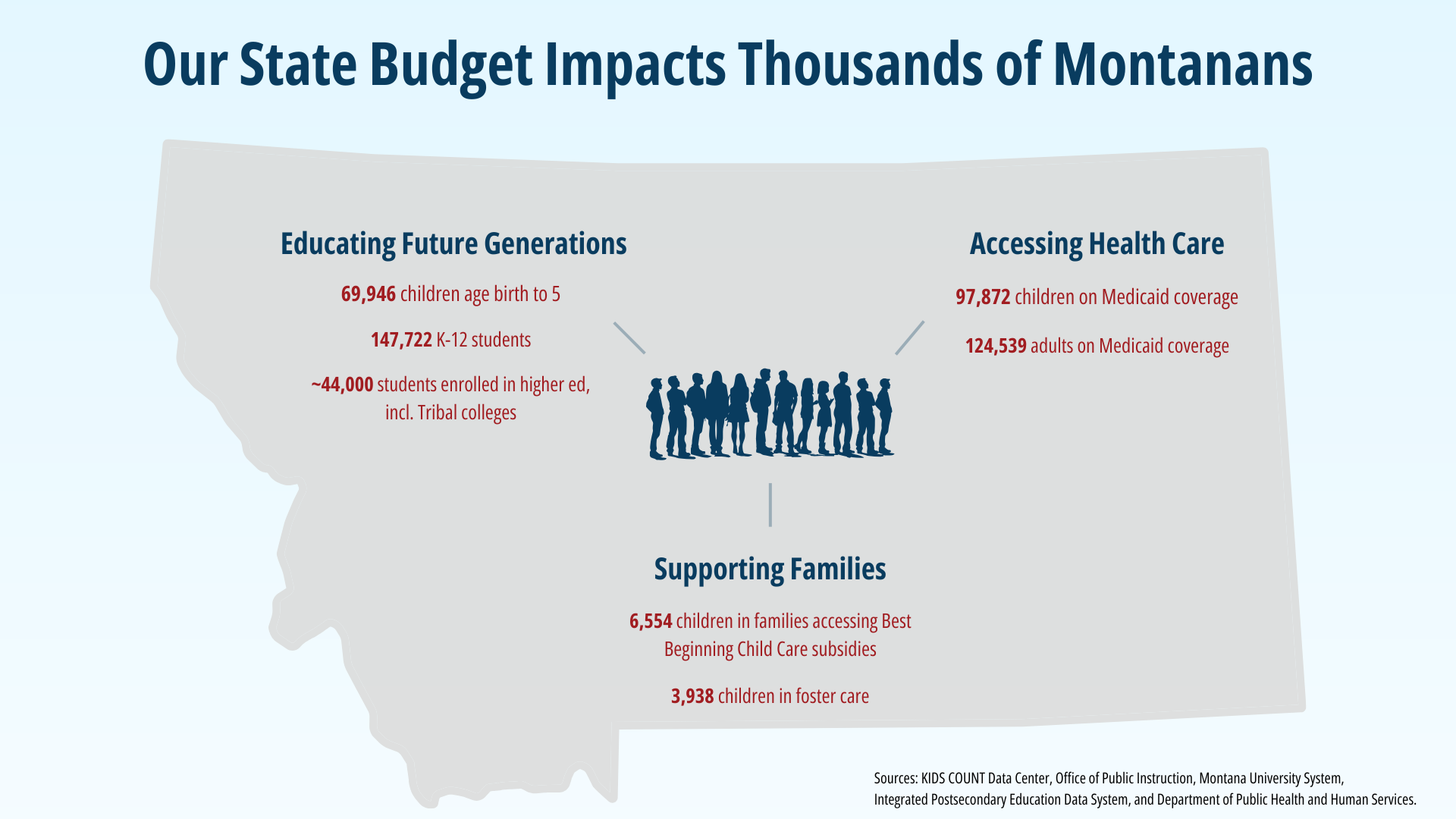

Every two years, state lawmakers put forward a budget to fund government and community services across the state. Montana’s biennium budget represents our collective vision of what we want to see for our state and represents an opportunity to invest in Montana’s workforce and families who are the backbone of Montana’s economy. The state’s budgeting process starts with the Governor’s proposed budget, which was released on November 15, 2024.[i] While the Governor’s budget includes some proposals to help Montana families, like continuing Montana’s current Medicaid program and additional investment in affordable housing, the proposed budget fails to prioritize the investments that working families need, and instead, squanders hundreds of millions in Montana revenue toward tax breaks for the wealthiest households. This report provides a snapshot of what is included in that proposed budget, what is missing, and next steps in the budget process. MBPC will provide more detailed analysis on the Governor’s tax and education proposals in the coming weeks.

What’s In: Continuing Montana’s Medicaid Program, Additional Investments in Housing and Behavioral Health Initiatives

Governor Gianforte’s 2027 Biennium Budget proposes continuing Montana’s Medicaid program at current service and eligibility levels. Montana expanded coverage for adults under Medicaid in 2015 with the passage of the Health and Economic Livelihood Partnership (HELP) Act, providing coverage today to nearly 80,000 Montana adults.[ii] The Montana Legislature will need to pass legislation in 2025 to continue Montana’s current Medicaid program and protect this vital coverage for Montanans. The executive’s 2027 Biennium Budget reflects the current Medicaid program in the base budget, with adjustments to caseload and service costs for the Medicaid program.

The Governor’s proposed budget reflects (to some extent) 10 of the 22 recommendations from the Behavioral Health Services for Future Generations (BHSFG) Commission, expanding critical services for individuals with mental or behavioral health needs and for those with developmental disabilities.[iii] These proposals include expanding certified community behavioral health clinics, investments in school-based behavioral health services, and improving services for individuals with complex needs.[iv] The executive’s proposed budget would allocate $54 million in state special revenue and $46 million in matching federal funds for these initiatives in the 2027 Biennium. While this investment is an important step, many of the recommendations put forward by the BHSFG Commission are not included in the budget. Furthermore, continuing Montana’s Medicaid program is critical to ensuring BHSFG initiatives can succeed.

The Governor’s budget proposes additional one-time-only investment in affordable housing within the Coal Trust Multifamily Homes Program to develop or preserve multifamily rental homes within Montana. While details have not been released, it appears the Governor is proposing $50 million in FY2025 and $50 million in FY2026.[v] This program has had significant success, supporting the development of nearly 600 affordable units over the last four years.[vi]

What’s Out: Missed Opportunities to Support Families with Rising Costs

The proposed budget, however, misses several opportunities. Unfortunately, Governor Gianforte’s proposed 2027 Biennium Budget fails to include any new investment in child care. While the 2023 Legislature expanded access to the Best Beginnings program, more must be done to address the lack of child care for Montana working families, given that access to affordable child care remains limited.[vii] Montana can look to the investments North Dakota has made to improve its child care scholarship program and to support child care providers in expanding infant and toddler slots to help more families afford child care.

The proposed executive budget also fails to continue critical funding for Tribal Colleges to support their work in providing high school equivalency testing (HiSET) services. In 2023, the Montana Legislature continued funding for HiSET but did so on a one-time-only basis. During the interim, Legislators heard from Tribal Colleges on the impact of these services, providing over 190 individuals with HiSET prep and testing services.[viii] As the interim report notes, Tribal Colleges are “often the only community-based program that assists those seeking to earn a high school diploma equivalent.” The Governor’s proposed budget does not reflect continued funding for this program, resulting in a nearly 10 percent cut in state funding for Tribal Colleges over the past biennium.

The Governor’s budget skews resources toward Montana’s prison system rather than providing adequate resources to support health services and preventative supports for families. The Governor is proposing $150 million toward increasing prison beds and another $250 million for Corrections initiatives (though no details have been released).[ix],[x] This $400 million in state dollars for prison infrastructure compares to roughly $54 million to support related behavioral health initiatives.

Income Tax Cuts Aimed at the Wealthy Would Decimate Revenue for Investments

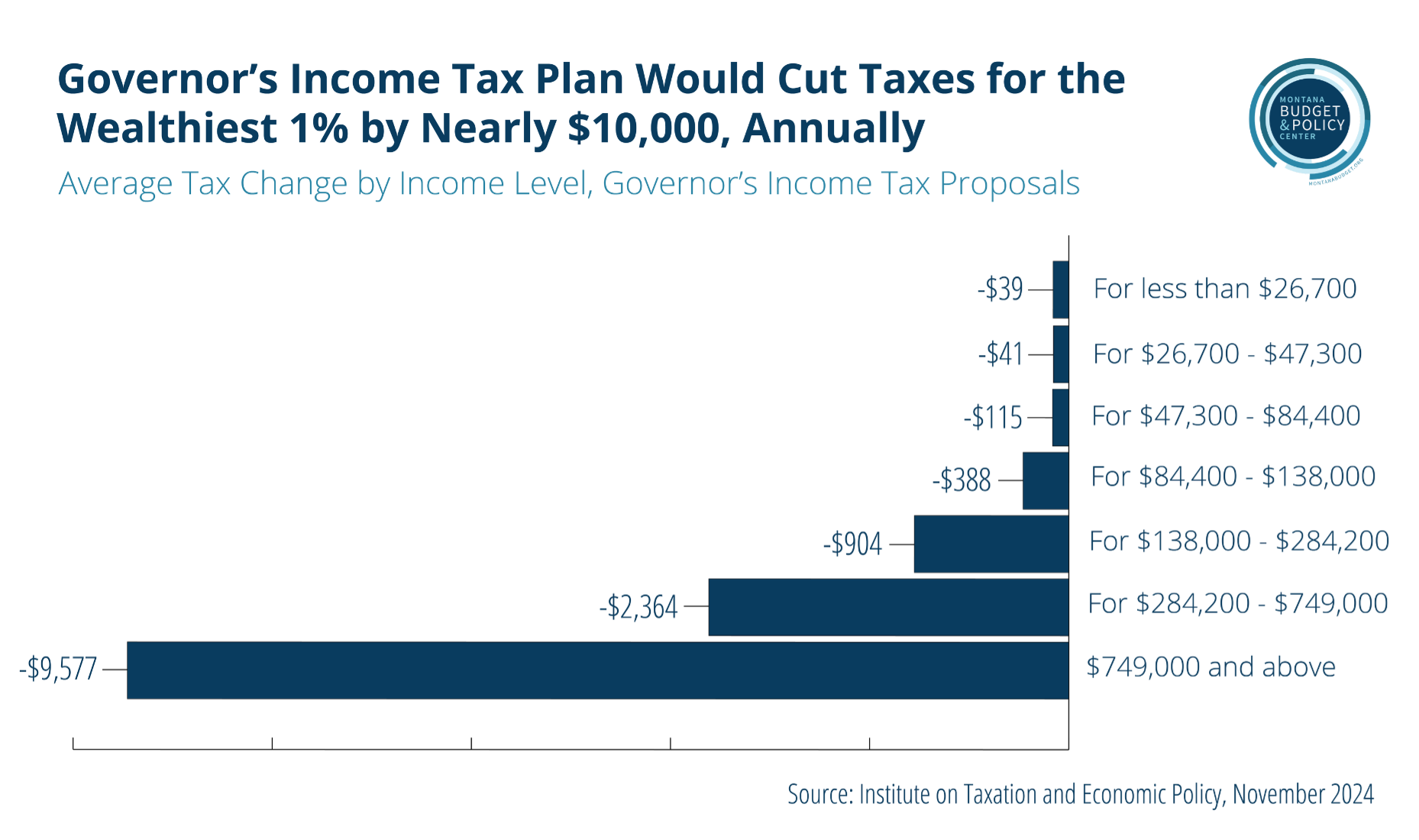

The way our tax code has been structured has disproportionately benefited white, wealthy individuals, while families living on lower incomes pay a higher share of their income in taxes.[xi] Unfortunately, the Governor’s proposed budget will exacerbate these inequities through massive income tax cuts aimed at the wealthiest households, costing the state hundreds of millions in lost revenue.

While MBPC is awaiting more detail on many of the tax proposals, Governor Gianforte has announced that his budget would propose reducing the top personal income tax rate to 4.9 percent, from 5.9 percent.[xii] This further reduction in the top rate will disproportionately benefit the richest households, with the wealthiest 20 percent of households receiving nearly 75 percent of the income tax reduction.[xiii] If enacted, the wealthiest 1 percent of households (those with incomes over 749,000 annually) would see a tax cut every year of nearly $10,000. Families in the middle (with incomes between $30,000 and $85,000) would see, on average, a tax cut of $40 to $115. The Governor is proposing a modest expansion to the state’s earned income tax credit (EITC), from 10 percent of the federal credit to 15 percent, providing an average $39 for those with incomes below $26,000. The overall cost of the rate reduction, estimated to be $255 million per year, is 25 times larger than the cost of the EITC expansion.

Proposed 2027 Budget – Agency Summaries

The below provides some additional information on key agency budgets. This information can be found on the Office of Budget and Planning Program 2027 Biennium Executive Budget.[xiv]

Governor’s Office and Proposed Cuts to Agency Budgets for Vacancy Savings

The Governor’s proposed budget assumes a reduction in personal services (staffing) budgets to reflect a 5 percent vacancy savings. Vacancy savings is the difference between what it would cost to fully fund all of an agency’s approved positions and what is actually spent for personal services because positions were vacant for the year. The Legislature can mandate a certain amount of vacancy savings by appropriating less than the amount needed to fully fund all of an agency’s budget. With some exceptions, the Governor’s proposed budget reflects a 5 percent vacancy savings rate for most agencies.

The Governor’s Office own budget proposes an increase of $46 million in total funds, a 297 percent increase, compared to the past biennium. This increase is tied to $46 million allocated to the Office of Budget and Program Planning to use “when personnel recruitment and retention issues arise and must be dealt with.” Use of the proposed fund would require the Budget Director’s approval and could be used to adjust base pay of agency salaries.

Department of Revenue

The Department of Revenue (DOR) is the state agency responsible for the collection and assessment of taxes, property valuation, and alcoholic beverage and cannabis control. The governor is proposing an overall increase in funding for DOR of $20.4 million, a 2.66 percent increase, over the last biennium. This includes $1.78 million over the biennium for the Cannabis Control Division to deal with the anticipated increase in new site locations, with the moratorium on who qualifies for a cannabis license expiring on June 30, 2025, and $75,000 for DOR to administer the cannabis local-option tax. The budget proposes reopening Property Tax Division offices in Livingston and Boulder. The budget allocates $730,000 to Alcoholic Beverage Control Division for overtime and temporary staff to meet increased demand for liquor products. Assuming legislation passes to reform property taxes, DOR is requesting $1 million for additional staff to implement these changes.

Department of Labor and Industry

The Montana Department of Labor and Industry (DLI) upholds labor laws, ensures worker safety, and encourages business and employee growth. DLI provides business support, job training, worker education, community resource centers, and investigates discrimination complaints. The governor is proposing an overall increase in funding for DLI of $8.7 million, a 4.56 percent increase, over the last biennium. This includes mostly statewide present law adjustments for inflation, operations, and personal services. This budget includes a new proposal of $630,000 to place job service kiosks in rural areas across the state that lack access to Job Service offices. These kiosks would be placed in local office of public assistance, county courthouses, and tribal headquarters.

Department of Commerce

The Department of Commerce (Commerce) is responsible for fostering a good business environment to enhance community vitality and helping to support affordable housing in the state. The Governor is proposing an overall increase in funding for Commerce of $5 million, a 6.91 percent increase, over the last biennium.

The Housing Montana Division is part of the Department of Commerce and consists of the Board of Housing, Housing Assistance Bureau, and Community Housing. Its 2027 Biennium budget is $24.1 million, consisting primarily of federal grant funds. The proposed budget provides an increase of $3.7 million over the biennium of federal funding authority for the Home Investment Partnerships Program and Housing Trust Fund programs, providing grant funding to increase the supply of affordable housing for families living on lower income.

Department of Public Health and Human Services

The Department of Public Health and Human Services (DPHHS) provides health and other assistance services to Montanans, including administering programs such as Medicaid, TANF, SNAP, child and family services, child care, and disability employment. DPHHS is the largest agency of the state, with 67 percent of its budget coming from federal funds. The Governor’s budget is proposing an increase of $275 million, a 4 percent increase, for DPHHS from the last biennium.[xv]

The budget includes funding for current Medicaid service levels, which assumes the legislature will continue Montana’s current Medicaid program without ending eligibility for adults earning less than 138 percent of the federal poverty level. Coverage for this population, known as the Medicaid expansion population, is 90 percent funded by the federal government.

Significant proposals in the DPHHS budget include (including both state and federal funds): (a) $20 million for the biennium to fund Summer-EBT benefits and administrative costs, which will help kids access food over the summer months; (b) $28 million for the biennium to fund Technology Services Division operational costs to update systems, such as the Medicaid enrollment system; (3) $100 million to fund the recommendations made by the Behavioral Health Systems for Future Generations commission; and (4) $70 million for the biennium for facility wage and operational standardization at state-owned health care facilities.

One of the new proposals includes an increase in the provider rates paid to providers offering Part C services, as recommended in the provider rate study completed in October 2023. Part C Early Intervention provides services for children age birth through three who have significant developmental delays or disabilities. DPHHS contracts with regional providers to offer Part C services throughout the state.

The Governor missed opportunities to fund improvements to benefit access, including improving staffing for the Public Assistance Help Line, and eligibility determinations. The Governor’s proposed budget fails to include any adjustment to reimbursement rates for providers who accept Medicaid.

Additionally, many other early childhood programs in Montana have limited reach and will continue that trend without new investments. For example, Healthy Montana Families, Montana’s statewide home visiting program, faces two challenges from budget shortfalls: 1) home visiting services are only available in a limited number of communities, and 2) waitlists prevent programs from serving all the families that would like to receive them in existing programs.[xvi] In the 2022-2023 program year, 976 families (who lived in 26 counties across the state) benefited from the Healthy Montana Families program.[xvii]

Office of Public Defender

The Office of Public Defender (OPD) is responsible for providing high-quality legal representation for individuals who cannot afford an attorney.

The governor is proposing an overall increase in funding for OPD of $27.8 million, a 27 percent increase, over the last biennium. This includes mostly statewide present law adjustments for inflation, operations, and personal services. Within present law adjustments, there is an additional $2.9 million within the public defender division over the biennium to provide appropriated FTE positions to its existing modified positions. This move is also seen within other divisions. The budget proposes $1.5 million in general fund dollars to fund services in Yellowstone County previously funded through one-time-only ARPA grant. Present law adjustments also include increasing rates of non-attorney providers. OPD notes that the shortfall of public defenders is currently 45 attorneys. The executive budget works toward closing that gap, by including 8 FTE in 2026 and 16 FTE in 2027 at a total cost of $3 million over the biennium.

While the budget does not explicitly exempt OPD from the Governor’s 5 percent requirement for agencies, vacancy savings is not mentioned in OPD’s present law adjustments. As of the last LFD report, this agency is experiencing a 3.9 percent vacancy rate overall.[xviii]

Department of Corrections

The Department of Corrections is responsible for the supervision of people who have been arrested, convicted, or sentenced for criminal offenses. Their responsibilities include victim services, incarceration and rehabilitation, and community support. The governor is proposing an overall increase in funding for Corrections of $46 million, an 8.2 percent increase, over the last biennium. This includes some statewide present law adjustments for inflation, operations, and personal services. The budget reflects an adjustment for payments for county jail holds from 250 inmates per day to 350, at an increased cost of $6.2 million over the biennium.

This budget includes a number of new proposals, totaling $23.2 million over the biennium, including: (a) $2.7 million for contracted placements and services for juveniles. New proposals within the rehabilitation and programs division include additional pharmacy needs, increased funding for victim services, parenting and tattoo removal programs for inmates, and salary increases for staff. This agency’s budget includes the Governor’s 5 percent vacancy savings reduction.

Office of Public Instruction

The Office of Public Instruction is responsible for supervising all public schools in the state including providing technical assistance in school finance, law, teacher certification, school accreditation, and teaching and learning standards.

The Governor’s budget proposes an overall increase in OPI funding of $356 million, or a 15 percent increase from the previous biennium. These funds are separated into two main branches under OPI: state-level activities funding through OPI and local educational activities through local public school districts.

State-level activities provide leadership, coordination, and data management to different school and public groups. For example, it assists school districts and administers federal programs such as Every Student Succeeds Act and special education. Within state-level activities, the executive budget includes several new proposals: (a) $30,000 to cover costs associated with the Montana Advisory on Indian Education; (b) $2.8 million PowerSchool subscription, to support the ongoing data modernization project; and (c) $1.8 million in additional funds for the Montana Digital Academy.

Local Educational Activities, which allocates state and federal funds to local educational agencies, is the larger share of the OPI budget, accounting for over half of the total, or approximately $2.6 billion. The proposed budget includes inflationary and other adjustments, including: (a) $52.1 million adjustment for K-12 BASE Aid; and (b) $150,000 in increased funding for Indian Language Immersion to increase schools' participation.

There are also a few new proposals, including a one-time-only request for $1 million dedicated to creating "cell-phone-free schools." The budget indiciates school districts could use the funds "to purchase secure systems so that cell phones are inaccessible to students during school hours." Lastly, there is a new proposal for Teacher Pay Incentive that is dependent on legislation. This program will increase teachers' pay for the bottom third of teachers on the pay scale. According to the National Education Association, Montana ranks 51st in the nation for average teacher starting salaries.[xix]

Office of the Commissioner of Higher Education

The Office of the Commissioner of Higher Education (OCHE) serves students by providing high-quality, accessible postsecondary educational opportunities. The governor's budget is proposing an increase of funding for OCHE of $59.9 million, or a 9 percent increase, from the last biennium. This primarily includes inflationary and other present law adjustments, including a $5 million increase to Research and Development and $4.2 million for Student Assistance Program.

The executive’s proposed budget reflects a decrease in funding for Tribal College Assistance. Tribal College assistance provides funding for Tribal colleges to support a portion of the costs of educating nonbeneficiary Montana students (non-tribal members). This program saw a $200,000 decrease in funding or an approximately 10 percent decrease, because of not continuing funding for HiSET services previously funded on a one-time-only basis.

There were very few new proposals in OCHE, one of which is to support the start of an online J.D. program at the University of Montana. It will provide $575,000 for FY 26 and $425,000 for FY 27. The online J.D. program aims to address Montana's need for lawyers in rural areas and focuses on agriculture, natural resources, and Indian law.

Next Steps and How to Engage in the Budgeting Process

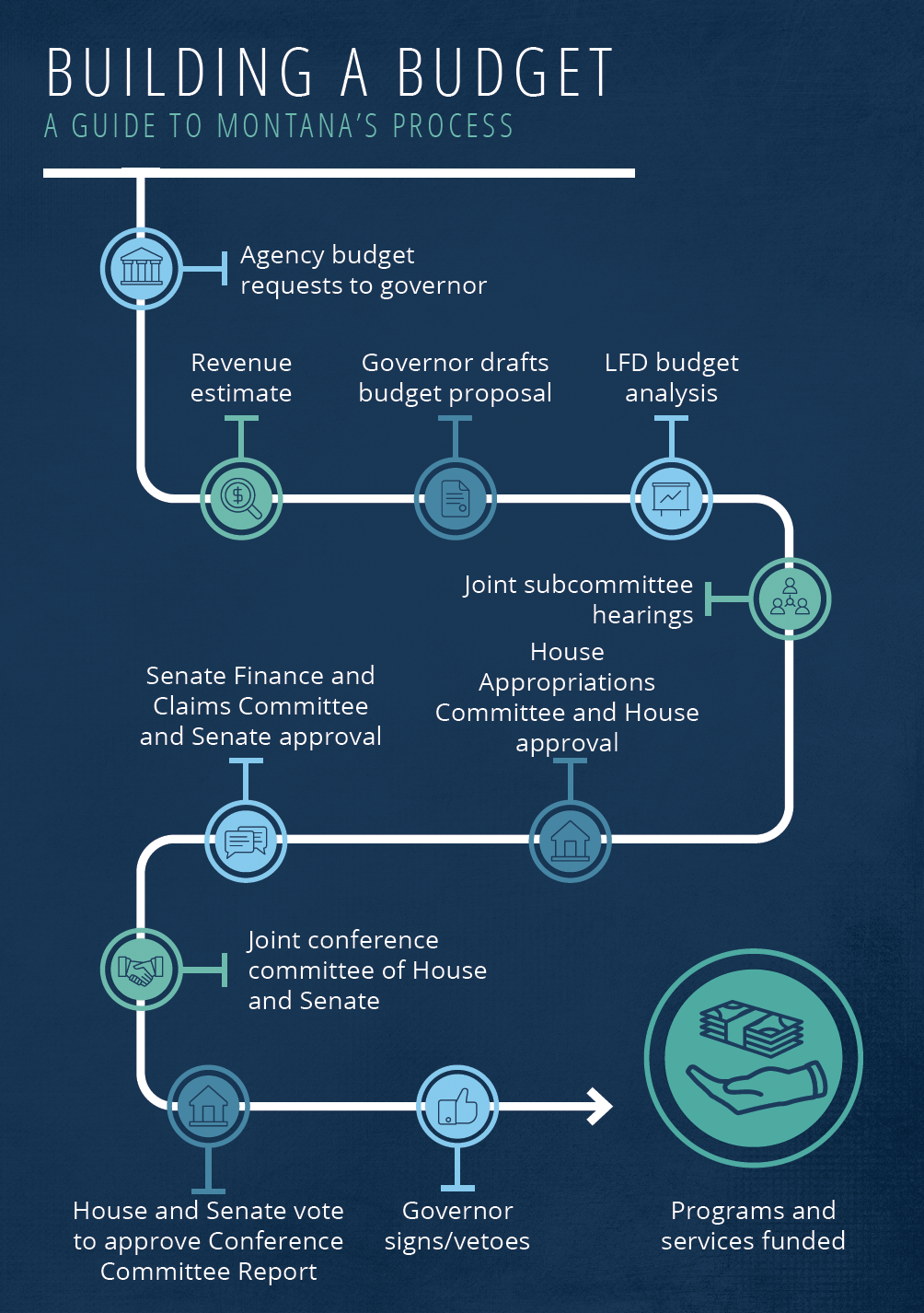

The Governor’s proposed biennium budget is the start of the process, and Montanans have the opportunity to weigh in on what investment they want to see in their communities. Ultimately, it is the Legislature’s responsibility to appropriate state funding and pass a balanced budget. Members of the House Appropriations and Senate Finance & Claims Committees will convene Joint Appropriation Subcommittees to dig into each section of the proposed budget. Joint Appropriation Subcommittees will hear from state agencies on their proposed budgets and take public comment throughout the process. As more information and budget analysis is provided, Montanans can find more information on the Legislative Fiscal Division website at https://www.legmt.gov/lfd/.

Conclusion

The state’s long history of underinvestment in public education, child care, health services, and caregiver support, has meant that families are left struggling with increased costs, unaffordable housing, and impossible-to-find child care. Budget decisions should focus on righting these wrongs and providing targeted and meaningful support for families. This upcoming 2027 Biennium budget process is an opportunity for Montanans to call on the investments needed to support Montana families and communities.

[i] Governor’s Office of Budget and Program Planning, 2027 Biennium Executive Budget, Nov. 2024.

[ii] Department of Public Health and Human Services, Montana Medicaid Enrollment Dashboard, Medicaid and CHIP Enrollment, as of August 2024, accessed Nov. 2024.

[iii] While the executive budget reflects ten of the recommendations, NP 10717 (Redesign Rates to Improve In-State Youth Residential Services) does not appear to be funded at the recommended amount.

[iv] Department of Public Health and Human Services, Behavioral Health System for Future Generations (BHSFG) Commission Report, September 2024.

[v] Office of Budget and Program Planning, State of Montana 2027 Biennium Executive General Fund Budget, Nov 2024. Additional information provided by the Office of Budget and Program Planning, on file with author.

[vi] Montana Housing Coalition, HB 546 – Reauthorize Coal Trust Multifamily Homes Loan Program, accessed Nov 2024.

[vii] Burg, X., Reaching Families: Assessing Best Beginnings’ Impact on Montana’s Communities, Montana Budget & Policy Center, Nov. 2024.

[viii] HiSET OTO Funds to Tribal Colleges, report to Section E Interim Budget Committee, Sept. 2024.

[ix] Office of Budget and Program Planning, Section F: Infrastructure in Montana, Nov 2024.

[x] Office of Budget and Program Planning, State of Montana 2027 Biennium Executive General Fund Budget, Nov 2024. Additional information provided by the Office of Budget and Program Planning, on file with author.

[xi] Bender, R., Racist Roots of Montana’s Tax System, Montana Budget & Policy Center, Dec. 2022.

[xii] Dietrich, E., and Silvers, M., Tax cuts, teacher pay boosts, prison expansion shape Gianforte’s budget proposal, Montana Free Press, Nov. 18, 2024.

[xiii] Institute on Taxation and Economic Policy, Montana – Governor Income Tax Plan, All State Residents, 2024 Incomes, Nov. 13, 2024, on file with author.

[xiv] Governor’s Office of Budget and Program Planning, 2027 Biennium Executive Budget, Nov. 2024.

[xv] In order to compare across biennia, figures include total biennium budget plus expenditure on SNAP. The Executive’s budget proposes moving SNAP to a statutory appropriation.

[xvi] Healthy Mothers Healthy Babies The Montana Coalition, Montana Home Visiting Coalition, accessed Nov. 2024.

[xvii] MBPC calculations using Department of Public Health and Human Services, “HMF Families Served by County 20240105,” MBPC information request, received on Jan. 9, 2024, on file with author.

[xviii] Legislative Fiscal Division, Quarterly Report, Office of State Public Defender, FY 2024.

[xix] National Education Association, Educator Pay in America, Apr. 18, 2024.

MBPC is a nonprofit organization focused on providing credible and timely research and analysis on budget, tax, and economic issues that impact low- and moderate-income Montana families.